Currently, individual investors are noticeably cautious about the cryptocurrency market. This behavior stands in contrast to past cycles, which had a significant impact on market trends.

Understanding the reasons for this hesitation is critical to predicting future market movements.

Individual investors haven't arrived yet

Individual investors are showing a reluctance to participate in the cryptocurrency market, a trend that experts say could affect the trajectory of the market. Nosi co-founder Gustavo Faria highlights key indicators showing that retail investor participation remains low.

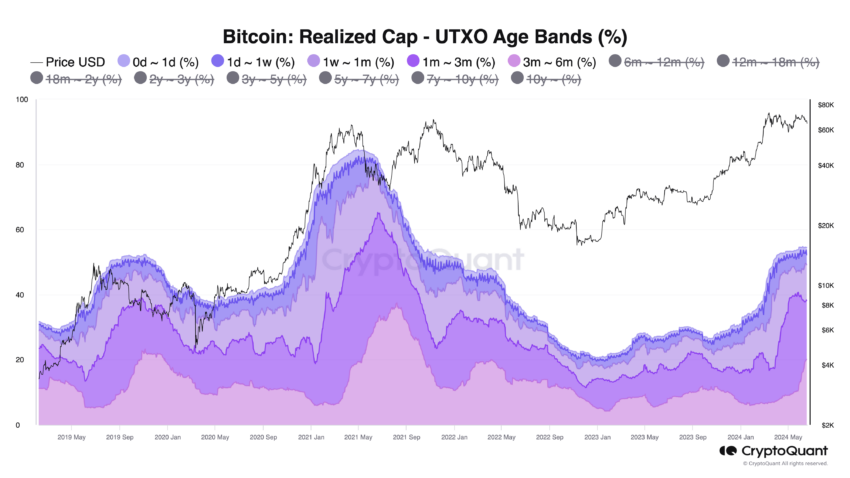

“A key characteristic of the Bitcoin cycle high is the dominance of coins with holding periods of less than three months,” says Faria.

Short-term holders currently account for about 35% of market capitalization, compared to more than 70% at previous market peaks. This suggests that long-term Bitcoin holders, commonly referred to as ‘smart money’, are maintaining their positions and providing a more stable market base.

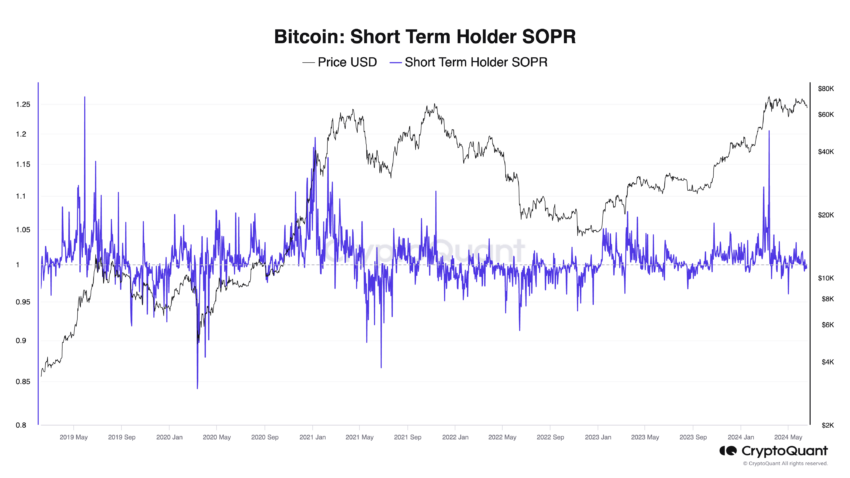

Historically, short-term holders' Spending Output Return (SOPR) has exceeded 1.10 during market peaks. The highest SOPR recorded this cycle is 1.05, indicating a more neutral market stance.

“These structures suggest that the peak of this cycle has not yet been reached,” adds Faria.

He believes the current market strength makes an immediate bear market less likely and suggests the potential for further growth.

Read more: Bitcoin (BTC) price prediction for 2024/2025/2030

Independent Ethereum educator Anthony Sassano also pointed out the unusual nature of the current bull market , calling it “the strangest ever.” He points out that the expected four-year cycle has been broken and that cryptocurrency natives, not individual investors, are driving market movements.

Sassano highlights the absence of broad-based market growth, which is typically fueled by the participation of retail investors.

“Retail and new money were and are still the same, and only crypto natives are doing the most PvP,” he says.

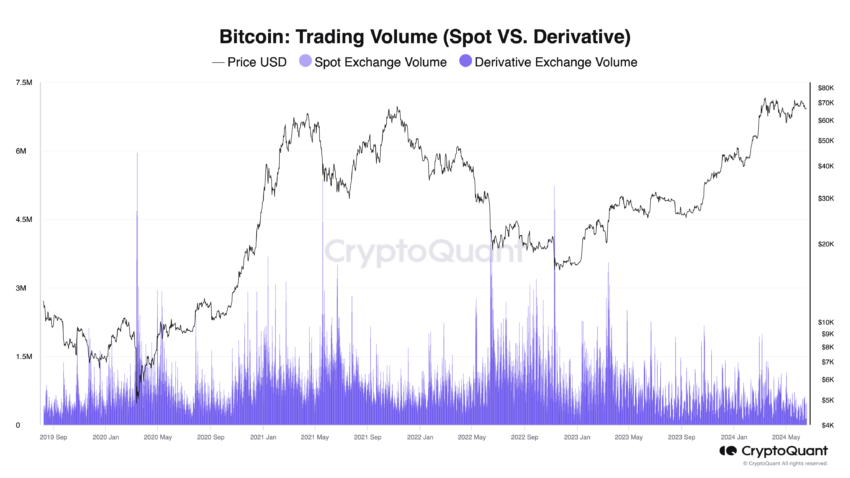

Adding to this view, cryptocurrency analyst Cyclop highlights the lack of enthusiasm in retail. He points out that despite Bitcoin's high price , current trading volume is significantly lower than in 2021.

Cyclops says the lack of participation from retail investors means the market has not yet reached the speculative frenzy seen in previous cycles.

“The general public is still not interested in cryptocurrency. My friends don't message me on WhatsApp. “My mom doesn’t even know that Bitcoin is at an all-time high,” he says.

These insights suggest that retail investors are taking a cautious approach due to the volatility of the cryptocurrency market. This hesitation, combined with the current market dynamics dominated by seasoned cryptocurrency players, could limit the market's growth potential.

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some contents are AI-translated English versions of BeInCrypto articles.