Author: Stephen McBride, Chief Analyst, Riskhedge Source: Medium Translation: Shan Ouba, Jinse Finance

We are already halfway through 2024, and what a year it has been for cryptocurrencies.

First, the Bitcoin ETF was launched in January…

Then, in April, the long-awaited fourth Bitcoin halving…

Soon, the newly approved Ethereum ETF will begin trading…

Today, I want to answer another important question on investors’ minds: Where are we in the Bitcoin cycle?

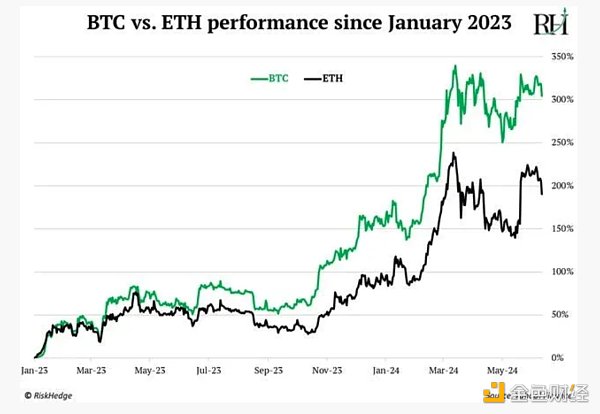

BTC and ETH are up 52% and 48% this year, respectively.

Since the beginning of 2023, Bitcoin has surged around 300% and Ethereum has risen around 200%:

It’s been a wonderful journey, but is it coming to an end? The answer is no.

In short: My research suggests that we are only approximately halfway through this bull market cycle.

Let me explain. First...

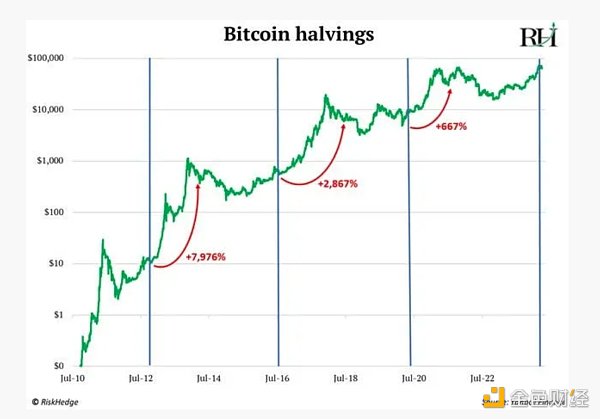

BTC has followed a predictable pattern before, during, and after each Bitcoin halving

The fourth Bitcoin halving took place on April 19. I wrote a lot about it before this.

Why?

Because this scheduled event — which automatically cuts the new supply of Bitcoin in half — creates a predictable upward cycle every time it occurs.

Cryptocurrency prices typically bottom out 12 to 18 months before a Bitcoin halving. They then rise during the halving… and rise even faster in the year after the halving.

BTC rose 8,000% after the first halving… it rose almost 30x in the year after the second halving… and the most recent halving four years ago brought another 6x gain.

Bitcoin is on track for this cycle. The price bottomed out 17 months before the halving and is now up more than 300% from that low.

BTC has only risen slightly since the most recent halving, but this is nothing to worry about. We are in the window where the biggest price gains typically occur.

Analyzing the crypto market through the lens of Bitcoin’s halving suggests that we are in the fourth or fifth inning of this bull market.

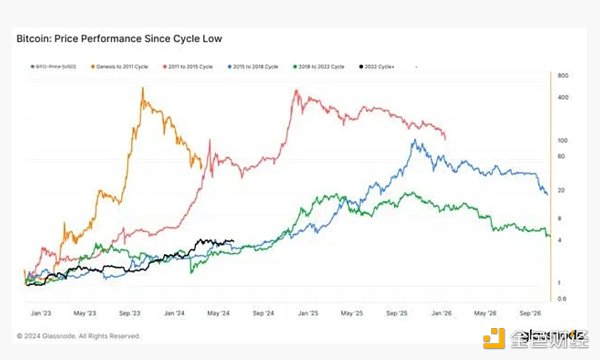

When I look at Bitcoin’s gains since bottoming out in late 2022, I come to the same conclusion.

You can see that the current cycle (black line) is similar to the previous two market cycles:

Everything that happens on the blockchain is transparent and public. On-chain analytics allows us to see what is actually happening in the crypto market in real time.

All the on-chain metrics I follow tell the same story: the crypto bull market has 12 to 18 months left.

Although we are roughly halfway through the cycle in terms of time, studying past bull markets shows that the majority of profits are made in the second half.

About 80% of profits are made in the last 20% of the cycle.

It won’t be a straight path up. Remember: Cryptocurrency is the most volatile asset in the world. No other asset compares. But as I tell my RiskHedge Venture subscribers, “We’re still early. The best is yet to come.”

Don't lose sight of the big picture.

What are the best cryptocurrency investments at this stage in the Bitcoin cycle?

I have always said that I believe BTC will reach at least $150,000 this cycle. That is roughly a 120% gain from now.

I think ETH, the world’s second largest cryptocurrency, will perform better.

But my favorite way to participate in this crypto bull run is to invest in the lesser-known crypto businesses that are making money.