On Tuesday, American graphics processing unit (GPU) maker Nvidia surpassed tech giants Microsoft and Apple to become the most valuable company.

This surge in Nvidia's market capitalization triggered a rally in AI-themed cryptocurrencies.

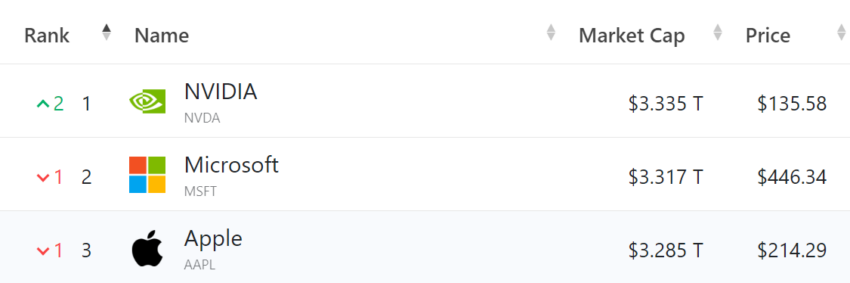

AI tokens rally as Nvidia surpasses tech giants to take first place

According to the latest data, Nvidia's stock (NVDA) price is currently $135.58 and its market capitalization is $3.33 trillion. Meanwhile, the market capitalizations of Microsoft and Apple are $3.31 trillion and $3.28 trillion, respectively.

Read more: 9 Best AI Stocks to Buy in 2024

A key driver of this growth is the demand for artificial intelligence (AI) products, which will become increasingly essential across a variety of industries beyond 2023. According to its first quarter 2024 earnings report, data center segment revenue increased 427% to $22.56 billion. This category includes AI chips and components for AI servers.

NVIDIA's success has also had an impact on the cryptocurrency market. Over the past 24 hours, the prices of major AI-themed cryptocurrencies, including Fetch (FET) and Render (RNDR), have risen significantly.

The price of FET has risen 16.3% and is currently trading at $1.33. Meanwhile, RNDR is up 10.3% and is currently trading at $7.75. Additionally, data from Santiment, an on-chain analytics tool, shows that social volume change increased by 33.33% during this period.

In the long term, NVIDIA is expected to have a significant impact on the AI and cryptocurrency fields . A report from asset manager Bitwise shows that the AI boom is having a major impact on data centers, leading to shortages of AI chips and power supplies.

With powerful chips and advanced cooling systems, Bitcoin miners provide the infrastructure AI companies need. Nvidia, a leading manufacturer of AI chips and GPUs for cryptocurrency mining , stands to gain significantly from increased demand.

Greg Beard, CEO of Stronghold Digital Mining, noted that research analysts are sounding the alarm about increased power demand due to the expansion of AI data centers. He cited an April Goldman Sachs report that said data center power demand, excluding cryptocurrencies, will increase 160% in 2030 compared to 2023.

However, infrastructure is not sufficient to meet demand. Moreover, Beard pointed out that the U.S. power industry has not developed new baseload power infrastructure in nearly 20 years.

Read more: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

“AI developers are well-capitalized and rushing to develop, but they face serious barriers to accessing power. The most obvious way to access this power is through existing Bitcoin mining farms, which are already connected to increasingly valuable power sources. “The only way for AI developers to overcome the resource gap and address future energy needs is to develop new sites and repurpose existing ones like Bitcoin miners,” Beard told BeInCrypto.

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some contents are AI-translated English versions of BeInCrypto articles.