After the approval of Bitcoin and Ethereum exchange-traded funds (ETFs), attention is focused on the potential of Solana ETF.

In fact, as Solana gained attention as the U.S. Securities and Exchange Commission (SEC) approved these financial products, interest in other altcoins increased.

Solana ETF’s Potential

The idea of the Solana ETF is generating considerable discussion among industry leaders and investors. Given the popularity of altcoin ETFs as a means of diversifying cryptocurrency investments, approval of the Solana ETF could provide significant benefits and greater exposure to the ecosystem.

Over the past few years, Solana has garnered quite a bit of attention. Despite initial obstacles such as network outages and difficult market conditions, Solana achieved remarkable milestones.

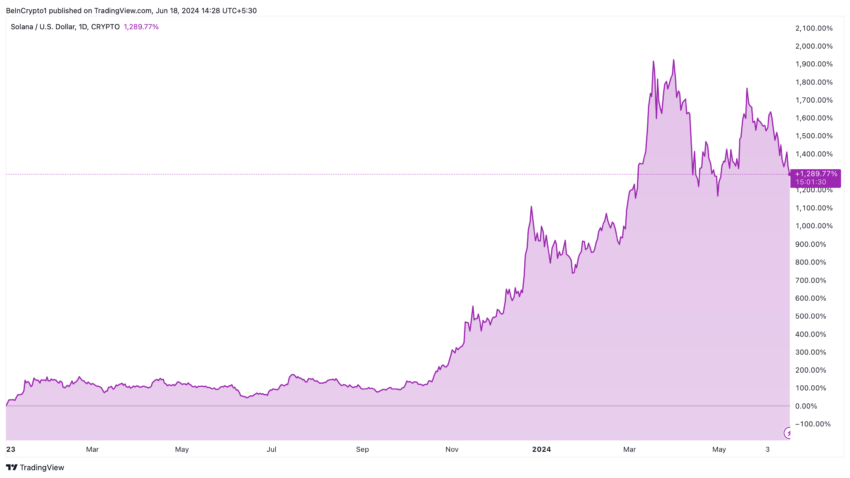

Since January 2023, SOL's price has surged more than 1,289%, demonstrating its resilience and increasing investor confidence.

Read More: Solana (SOL) Price Prediction 2024/2025/2030

Additionally , active addresses on the Solana network increased from 660,000 to 1.56 million, and search interest on Google Trends hit an all-time high. These metrics reflect Solana's growing awareness among individual and institutional investors, and indicate a growing user base and increased network activity.

Path to Solana ETF Approval

Experts have varying opinions about the feasibility and timeline of the Solana ETF. Cryptocurrency investor Brian Kelly kicked off the discussion by expressing his belief that X (formerly Twitter) could be next .

Bloomberg ETF analyst James Seipart agreed, saying it could take years but said the process could be sped up under certain conditions.

“[The Solana ETF] will launch within a few years of the creation of a CFTC-regulated futures market. But it may happen sooner if Congress passes market structure legislation like FIT21 . “I think the Solana ETF will be the most in demand compared to other digital assets,” says Seypart.

However, the approval process for all ETFs, including the Solana ETF, is rigorous and supervised by the SEC. Here is an outline of the process:

- Submission of Application: Sponsors submit a detailed proposal to the SEC describing the structure and objectives of the ETF.

- Regulatory Review: The SEC conducts a thorough review of proposals to ensure investor protection, market integrity, and regulatory compliance.

- Public Comment: Proposals are often open for public comment so stakeholders can express comments or concerns, which the SEC will consider before making a decision.

- Approval or Rejection: The SEC may approve or reject the proposal, possibly attaching conditions to ensure compliance.

Legal and regulatory considerations

Andrew Rossow, attorney at Minc Law and CEO of AR Media Consulting, demonstrated the challenges of getting cryptocurrency ETFs approved.

“The question we need to ask is what obstacles must be overcome for the United States to realistically and safely open the door to cryptocurrency ETF discussions. When the SEC approved a Bitcoin spot ETF last January, the process was a major headache and a waste of the SEC's time and resources. “It is unrealistic to expect different results now without substantial regulatory changes,” Rossow emphasizes.

So far , no formal application has been made for the Solana ETF in the U.S., and investor Anthony Pompliano of Pomp Investments admitted he had never heard of it. The strict regulatory environment may explain the lack of filing. More importantly, the SEC's previous classification of SOLs as 'securities' may make the approval process more complex.

Optimism is growing as the cryptocurrency market continues to develop with each ETF approved. The impending approval of an Ethereum ETF this summer is raising hopes for other altcoins, including Solana.

Ultimately, the potential of the Solana ETF will depend on regulatory approval, market maturity, and investor demand.

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some contents are AI-translated English versions of BeInCrypto articles.