Author: Filippo Pozzi Source: medium Translation: Shan Ouba, Jinse Finance

Objective of this article : Get a complete and detailed picture of the “health” of DeFi within the major blockchain ecosystems

Method : Analyze the data as usual. In particular we will see:

Total Value Locked (TVL)

Total locked value by blockchain

Number of transactions

Most used protocols

Stablecoin Market Cap

Total Value Locked (TVL)

The first metric we analyzed was the total value locked (TVL), which is one of the most important metrics in the space.

Before we go on, it is important to reflect on why analyzing this metric is crucial. TVL represents the total value of cryptocurrencies locked or frozen in DeFi protocols through smart contracts for various purposes such as cryptocurrency trading, lending, liquidity mining, staking, and other decentralized financial activities.

A high TVL indicates that the services provided by DeFi are widely used and that people have a strong interest in operating in the DeFi ecosystem; conversely, a low TVL indicates a low interest in this decentralized financial solution.

As can be clearly seen in the above chart, the overall TVL within all blockchains showed exponential growth during 2021 before falling back, from a peak of $180 billion to a low of approximately $30 billion. However, over the past year, we have seen a new period of growth, with the TVL currently sitting at approximately $100 billion.

In line with the general trend in cryptocurrencies, TVL experienced a period of strong distrust between mid-2022 and the end of 2023. This is partly attributed to the failure of the famous TerraLuna protocol and the subsequent bear market. Nevertheless, the chart presents a fairly positive outlook for the next year, showing a significant recent increase in TVL. This growth is attributed to users' new trust in DeFi products.

Total locked value by blockchain

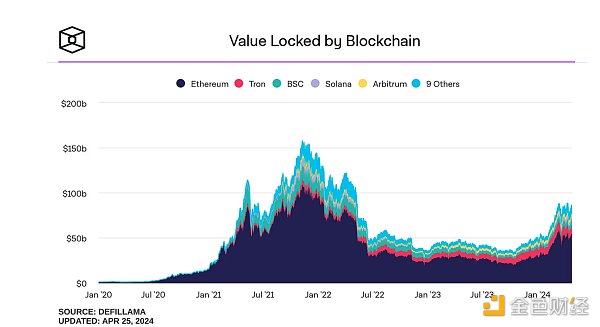

Continuing with the analysis of TVL, let’s now focus on where these stores of value are located. Until a few years ago, almost 100% of TVL was on Ethereum. However, over time, the situation has changed. While Ethereum is still the number one blockchain, an ecosystem of alternative blockchains has played an important role in the industry.

A small clarification is that it is incorrect to refer to all existing blockchains as “alternative blockchains” (relative to Ethereum). In fact, Ethereum’s second-layer networks, although autonomous blockchains, share most of the technology with Ethereum. Therefore, these are considered extensions of Ethereum, not alternatives.

As mentioned before, Ethereum remains the most important player in DeFi, currently holding over 60% of the total TVL. It is followed by Tron, which accounts for over 8%, and is the reference blockchain for the creation of the most used stablecoin USDT. Next is BSC, which accounts for 5.19%, and is one of the oldest blockchains in the field. Its importance in DeFi has slightly decreased, and more advanced networks such as Solana and Arbitrum account for 4.37% and 2.95% respectively.

Following the Dencun update, here is a link to one of my articles explaining the importance of this update in the Ethereum ecosystem and its layer 2. What I expect to see (and we are in the realm of speculation) is a gradual increase in activity on the main layer 2 due to the unparalleled ease and speed of operation compared to the Ethereum blockchain.

Number of transactions

While I prioritize TVL in this article and I think this metric is extremely important, I don’t think it’s the best indicator of the health of the ecosystem. In fact, TVL is directly affected by the value of capital locked in smart contracts.

Assume that during a bear market (similar to what happened between 2022 and 2023), no users withdraw capital from DeFi protocols. However, the depreciation of the underlying assets will still cause the TVL to drop, giving the false impression that capital is flowing out of the ecosystem.

That’s why we now turn to analyzing the number of transactions taking place in DeFi protocols, as we believe it will tell us a different story than the TVL chart.

