Author: Route 2 FI Source: substack Translation: Shan Ouba, Jinse Finance

Current Market

The crypto market has been very rough lately, with Altcoin slowly falling over the past three months while Bitcoin has barely moved. I think this will continue through the summer until August, when the Ethereum ETF is listed, the presidential election is ready, and interest rates are lowered, and the market will pick up. But that's just my opinion.

So what have I been doing lately? Aside from holding Ethereum, doing some yield farming with Pendle and Gearbox, and signing a lot of angel deals, I haven’t been doing much. Trading has become very difficult, and any airdrops on the market have basically been sold (with a few exceptions, such as $ENA which is up about 50% from the TGE). This is a new environment. I’ve written a couple of newsletters about low float, high fully diluted valuation (FDV) tokens (you can read them here and here). While tokens launched in 2021 and 2022 have had some price action post-TGE (which is good for traders), there has been almost no such thing for tokens launched in the past year. The price action for these tokens happened in the private phase, as Cobie wrote in his latest Substack. So unless you are a founder, VC, angel investor, gamer connected to these people, or a key opinion leader (KOL), this bull market may be very difficult for you. Yes, there are exceptions: October 2023 to March 2024 is generally a good period, as is the case with new memecoins if you get in early. But other than that, most would agree that this is their toughest bull run yet. What’s interesting is that the established players don’t have the advantage they once had. Take Hsaka, for example. While he’s still a key figure, we mostly only see him when the market is in simple mode. The same goes for Ansem, who seems to have lost his way. But can we really blame him? After all, we are responsible for what we buy, when we sell, or what we trade. Yes, influencers create FOMO, but we are the ones who make the decisions about what to do with our money.

I spent most of 2023 and early 2024 on different trading terminals (PvP terminal, Tweetdeck/X Pro, Telegram alpha chat), but lately I've taken a more slow approach to the market. Basically because it's almost impossible to trade in any direction except for scalping (the rumors about ETH ETF a few weeks ago are an exception). It reminds me of the period after the Terra crash in May 2022. There was nothing to do and you were forced to contact the real world. Although I see some similarities, I think DeFi is on the rise again. While I have been waiting for the return of classic DeFi, it seems that point farming and airdrop hunting are the new DeFi. APR is collected in the private phase or point phase. For example, with Ethena you can lock up USDe for three months in advance and get the yield through airdrops. At that time, few people knew that Ethena would become so popular. I wish I had a better grasp of it, but now there is a new protocol that gives me a similar feeling (Usual - a stablecoin protocol). They are now in the private phase and the APR is also high. The question is whether they can time the market as well as Ethena (their airdrop is scheduled for October).

Stablecoins

Speaking of stablecoins, I still think this is the most important use case for cryptocurrencies. You can store funds in your own wallet completely offline and send it to anyone in seconds, no matter where they are. We now have stablecoins with yields (Ethena, Open Eden, Usual, etc.). While there is discussion about the stability/reliability of these yields, we are clearly further along than UST (Terra). For example, Open Eden is a stablecoin protocol backed by treasury bonds (with an annual yield of ~5%). Terra UST was at 20 billion at the peak of the last bull market, while Ethena was only at 3 billion. Looking forward to seeing how big it gets, or if some others can challenge it. My ultimate dream is that after this bull market (and in the depths of the next bear market) we have a stablecoin that has become as "safe" as USDT/USDC and can provide some kind of sustainable yield (5%?). There is obviously a market demand, just think of Wall Street and all the bonds in people's portfolios. The first step is to make it 100% safe (hopefully with the help of Larry Fink and Black Rock).

There are other things I'm excited about in this bull run like EigenLayer, Pendle, Gearbox, Hivemapper, and sports betting/prediction market protocols. I do miss the crazy yield farms from the last bull run. For example $TOMB on Fantom. Definitely high risk decentralization, and while we still have similar decentralized projects, the TVL on these protocols is not high and the popularity is low. Overall, I'm more interested in supporting projects that do innovative things because I'm not sure how many new Pendle and EigenLayer forks we need to be honest.

Since the market has been slower lately, I've also had more time to read books. I posted a photo of some of the books I've been reading recently. Mostly books on philosophy, economics, and life hacks. I also wanted to read some books on venture capital, as that's an area I've been gradually getting into over the past year and a half.

