Source: Coinbase; Compiled by: Wuzhu, Jinse Finance

Summary

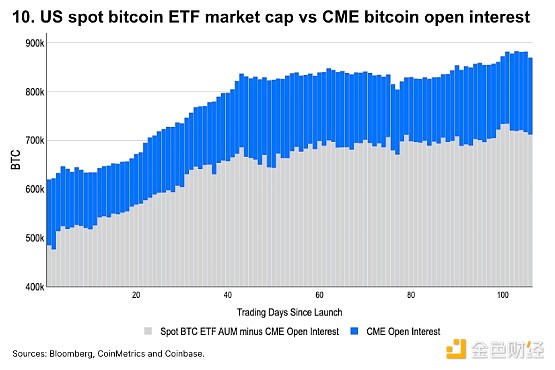

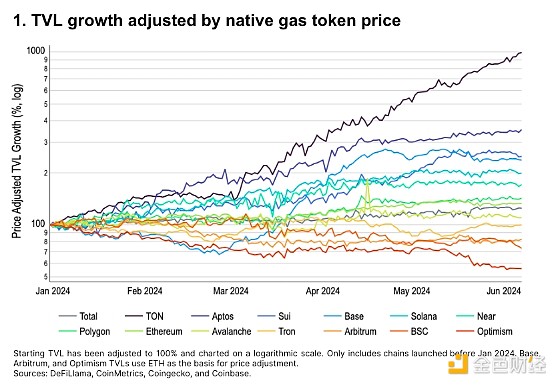

We looked at the growth of total value locked (TVL) normalized by the native gas token price appreciation in both L1 and L2 networks.

Our analysis of the impact of CME futures underlying trading on ETF flows shows that the growth of unhedged BTC ETF exposure has slowed significantly since early April.

Preface

This article reviews fundamental and technical trends in the crypto market through the first half of 2024 in 10 charts. We look at the growth of total locked value (TVL), normalized by the appreciation of the native gas token price in L1 and L2 networks. We also use a relative approach to measure on-chain activity in these networks through total transaction fees and active addresses, and then specifically analyze the biggest drivers of transaction fees on Ethereum. After that, we look at on-chain supply dynamics, correlations, and the current state of liquidity in cryptocurrency spot and futures markets.

Separately, one of the more closely tracked metrics in crypto is the inflows and outflows of US spot Bitcoin ETFs, which is often viewed as a proxy for changes in demand for crypto. However, the year-to-date growth in CME Bitcoin futures open interest (OI) suggests that some of the ETF inflows since launch have been driven by underlying trading. We analyze the impact of CME futures underlying trading, showing that the growth of unhedged BTC ETF exposure has slowed significantly since early April.

Fundamentals

TVL Growth

Rather than comparing raw TVL across chains, we track TVL growth normalized by price appreciation of their native gas tokens. Typically, native tokens make up a large portion of TVL in an ecosystem due to collateral or liquidity use. Adjusting TVL growth by price growth helps isolate how much of TVL growth comes from net new value creation versus pure price appreciation.

Overall, TVL growth has outpaced total cryptocurrency market cap growth of 24% year-to-date. The fastest-growing chains – TON, Aptos, Sui, and Base – can all be considered relatively new and benefiting from a rapid growth phase.

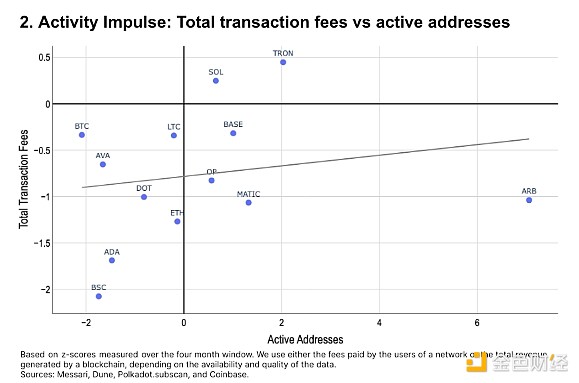

Cost and users

We compared each network’s (1) average daily active addresses in May with (2) average daily fees or revenue over the same period, both measured as standard deviations compared to the previous four months (January-April). The results show:

On-chain fees generally declined in May, with the exception of Solana and Tron;

As fees dropped after EIP-4844, active addresses on Ethereum L2 (especially Arbitrum) increased significantly;

Fees on Cardano and Binance Smart Chain were lower than the decline in wallet activity.

