Significant moves and selling pressure have rocked Bitcoin in recent weeks.

Concerns about the cryptocurrency's near-term stability are growing as long-term holders, early miners and ETF managers sell off billions of dollars of Bitcoin.

Bitcoin selling pressure accelerates

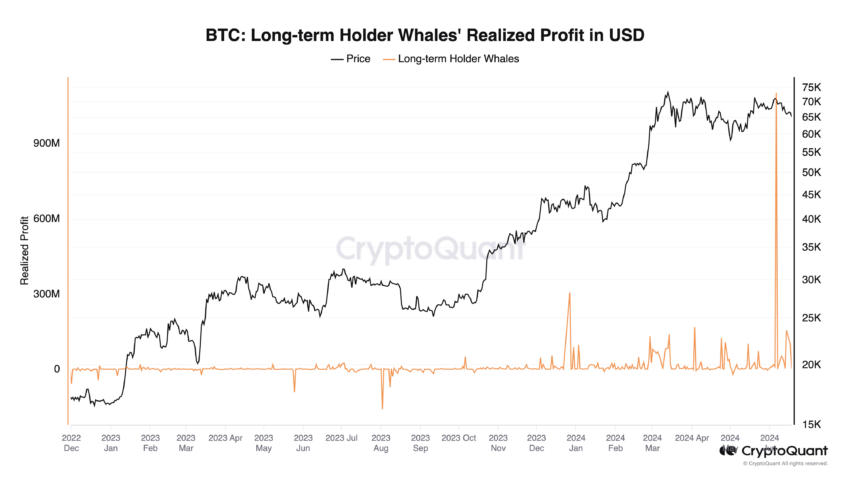

Long-term Bitcoin holders have sold $1.2 billion over the past two weeks. This massive selling is putting pressure on the market .

According to Joo Ki-young, CEO of blockchain analysis firm CryptoQuant, this amount of selling liquidity must be absorbed through over-the-counter transactions. Otherwise, brokers could have a greater impact on the market by depositing Bitcoin on exchanges .

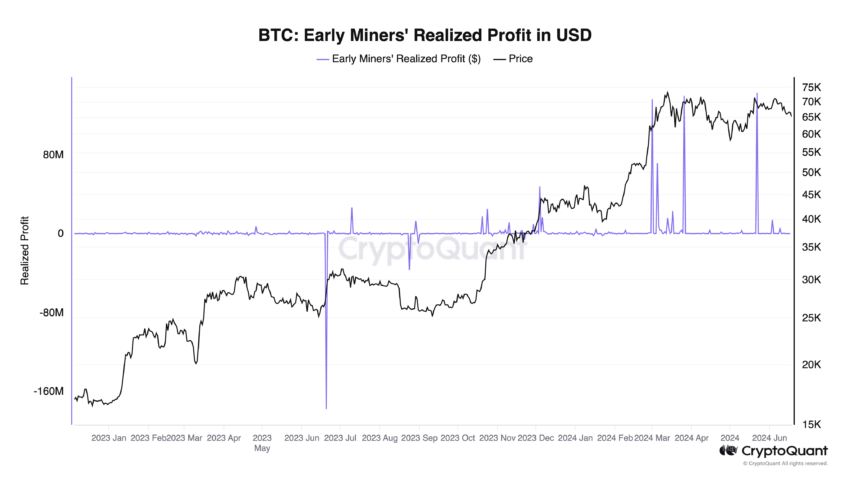

Early Bitcoin miners also contributed to the selloff. They realized profits of about $550 million this year when Bitcoin was trading between $62,000 and $70,000. This trend has intensified downward pressure on the Bitcoin price .

Interestingly, on-chain analysis suggests that this “rare” miner capitulation is related to the recent Bitcoin halving. During the Bitcoin halving process, the number of miners decreases, temporarily increasing the amount of Bitcoin sold . With these miners exiting, the market is likely to experience a decline and then rebound.

However, on-chain analyst Willie Wu argues that open interest in the futures market must be cleared for the bullish trend to resume at this stage.

“A significant amount of liquidation is still needed for further upside,” Wu emphasized .

