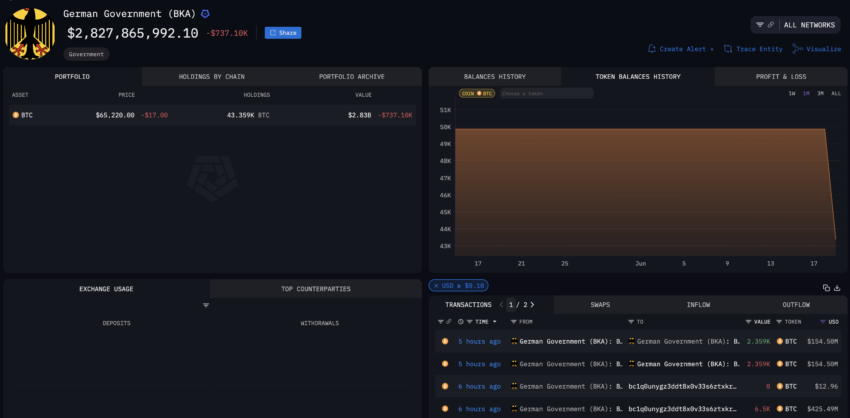

Today, a significant number of Bitcoin (BTC) transactions were initiated from wallets labeled as “German Government (BKA)” by cryptocurrency on-chain analytics firm Arkham. This activity has sparked widespread curiosity within the cryptocurrency community.

There is speculation in the cryptocurrency community that the German government may liquidate some of its BTC assets.

German government transfers 1,000 Bitcoin (BTC) to centralized cryptocurrency exchange

The Bitcoin wallet transferred approximately 6,500 BTC, which is worth a whopping $425.49 million. Previously, the German government's Bitcoin wallet held a balance close to 50,000 BTC.

Arkham's analysis suggests the funds were seized from the operators of the now-defunct pirated movie site Movie2k. Like other governments around the world , Germany confiscates digital assets resulting from criminal activity and sometimes auctions them off. For example, the U.S. government once auctioned off a significant amount of Bitcoin seized from the infamous Silk Road dark web marketplace.

About six hours ago, three significant transactions were executed from a wallet belonging to the German government. Initially, I sent 6,500 BTC to a new wallet address called “ bc1q0 ”. Additionally, 2,359 BTC was transferred within its own address.

Read more: How to Make Money with Arkham Intelligence

Afterwards, the bc1q0 wallet moved 2,500 BTC to another address “ bc1qq “. The wallet distributed 500 BTC each to various recipients, including cryptocurrency exchanges Kraken and Bitstamp, and two unknown Bitcoin addresses. However, the wallet still holds the remaining 500 BTC worth $32.64 million.

Despite this large transaction, the default wallet still holds 43,359 BTC, or approximately $2.83 billion worth of Bitcoin. Interestingly, only 1,000 BTC moved to centralized exchanges, presumably for selling. Daan, a cryptocurrency trader, says this action led to a slight decline in the price of Bitcoin .

“The actual BTC transferred to Bitstamp and Kraken is approximately 500 BTC each, with no issues so far. The post was meant to show that there was no need for large pumps/dumps etc,” Daan explained .

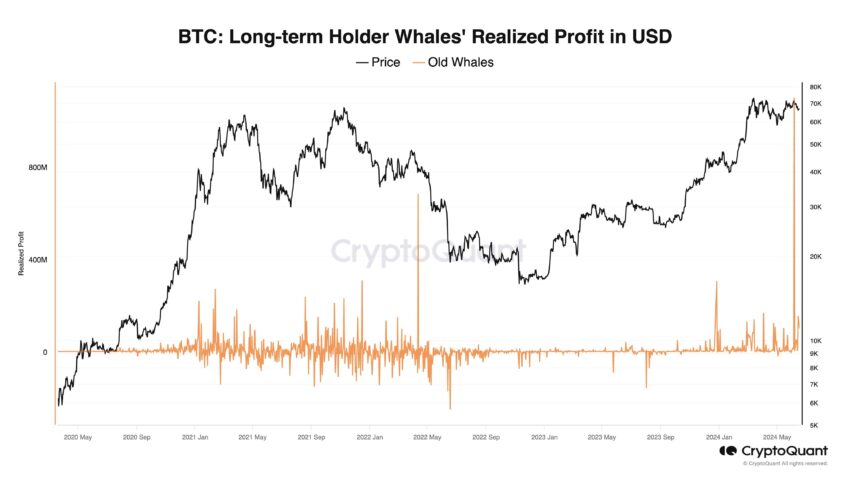

Although these transactions have not had a significant impact on the Bitcoin price, other market dynamics suggest potential selling pressure. Long-term Bitcoin whales have sold $1.6 billion worth of assets through brokers over the past two weeks, according to CryptoQuant co-founder Ki Young-joo.

“If approximately $1.6 billion of selling liquidity is not purchased over-the-counter, brokers could impact the market by depositing BTC on exchanges,” Zhu warned .

Read more: Who will own the most Bitcoin in 2024?

There was also notable movement in the Bitcoin spot ETF . Notably, the Bitcoin spot ETF recorded net outflows of $152.4 million on Tuesday.

Most of this movement came from the Fidelity Wise Origins Bitcoin ETF (FITB), which saw an outflow of $83.1 million. Grayscale's Bitcoin Trust (GBTC) followed with a decline of $62.3 million.

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some contents are AI-translated English versions of BeInCrypto articles.