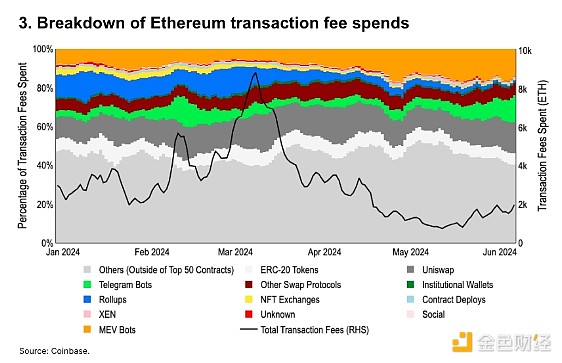

Transaction cost drivers

A breakdown of the fees for the top 50 contracts on Ethereum. Together, these contracts account for over 55% of total gas spending year-to-date.

Following the Dencun upgrade in March, Rollup spending has gradually decreased from 12% of mainnet fees to <1%. MEV (maximum extractable value) driven activity has increased from 8% to 14% of transaction fees, and direct transaction fees have increased from 20% to 36%. Although ETH has seen inflation since mid-April, we believe the return of market volatility (and high-value transaction block demand) may offset this trend.

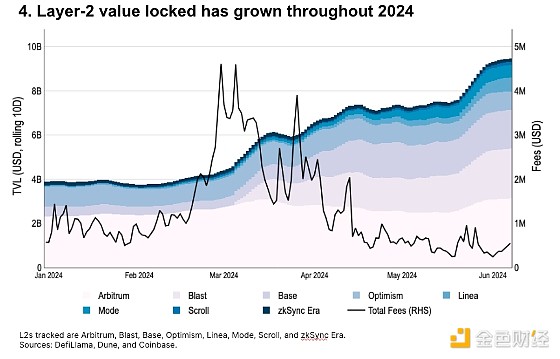

Ethereum L2 Growth

Ethereum L2’s TVL has increased 2.4x year-to-date, with total L2 TVL at $9.4 billion at the end of May. As of early June, Base currently accounts for approximately 19% of L2’s total TVL, behind only Arbitrum (33%) and Blast (24%).

Meanwhile, while TVL (and transaction counts on many chains) are at all-time highs, total transaction fees have dropped significantly since the launch of blob storage in the Dencun upgrade on March 13th.

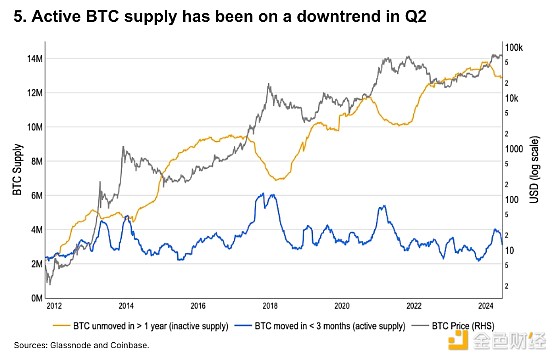

Bitcoin active supply changes

Declines in active BTC supply (which we define as BTC that has moved in the past 3 months) have historically lagged local price peaks, signaling a slowdown in market volume. Active BTC supply peaked at a local peak of 4M BTC in early April — its highest level since the first half of 2021 — before falling to 3.1M BTC in early June.

But at the same time, BTC’s inactive supply (i.e., no additional BTC has been moved in over a year) has remained flat year to date. We believe this indicates that short-term market excitement has faded, although long-term cyclical investors remain concerned.

Technical aspects

Correlation

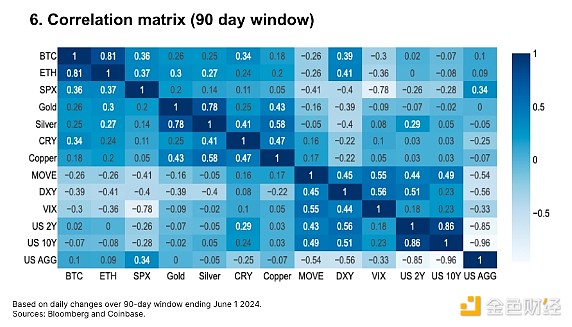

Based on a 90-day window, Bitcoin returns appear to be moderately correlated with daily changes in a number of key macroeconomic factors. These include U.S. stocks, commodities, and the multilateral dollar index, although the positive correlation with gold remains relatively weak.

Meanwhile, the correlation between Ethereum and S&P 500 returns (0.37) is nearly identical to the correlation between Bitcoin and the S&P 500 (0.36). Crypto pairs still trade highly correlated compared to cross-sector peers, though the BTC/ETH correlation has dropped slightly to 0.81 from a peak of 0.85 in March-April.