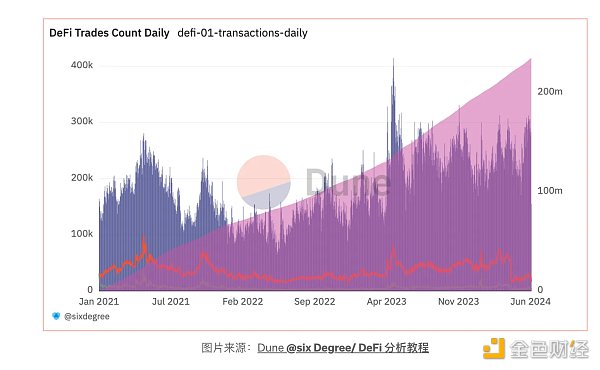

Looking at this chart, we can notice a significant difference from the one highlighted in the TVL analysis. Although transaction volume has declined after the summer of 2021, this decline is not comparable to the decline recorded by TVL. Furthermore, it is important to note that after the number of transactions peaked in the summer of 2021 and declined in 2022, it has significantly exceeded the 2021 peak in April 2023 and continues to record numbers above the 2021 peak, thus demonstrating the growing interest in the DeFi space and the increasing activity in these protocols.

Most used protocols

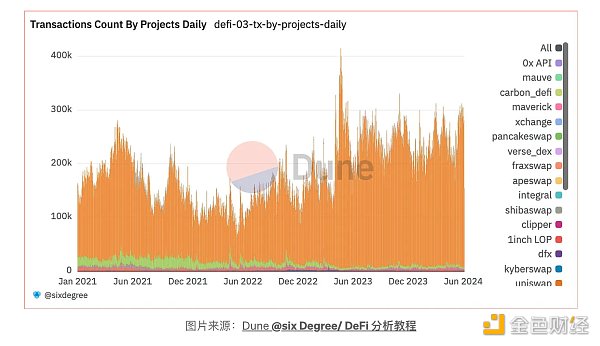

Now let’s analyze the previous chart from another perspective, focusing on the origin of transactions to identify the most relevant protocols in DeFi.

From my perspective, the results revealed by this chart are quite surprising. Before starting this research, I thought Uniswap (represented by the orange candles) was one of the most relevant protocols in the space. However, the results left me speechless, showing that Uniswap represents the vast majority of DeFi transactions so far in 2021, followed by Sushiswap and Curve.

From my perspective, the results revealed by this chart are quite surprising. Before starting this research, I thought Uniswap (represented by the orange candles) was one of the most relevant protocols in the space. However, the results left me speechless, showing that Uniswap represents the vast majority of DeFi transactions so far in 2021, followed by Sushiswap and Curve.

While I am surprised by this chart, it is important to note that the chart represents the number of transactions, not the volume/USD transferred by the protocol.

Stablecoin Market Cap

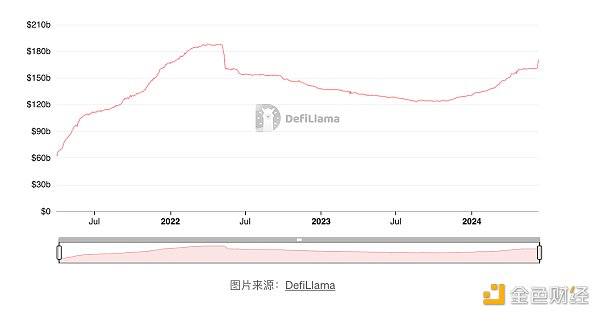

The last metric we analyzed concerns the number of stablecoins present in DeFi.

But why is it important to consider the number of stablecoins in the ecosystem? The reason is simple, stablecoins = liquidity, and liquidity = potential future investment. In fact, stablecoins represent the available liquidity in the space, indicating the investment capacity of holders. Increased liquidity leads to new investments.

As we can see, this chart is consistent with what is observed in the other charts, with a decrease between 2022 and 2023. However, this decrease is minimal and a subsequent recovery is seen in 2024, with a small increase in recent weeks. This brings us to a level close to the historical high of $190 billion recorded in the summer of 2022.

As we can see, this chart is consistent with what is observed in the other charts, with a decrease between 2022 and 2023. However, this decrease is minimal and a subsequent recovery is seen in 2024, with a small increase in recent weeks. This brings us to a level close to the historical high of $190 billion recorded in the summer of 2022.