Some basic knowledge about venture capital

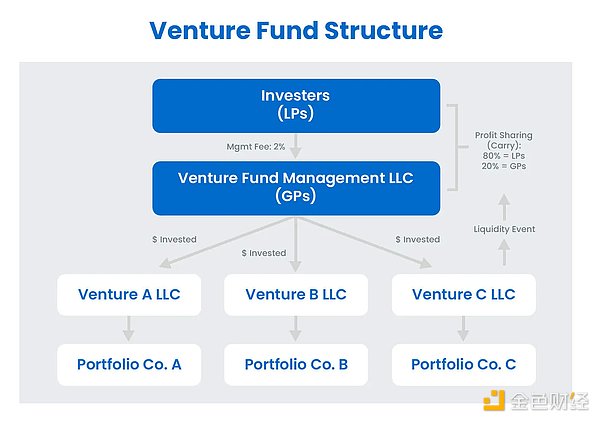

There are a few key terms to understand when pitching to investors that relate to venture fund structures.

Please see the picture below and we will explain it in detail in the subsequent text.

A venture capital fund is a pool of money that is used as the primary investment vehicle for investing in startups. This money, often called "dry powder," is used to invest in startups.

Each fund is structured as a limited partnership and is typically governed by a partnership agreement contract over a 7-10 year timeframe.

During this period, the fund's goal is singular: to make money. Venture capital funds make money in two ways:

Performance fee on fund returns (approximately 20%)

Management fee (usually around 2%)

That’s why you may have heard people talking about the 2/20 model (and now you know what it is).

The management company or venture capital firm conducts the actual business of the venture fund. It is different from the venture fund. The management company is the operations and personnel behind the fund. It exists as a business entity created by the general partners of the firm.

The management company uses the management fees it receives to pay for expenses related to the operation of the venture capital company, such as rent, employee salaries, etc. The management company receives the management fees to help deploy and grow its funds.

VC managers receive performance fees only after limited partners (LPs) are paid.

A general partner (GP) is a partner who manages a firm. Another way to define a GP is someone who manages/oversees a venture fund. A GP can be a partner in a large venture capital firm or an individual investor.

GPs raise and manage venture funds, make investment decisions, analyze potential deals, recruit on behalf of the funds, help their portfolio companies exit, and make the final decision on what to do with the money they manage. Overall, the role of a GP can be boiled down to two key responsibilities: investing capital in high-quality companies and raising future funds.

GP's income comes from performance fees and management fees. For example, if the performance fee is 20%, it means that 20% of the fund's profit will be paid to the GP.

So where does the actual capital for a venture capital fund come from? This is where the role of limited partners (LPs) comes in. LPs are the money behind a venture fund. Typically, LPs are institutional investors, such as:

University Endowment Fund

Pension funds

Sovereign Fund

Insurance companies

foundation

Family Office

High Net Worth Individuals

At the heart of the venture fund structure are, of course, the portfolio companies, which are startups that receive financing from the venture fund in exchange for preferred stock.

It depends on the specific fund, but to receive VC funding, portfolio companies must meet certain criteria or requirements. For example:

They should operate in a large market

There is product-market fit

Have great products that customers love

They must demonstrate promising economics and the ability to generate attractive returns for investors.

Here is a list of some of the largest crypto VCs: https://coinlaunch.space/funds/venture/?per-page=50&page=1

Angel Investment

On the other hand, you have angel investing, which generally means investing at an earlier stage than VC + angel investors operate on their own, so the investment amounts are smaller than VC firms. Angel investing is simply the act of investing in early stage companies. This usually happens at the "pre-seed" or "seed" stage of a business, meaning before the product or service is built or early in its life cycle. Angel investing is high risk, as most companies fail, but it also offers high returns if the company is ultimately successful.

One of the reasons I love this field is that you can be a nobody and after 1-3 years if you put in the time, effort and consistency, you can become one of the important voices in the field. This field is so new that even if you don't have a degree from an elite university, you can become an expert in this field. It's all about trial and error and curiosity.

How did I get started in angel investing?

To answer this question, we need to go back to where it all began. Before getting into crypto, I was a stock market “bro” and the Twitter I created in January 2019 was mainly focused on that as well as life maximizing. Before Twitter, I had a blog where I talked about investing and I also wrote a few newsletters (now deleted). For me, getting into crypto full time started in 2021, a few months after I quit my 9-to-5 job. In the beginning, I was just frantically buying NFTs, DeFi farms, and random tokens on Binance. But after writing posts and ideas about DeFi protocols for a while, I started receiving trade flows. In the beginning, I just rejected these trades because I felt inexperienced, but I gradually learned that many people who knew less than me were already in this game.

