Original | Liu Jiaolian

On Thursday night, the market had a false climax. This is what was mentioned in the internal reference last night. The number of initial unemployment claims in the United States exceeded market expectations. Unemployment is bad for the American working class, but good for the financial market. Bad is good. The brain circuit is strange. Americans are unemployed, but compared with last week, the number of unemployed people has decreased. Not being unemployed is good for American workers, but bad for the financial market. Good is bad. In fact, it is not the financial market that has a strange brain circuit, but the Federal Reserve inserted into the logical chain.

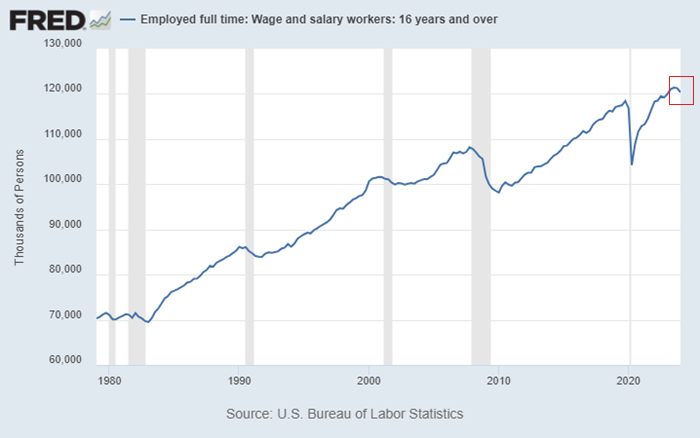

Is the American employment data facing another turning point, on the verge of a sharp drop, leading to an economic recession?

Whether or not they receive a salary, whether or not they can live without a salary, divides people in modern society into two classes. The working class works hard to create 100 yuan of income for the company, and takes 10 yuan for themselves. This 10 yuan is called salary. After deducting various expenses from this 100 yuan, the remaining 20 yuan is called profit. Taking out 10 yuan from the profit and splitting it among the shareholders according to the number of shares is called dividends.

Why do shareholders have the right to continue to share profits? The standard answer is that they are the investors. However, even when the dividends have fully repaid their investment, they can still continue to unconditionally take the profits created entirely by the labor of the working class, forever (unless the company goes bankrupt). This is capitalism.

You think this system is fair, reasonable, transparent, and practical. This is called capitalist ideology. Ideology is not brainwashing, but making people recognize a logic from the bottom of their hearts.

The financial market is a highly abstract version of the above logic. By abstracting away the payment of wages and the production of profits, only numbers remain: investment and income. The enterprise is abstracted into a symbol, which is no different from any financial target.

It is even more impossible for you to examine the entire process of profit creation and distribution to see whether it is fair and just. All you can see is: invest 100 yuan in XYZ and get a 20% dividend every year, a number game like that.

Then, we also mask the 20% dividend and turn it into an increase in XYZ's stock price. This further transforms it into: XYZ's CAGR (compound annual growth rate) is 20%.

This is an amazing series of tricks. At this point, the capital has completely disappeared. All people can see is asset XYZ.

Finally, we allow XYZ to be freely traded and bought and sold in the financial market. In this way, psychological expectations and macro factors will be mixed in, stirring people's nerves and dragging the price of the underlying asset. It begins to fluctuate. It rolls up and down, and the waves surge.

In an era when the capitalist mode of production still dominates the world, for any financial target, not rising is a sin.

Since March, the leeks who have been suffering in the crypto market, where the mainstream has been fluctuating sideways and the copycats have been cut in half, may have a deep understanding of this sentence. They are too eager for the rise. They would rather be guilty than have the chips in their hands be guilty.

If the capital invested by these "leeks" is squeezed out of their salary income by cutting back on expenses and then is harvested by a decline in prices, then they are being "double exploited" by the capitalist system, which is even more miserable than the working class who are happy to work and receive wages, and spend their wages to make themselves happy.

In general, the wages that the capitalist system can pay to the working class will be on the edge of satisfying the reproduction of labor (such as your own rest, study, and giving birth to the next generation of workers), and will often be less. Therefore, if you want to save money from your wages and save enough to turn things around, it is as difficult as ascending to heaven, and it will inevitably be at the expense of other factors of labor reproduction, such as:

Rest, exercise, entertainment, study, marriage, childbirth, ...

Basically, every time you save a little money from your salary for so-called "investment", you are sacrificing one or more of the above factors.

But after you have sacrificed so much, you "invested" in, but were manipulated by the dealers, project owners, platforms, and market makers, and were repeatedly harvested, leaving nothing behind. If this is not tragic, what else is tragic?

This silent tragedy is even worse than the unemployed big bear who died heroically on the front line, and his wife and children in the rear hometown received large pensions and honorary titles. After all, if you die for the country, you still have children to pass on your genes. When the leeks are harvested, they will really disappear from this world completely.

What is the longest labor reproduction time? It takes 20-30 years to give birth to a child, raise him/her to the age where he/she can work, and then go out into society to work and earn money.

If an investment product cannot continue to set new highs in 20 years, and cannot make a profit 20 years after any buying point, then such a thing will harm a generation and will be tantamount to a crime.

The cycle of the crypto market is even shorter. It is as short as the halving cycle of BTC production. A cycle is 4 years, a reincarnation.

