Bitcoin's potential to reach $100,000 remains a hot topic among investors. A variety of market dynamics and economic indicators suggest that this ambitious goal is still within reach.

Experts share their insights on what Bitcoin needs to achieve this milestone.

The Road to $100,0000 in Bitcoin

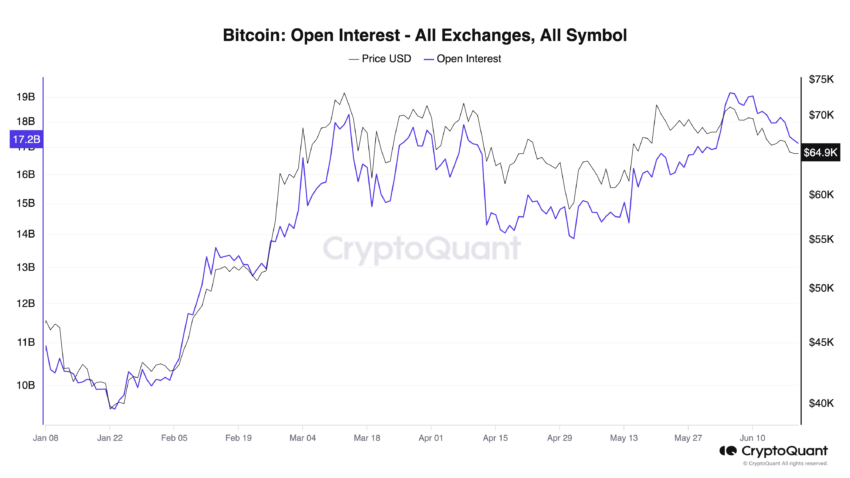

Felix More, co-founder of Morewolf, spoke about Bitcoin's potential in an interview with BeInCrypto, highlighting the growing demand and increase in open interest (OI). Recently, Bitcoin futures OI surged by $2.02 billion in just 3 days.

“This increase in buying pressure for Bitcoin is not a coincidence. “Investors are expecting two US Federal Reserve interest rate cuts by the end of this year,” explains Mohr.

In fact, investor sentiment is greatly influenced by speculation surrounding the Federal Reserve's monetary policy. A Reuters poll suggests a rate cut is likely in September, but it's also possible there will be a smaller or no cut at all.

“In a Reuters poll conducted from May 31 to June 5, nearly two-thirds of economists, 74 out of 116, predicted the first cut in the Federal Reserve's benchmark interest rate in September, to a range of 5.00% to 5.25%. . “This is the same conclusion as last month’s opinion poll, with a similar majority.” You can check it out in the Reuters report .

Historically, Bitcoin has benefited from strong stock markets, which could be buoyed by interest rate cuts from the Federal Reserve. But Federal Reserve Chairman Jerome Powell remains cautious and economic data is making the situation more complicated.

The consumer price index (CPI) rose 3.4% last year, while the core CPI rose 3.9%. The producer price index (PPI) also rose 2.2% annually, exceeding expectations. These numbers suggest that inflation is continuing, which could curb the Fed's aggressive interest rate cuts.

“Amid a flood of economic indicators that are below expectations, the SP500 index has reached an all-time high, suggesting a possible turnaround. Bitcoin and traditional markets have historically moved together. A correction in traditional markets could send Bitcoin prices crashing,” More told BeInCrypto.

Read more: How to Use Cryptocurrency to Protect Yourself from Inflation

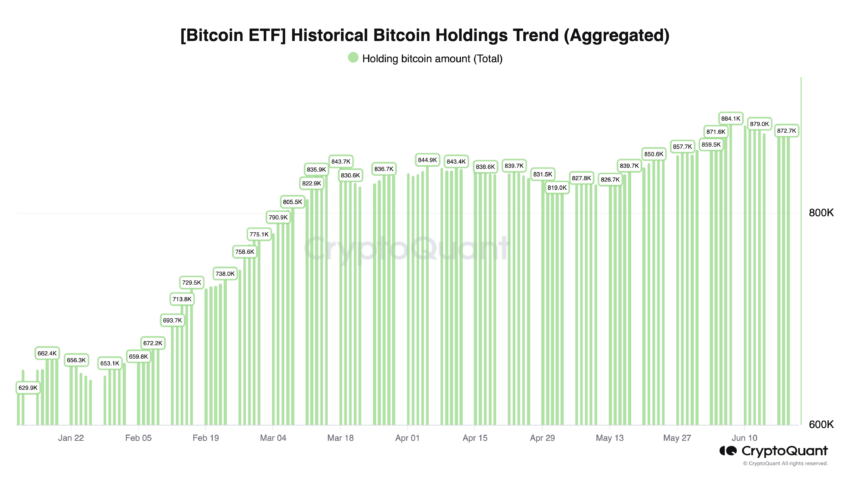

Nonetheless, Bitcoin’s trajectory is also influenced by institutional interest. The U.S. Securities and Exchange Commission 's (SEC) approval of a Bitcoin exchange-traded fund (ETF) served as an important catalyst.

Expectations of approval of an Ethereum ETF by major financial institutions later this year could also lead to significant price gains.

“Bitcoin hit a new all-time high of $74,000 in mid-March. “If the Fed actually cuts rates twice, the march to $100,000 will begin again by the end of the year,” Mohr concluded.

This optimistic scenario is also supported by Bernstein Research. The company expects Bitcoin to reach $200,000 by 2025, $500,000 by 2029, and $1 million by 2033.

Bernstein analysts argue that Bitcoin ETFs, which initially saw retail-focused allocations, are poised for wider adoption as major wirehouses and private banks prepare to offer such investment products.

Read more: Bitcoin (BTC) price prediction for 2024/2025/2030

They argue that these institutional-based transactions could act as a ‘Trojan horse’ for the widespread adoption of Bitcoin, potentially turning it into a mainstream asset class . Therefore, it seems likely that Bitcoin could achieve $100,000+, depending on favorable economic policies and continued institutional interest.

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some content is an AI-translated version of the English version of BeInCrypto articles.