As you know, I am a KOL/influencer (don't like that term, but it's true). After having a relatively large audience on Twitter (300k followers) and Substack (30k subscribers), I was approached by project founders asking if I would invest in them, usually with no strings attached. However, there is a gentleman's rule that you should post something about the project, which makes total sense. Project gets exposure -> people get interested -> more people buy -> price goes up. Very well explained.

That being said, I think there are also more KOL rounds in this cycle because many founders feel that VCs don’t contribute much. Yes, they have networks, but most of the time they don’t have big audiences. KOLs, on the other hand, have huge audiences and usually solid networks as well. Therefore, many VCs also transitioned to semi-KOLs in order to get a bigger piece of the pie. I don’t blame them, to be honest.

So basically what I do is follow my natural curiosity and dabble in multiple areas in the crypto/web3 space. I wouldn't call myself an expert in any area, but rather a jack of all trades who knows a lot of topics. If I don't have an answer myself, I use my excellent network in the space to find it. Many opportunities present themselves simply because people contact me after seeing something I wrote or tweeted. However, I do think I have some advantages in certain areas. In terms of DeFi, I'm personally most interested in trading DEXs, stablecoin protocols, and yield narratives (like EigenLayer/Pendle/Gearbox, Mellow, Symbiotic+++). I'm also very fascinated by trading (both on CEX and DEX). My dream is to have a platform that can compete with Binance/Bybit, so I also like to work with teams that have this goal. I also have an advantage in marketing/growth, as an influencer, I know what works and what doesn't.

Regarding deal flow, how do you get it? You should have some kind of expertise in a niche area in crypto, or a big brand. The best combination is both (obviously).

The reason people with big personal brands or audiences perform well as angels is that companies want them on their side for credibility and distribution. There is the signaling power of having a trusted person aligned with your business who can spread the word about your product or service.

Also, when the founders send out their pitch materials, they can use your name on the materials to show that it is a good investment. Assuming you see a material and Cobie is on the equity table, I am sure most people will blindly invest in the project without doing any due diligence. After all, if it is good enough for Cobie, it should be good enough for you, right?

What am I looking for when I decide to make a trade?

There is no doubt that timing is a big factor. The terms of the deal are critical in my decision whether to invest. What market are we in? What is the outlook for the next 3, 6 and 12 months? What about the next 2-3 years? Vesting schedules can be long, so it is important to take that into account.

Is the team building something interesting that has product-market fit? Do you think it’s sustainable? What narratives does it cover? Which VCs are coming in? I then talk to people in my trusted network. Why did some of my VC friends miss out? Or why didn’t they invest more? Who are the competitors? What do you think about TVL today and in the future? Will the protocol be abandoned after the incentive program ends? All of these are valid questions.

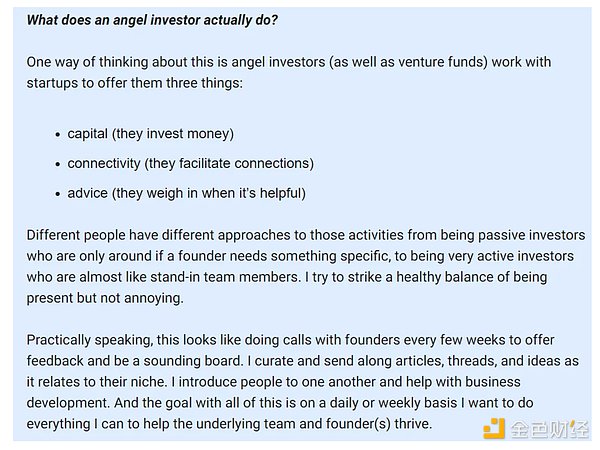

I’ve already covered the role of VCs and briefly mentioned the role of angels. Here’s a longer explanation from Ben Roy: To wrap up this post, here’s an excerpt I liked from @DCbuild3r’s latest post on angel investing.

“A key point to note is that social capital compounds just as much, if not more, than financial capital, and I believe that social capital is the biggest driver of career success in any endeavor, whether it’s sales, technology development, research, or philanthropy/volunteering.

Whatever it is, having friends in your network who have skills, who have other friends, who have capital, new insights, and wisdom, who can change things, and if you become friends, together you can really change the world.”