For crypto assets that are investment targets, if a coin cannot reach a new high after going through a bull and bear cycle, it is a failure; if a coin cannot rise to a profit four years after any buying point, then it is a sickle of harvest, a deception and a crime.

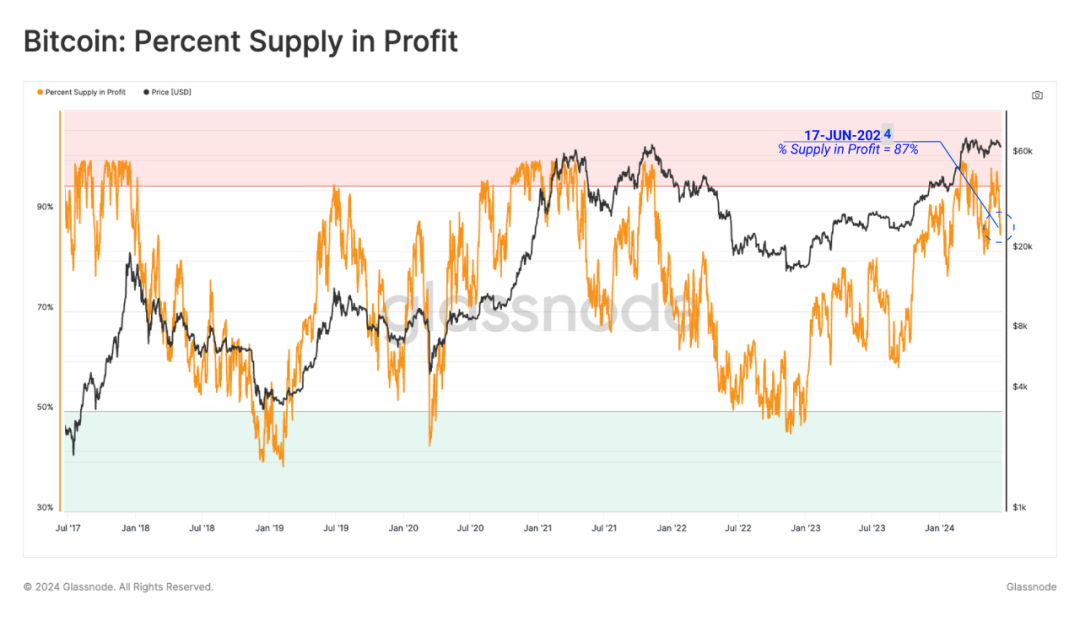

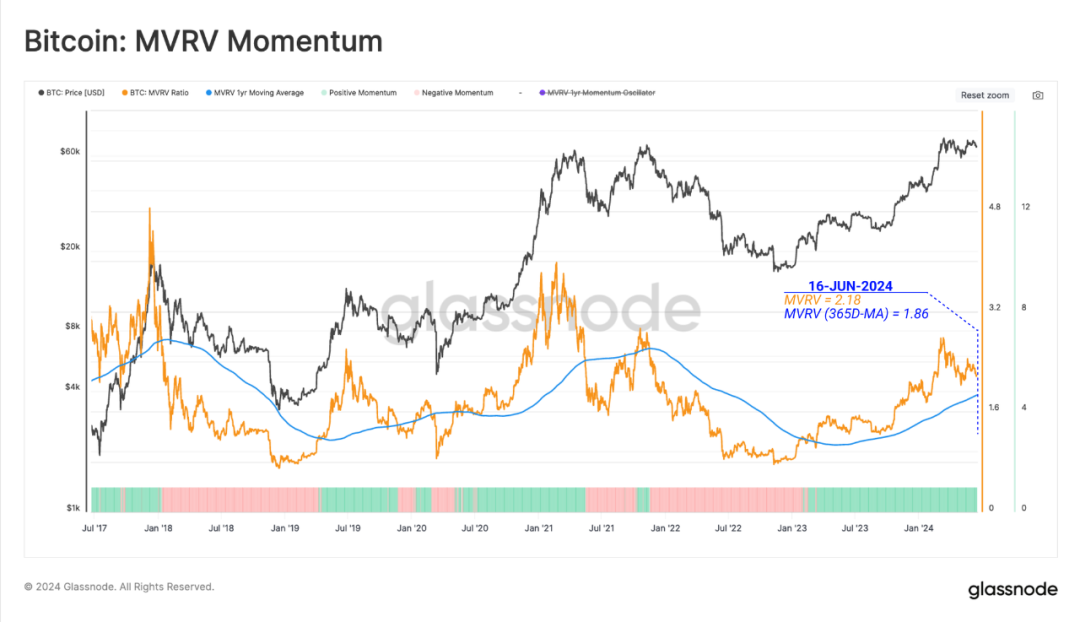

According to statistics, by mid-June 2024, 87% of all BTC positions were in profit. The average unrealized rate of return was +120%! These are obviously two impressive numbers!

(Official account: Liu Jiaolian . Knowledge Planet: reply “Planet” to the official account)

(Disclaimer: The content of this article does not constitute any investment advice. Cryptocurrency is an extremely high-risk product and there is a risk of it returning to zero at any time. Please participate with caution and be responsible for your own actions.)