Author: Zach Rynes, ChainLinkGod; Translated by: Baishui, Jinse Finance

The tokenization of every financial asset in the world is inevitable.

While this might have been a controversial statement a few years ago, the cryptocurrency industry is no longer the only one making it. Larry Fink, co-founder and CEO of BlackRock, now speaks frequently about the inevitability of tokenization and the benefits it can bring to the global financial system. As the world’s largest asset manager, BlackRock’s assets under management ($10.5 trillion) are more than 4 times the market value of the entire crypto asset class ($2.5 trillion).

In other words, an institution that manages more capital than the entire crypto industry is worth is telling the world that the global financial system and all its assets will exist on crypto rails in tokenized form. This is a signal that cannot be ignored.

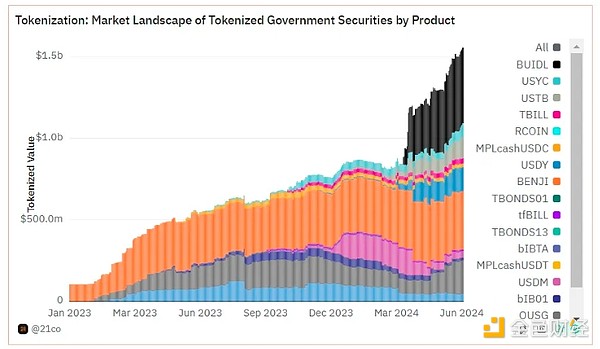

This tokenized reality is arriving faster than most people realize. BlackRock’s BUIDL fund (a tokenized basket of U.S. government securities on the Ethereum mainnet) is now over $460 million, quickly becoming the largest tokenized fund ever issued on a public blockchain in just a few months.

21.co Dune Analytics

However, ironically, as more and more of the world’s largest financial institutions recognize the value of asset tokenization to the capital markets and even launch tokenized financial products, ordinary people (retail investors) still largely believe that cryptocurrency is a “speculative casino” with no real-world utility or value proposition for society.

Honestly, it’s not hard to blame them.

Like a hangover the morning after a binge, the 2021 cryptocurrency craze ended with the collapse of a $40 billion Ponzi scheme, the bankruptcy of nearly every retail lending platform, and the widely reported FTX fraud. Tens of billions of dollars of retail capital evaporated overnight, never to be seen again.

2024 brought a breath of fresh air, with a U.S. court-mandated spot Bitcoin ETF and subsequent approval of a spot Ethereum ETF, as well as an election cycle in which cryptocurrencies became a focal point of bipartisan discussion. But even so, the negative perception surrounding cryptocurrencies has not disappeared.

So, what can solve the information asymmetry problem between institutions and retail investors when it comes to asset tokenization?

Stablecoin.

Digital Dollar: The Visual Propaganda of Cryptocurrency

Crypto is an extremely difficult concept to explain succinctly to the general public. The industry touches on a wide range of fields, including cryptography, distributed systems, game theory, economics, politics, etc. Most people don’t understand how the financial system actually works (and they don’t need to), so the problems that crypto aims to solve are largely unfamiliar.

Imagine explaining what the Internet is to someone who knows nothing about computers.

As such, there is no single universal explanation for cryptocurrencies. Instead, what often happens is that people interested in cryptocurrencies are inundated with monologues about the historical failures of central banks and the debasement of fiat currencies, while absorbing an almost deadly amount of industry jargon that is incomprehensible to anyone except those who already know a lot about cryptocurrencies.

But stablecoins…

People understand stablecoins.

Stablecoins are a powerful construct because they take a concept that people already know and interact with every day (the dollar) and add something they don’t understand (the blockchain). Not only does this create a curiosity gap, but because people have a basic mental model to compare stablecoins, the core differences and advantages of cryptocurrencies are more apparent.

By sidestepping the whole existential “what is money” question that inevitably arises when explaining crypto-native assets like Bitcoin and its derivatives, the existence of stablecoins makes a core point: crypto is the best representation of an asset.

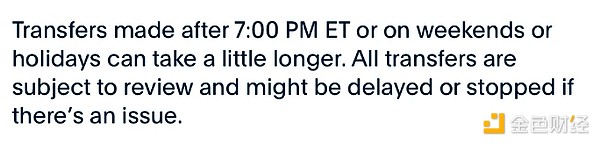

In effect, stablecoins allow anyone with an internet connection to transfer dollars to anyone in the world. Transactions are completed in less than a second and cost less than a penny. No rent-seeking intermediaries, no bank accounts required, no oppressive capital controls, no multi-day settlement delays, no nonsense.

The benefits of stablecoins are clear for anyone who lives in a country with an over-inflated local currency, tries to send money across borders, or simply wants to conduct financial transactions over the weekend or during holidays.

Once you start regularly transacting USD in a stablecoin format (digital USD), going back to using traditional banking services will feel very outdated. It’s similar to going from fiber optic gigabit internet back to 56K dial-up.

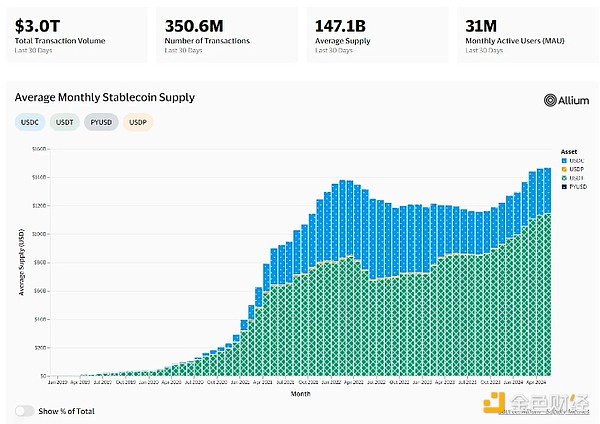

In terms of market demand, the data speaks for itself. Stablecoins have objectively achieved product-market fit, and no matter which metric you look at — monthly active users, transaction volume, circulation — they have all broken through all-time highs.