Read more: What happened at the last Bitcoin halving? Forecast for 2024

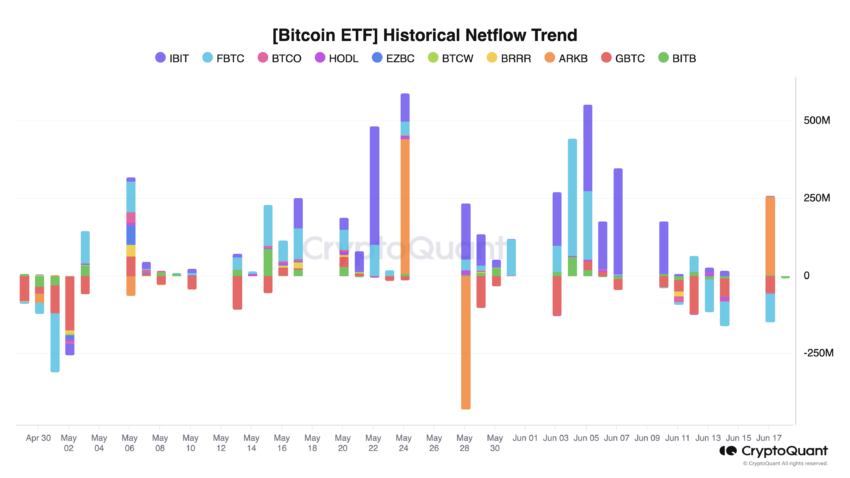

Adding to market difficulties, analysts at AI-powered analytics platform Spot On Chain showed continued negative net outflows for the Bitcoin ETF.

On June 18, 2024, Bitcoin ETF net outflows reached $152 million. This was the fourth consecutive day of negative net inflows, totaling $714 million. In particular, significant outflows from Grayscale and Fidelity exacerbated bearish sentiment.

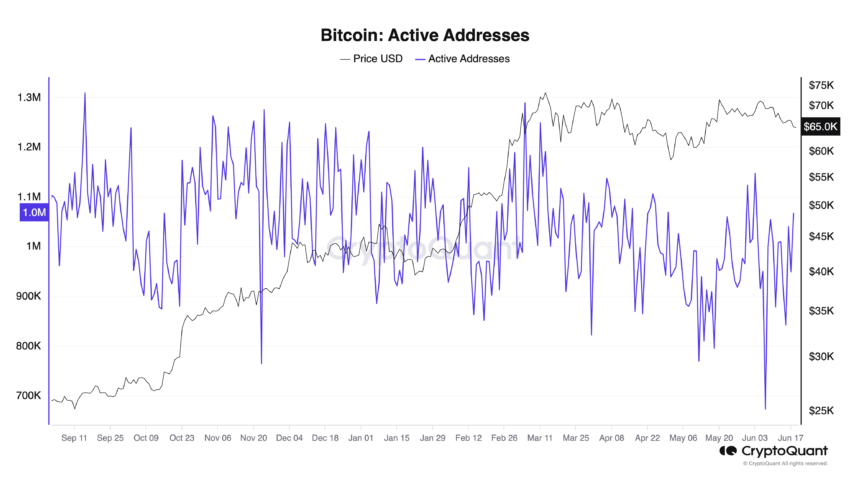

Finally, analysts at data science firm IntotheBlock noted that excitement around Ordinals and Loon led to a surge in Bitcoin trading volume earlier this year. However, the increase in usage and whale activity does not mean an influx of new participants.

“Typically, cryptocurrency bull markets are fueled by widespread Bitcoin enthusiasm. However, despite Bitcoin’s initial rise, retail user growth is lacking,” says analysts at IntoTheBlock.

In fact, the number of new Bitcoin users has fallen to its lowest level in years, even lower than during the 2018 bear market. This lack of retail investor growth raises significant questions about the sustainability of current market dynamics.

Read more: Bitcoin (BTC) price prediction for 2024/2025/2030

Mr. Joo insists that media sentiment remains optimistic, but this optimism may not be helpful. With significant selling from long-term holders and early miners and continued negative ETF net inflows , Bitcoin could face a prolonged correction .

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some contents are AI-translated English versions of BeInCrypto articles.