The prices of AI-themed tokens, including Near Protocol (NEAR), are showing notable relief and moving counter to the overall market trend. This analysis reveals the reasons for this impressive performance and what you can expect for the token’s value.

This is not the first time these cryptocurrencies have gone their own way. In the past, positive developments in the artificial intelligence industry have spread to the cryptocurrency space.

NVIDIA and Pantera offer a way out for NEAR

As of this writing, NEAR appears to be following the playbook of previous periods. On June 19, cryptocurrency hedge fund Pantera Capital announced that it was raising a whopping $1 billion.

According to the company, 15-20% of the new capital will be invested in AI-related blockchains, with the NEAR Protocol leveraging AI and blockchain technology to scale decentralized applications.

Therefore, it is not surprising that native tokens of layer 1 projects are responding positively to development.

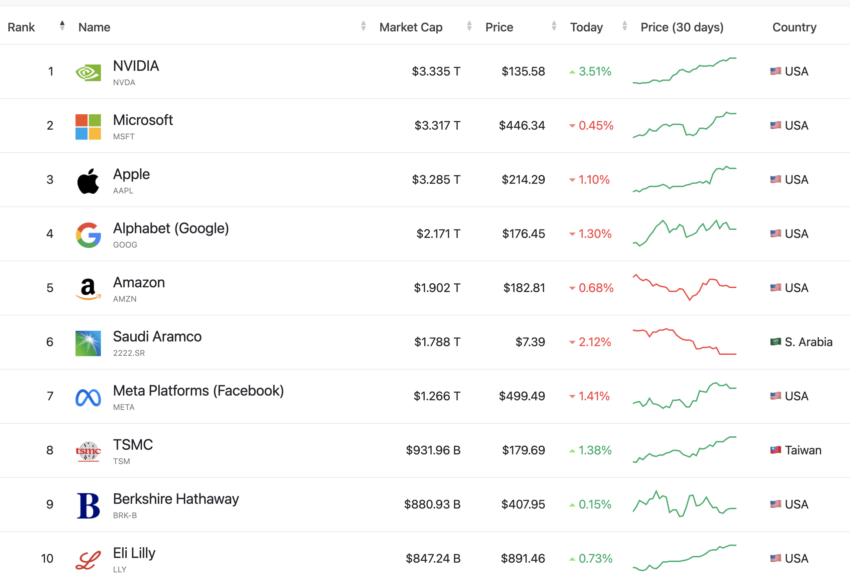

NEAR's price rise, which is trading at $5.40, is also related to Nvidia's recent milestone. On June 18, Nvidia, a leader in AI computing, surpassed Microsoft to become the world's most valuable company. This comes after its market capitalization reached $3.33 trillion.

Development activities are the cherry on top of the cake.

According to Santiment’s on-chain data, development activity on the NEAR protocol is improving. Development activity provides insight into the level of work being done to optimize the blockchain to its maximum capacity.

A decreasing indicator means that developers are not releasing new features on the network. Therefore, the recent rise means that public contributions to NEAR's GitHub repository are increasing. This is also a positive sign for the token price.

Read more: Top 8 NEAR Wallets of 2024

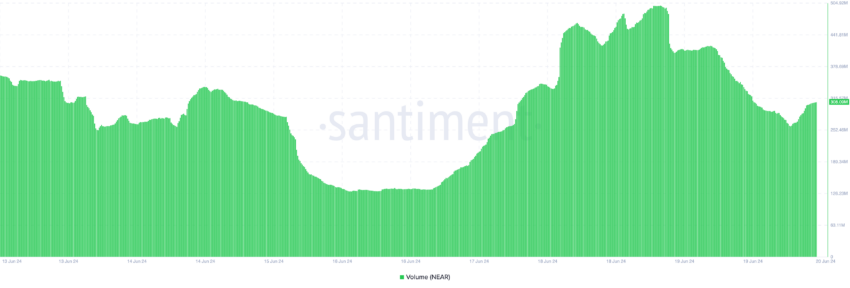

Another indicator that supports the bullish forecast is NEAR’s trading volume. Trading volume measures interest in a cryptocurrency. So an increase means an increase in buying and selling, while a decrease means not.

Apart from that, trading volume also affects the price. Increasing volume strengthens the price trend. On the other hand, when volume decreases, the trend weakens . As of this writing, NEAR's trading volume has increased to $380.91 million.

If volume continues to increase along with price, NEAR could reach $6 within a few days.

NEAR Price Prediction: Is $5.70 the Start of a Rally?

BeInCrypto noticed a notable rise in Funds Flow Index (MFI) and On Balance Volume (OBV). MFI measures the flow of funds into and out of cryptocurrencies. Additionally, technical oscillators can identify overbought and oversold signals.

At press time, the indicator appears to be barely above its midpoint level of 50.00, indicating increasing buying pressure on the token. Specifically, OBV measures positive and negative volume flows. Like MFI, this indicator indicates whether buying or selling pressure is dominant.

As OBV increases , the price of NEAR may continue to rise . We analyzed Fibonacci retracement levels for specific targets.

The Fibonacci retracement tool is a predictive indicator that shows a series of horizontal lines of potential resistance and support. Each level is associated with a percentage, the most important levels being 23.6%, 38.2%, 61.8%, and 78.8%.

The daily chart also shows that NEAR could rise to $5.70 if buying pressure increases. This is where the 61.8 Fibonacci level is located. In a very bullish situation, NEAR could move up to $6.15 at the 78.6% level.

Read more: What is the NEAR Protocol (NEAR) ?

However, if NEAR holders begin to pull back on recent price gains, the bullish logic will be invalidated. Additionally, a decline in development activity could offset the uptick. If this happens, the price of NEAR could fall to $5.06.

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some contents are AI-translated English versions of BeInCrypto articles.