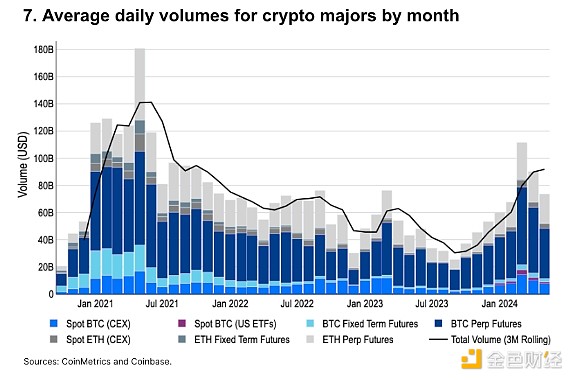

Increase market liquidity

Average combined daily spot and futures volume for BTC and ETH is down 34% from its March 2024 peak of $111.5 billion. Still, May’s volume ($74.6 billion) was higher than every other month since September 2022, with the exception of March 2023.

After the US spot Bitcoin ETF was approved in January, spot Bitcoin trading volume also rebounded significantly. In May, the spot centralized exchange (CEX) Bitcoin trading volume was 50% higher than in December (US$7.6 billion vs US$5.1 billion). In May, the spot Bitcoin ETF trading volume was US$1.2 billion, accounting for 14% of the global spot trading volume.

CME Bitcoin Futures

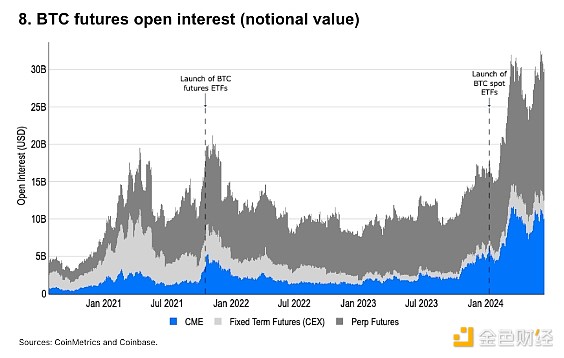

CME OI has increased 2.2x since the beginning of 2024 ($4.5 billion to $9.7 billion) and 8.1x since the beginning of 2023 ($1.2 billion). We believe that the majority of new flows year-to-date can be attributed to basis trades following the approval of the spot ETF. Following its launch, Bitcoin basis trades can now be fully conducted in the US with traditional securities brokers.

Perps OI has also increased from $9.8 billion to $16.6 billion year-to-date, keeping CME’s share of OI at around 30% (29-32%) for the year. That being said , CME futures’ market share has increased significantly from 16% at the beginning of 2023, indicating increased interest from US-based institutions .

CME Ethereum Futures

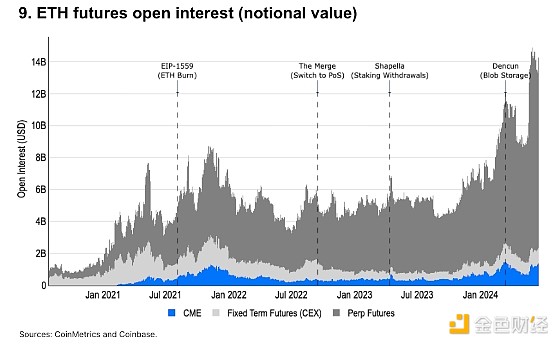

CME ETH futures OI is near all-time highs. However, ETH OI is still dominated by perpetual futures contracts, which are only available in certain non-US jurisdictions. As of June 1, 85% ($12.1 billion) of total OI came from perpetual contracts, while CME futures accounted for only 8% ($1.1 billion).

The impact of endogenous ETH catalysts on OI is usually noticeable, and the last time OI surged was after the approval of the spot ETH ETF (19b-4 filing) in the United States. Prior to that, OI peaked on March 13th when Dencun upgraded.

In addition, traditional fixed-term futures on centralized exchanges remain popular, with OI volumes similar to CME futures.

Isolate CME Bitcoin Basis Trading

Normalizing total spot ETF market capitalization to CME Bitcoin OI shows that the majority of spot ETF flows since early April (day 55) can be attributed to basis trading.

After the spot ETF was approved, the amount of BTC held in ETF custody increased by about 200,000 BTC as of March 13 (day 43). This indicates that there was directional buying of BTC during this period, which partly explains the price increase during this period. Since then, the amount of BTC held in ETF custody has remained in a range of 825,000-850,000 until the end of May when it strongly broke through this range.