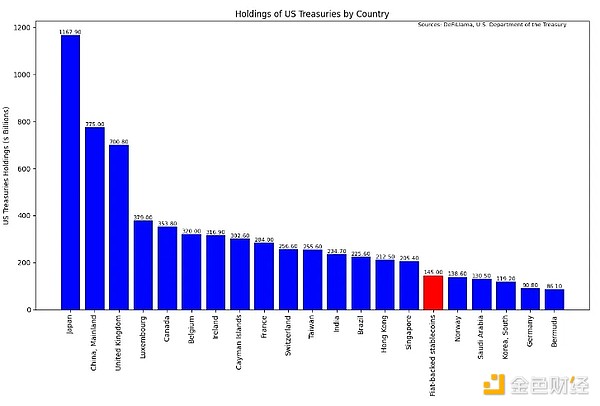

In contrast, the total amount of U.S. Treasuries held by stablecoins is about $145 billion, making it the 16th largest holder of U.S. Treasuries. It exceeds Norway, Saudi Arabia, and South Korea. As one of the largest and fastest-growing purchasers of U.S. government debt, and with stablecoins consolidating the global dominance of the U.S. dollar, the United States will increasingly support the existence and development of stablecoins over time.

The integration of fintech and stablecoins

One might think that stablecoins are designed to replace existing fintech payment applications, but this couldn’t be further from the truth. By launching their own stablecoins, existing fintech companies can not only benefit from the cost and speed advantages offered by blockchain-based settlements, but also eliminate fragmentation in the payments industry.

It’s simply ridiculous that you can’t send money from a Venmo wallet to a Cash App wallet or any other combination of common payment apps. Stablecoins, on the other hand, can be transferred between any two parties, regardless of the wallet software used. The improvement in user experience is undeniable, and consumers will come to expect this.

Furthermore, given their open and programmable nature, stablecoins (issued by fintech companies) can be seamlessly integrated into existing DeFi protocols and on-chain financial applications. This makes existing fintech companies particularly suitable as an interface layer for consumers who want to interact with on-chain applications, such as earning yield, while still receiving dedicated customer support.

Just like tokenized assets, this reality is arriving faster than people realize.

Look no further than PayPal USD (PYUSD), a $400 million+ stablecoin launched by the world’s largest payment processor and now available on multiple public blockchains. PYUSD has been integrated into the entire DeFi economy, including decentralized exchanges and lending platforms.

“PayPal USD is designed to reduce friction in the payment experience in virtual environments, facilitate rapid value transfers to support friends and family, send remittances or make international payments, enable direct liquidity to developers and creators, and facilitate the continued expansion of the world’s largest brands into digital assets.” - PayPal

In addition to fintech companies such as PayPal issuing stablecoins directly, we have also seen well-known payment card networks such as Visa publish comprehensive research on improving stablecoin payments and actively participate in live pilots to enable Visa card payments to be settled in Circle’s USDC.

“By leveraging stablecoins like USDC and global blockchain networks like Solana and Ethereum, we are helping to increase the speed of cross-border settlements and providing our customers with a modern option to easily send or receive funds from Visa’s vault,” said Cuy Sheffield, head of cryptocurrency at Visa.

In short, stablecoins are here to stay. They are becoming more and more embedded in the existing payments industry, thereby expanding their utility by making it easier for consumers to use stablecoins and for merchants to accept them.

On-chain financial transformation

With the above in mind, my advice for helping people get on board with crypto is to have them download a crypto mobile wallet (such as Coinbase Wallet), have them generate private keys, and provide some stablecoins to trade.

While the end-to-end user experience for cryptocurrencies today is by no means perfect, even in its current state, trading stablecoins is worlds apart from traditional international bank wires. Technical complexities will only continue to be abstracted away, making the core benefits of cryptocurrencies more apparent.

This is ultimately where the Trojan Horse effect comes into play. Once someone experiences firsthand the tangible benefits of cryptocurrencies, they will begin to demand that every aspect of finance work like stablecoins. Globally accessible, fully transparent, with minimal withdrawals, always online, and not easily manipulated.

What started as improving the way dollars are transferred has evolved into transforming the global financial system into an on-chain landscape based on smart contracts and tokenized assets.

The possibilities of a fully on-chain financial system are endless.

Payment processing solutions enable merchants to accept any fungible or non-fungible asset as payment while only receiving the currency they prefer (e.g. paying for groceries using stocks, Bitcoin, or tokenized digital art, while the recipient receives a USD stablecoin).

Ability to support online creators, independent publications, or social causes through micropayments and real-time payment streams that can be transparently tracked end-to-end.

A network of self-driving taxis could collect their own revenue and automatically pay for things like electricity consumption, tolls, mechanical repairs and upgrades (any service that is fully automated through AI will require an on-chain economic system).

Creating truly global capital markets where anyone with an internet connection can access the same investment opportunities and returns as the world’s largest and wealthiest entities.

These are just high-level concepts. Just as it was nearly impossible to accurately predict which internet-enabled use cases would scale to a global level in the early 90s, the same is true for creating an on-chain financial system.

Ultimately, stablecoins are the first stepping stone towards a fully tokenized economy. Not only are they one of the first crypto-driven use cases to achieve true product-market fit, but they are also an indispensable tool for succinctly demonstrating the core value proposition of crypto and tokenization to newcomers.

So the next time someone asks you what crypto is, skip the hour-long lecture and go straight to telling them about the digital dollar.