This week, developments in the cryptocurrency ecosystem continue to capture the attention of the community. From meme coins that captured the public's imagination and then faced sharp corrections to Bitcoin's (BTC) role as a safety net for global finance, the cryptocurrency market remains a complex and interesting field.

Adding to the appeal of the cryptocurrency market, mainstream figures like Andrew Tate have joined the meme coin ranks. There are also claims that former US President Donald Trump has launched his own meme coin. Meanwhile, experts are showing the risks of investing in altcoins despite the Bitcoin rally.

Andrew Tate's Daddy Meme Coin Plunges 60%

This week, Daddy Tate (DADDY), Andrew Tate's entry into the meme coin market, plummeted 65% . Despite Tate's ambitious strategy to increase usage, including converting to non-fungible tokens (NFTs) and integrating with its own real university, it failed to win the trust of investors.

“I want to reduce the supply of Daddy Coins so that even if you only have one Daddy Coin, you can receive retribution from the universe. I will do so by buying coins with my own money and burning them at a certain market cap. “The supply is so limited that owning one would be a symbol of honor,” Tate said .

Despite Tate's promise to buy and burn coins to increase market value, meme coins have struggled amid controversy and a volatile market. It has fallen more than 70% from its peak.

Learn more: Cryptocurrency Scam Project : How to Identify Fake Tokens

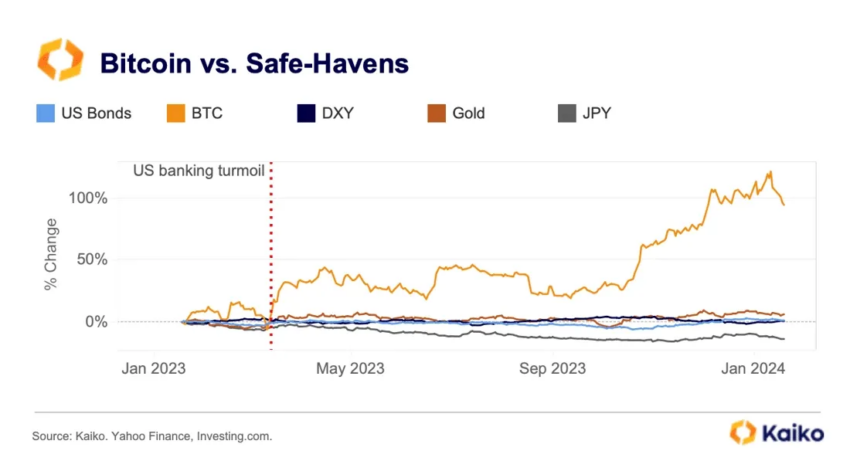

Bitcoin as a Safe Haven: BlackRock CEO's Remarks Demonstrate Economic Change

At the recent G7 Summit , BlackRock CEO Larry Fink highlighted pivotal changes in the global financial system . Capital markets have overtaken banks as the primary source of private sector financing.

As a result, Bitcoin has emerged as a potential safe-haven asset. Analysts cite the low correlation with stocks and strong institutional interest as factors boosting its safe-haven status. Bitcoin continues to attract attention as a reliable asset amid economic uncertainty, with the United States launching a $15 billion Bitcoin spot ETF starting in January.

“We believe that the role of Bitcoin and digital assets will become more and more important every year,” Matteo Greco, research analyst at Finekia, told BeInCrypto.

Read more: Who will own the most Bitcoin in 2024?

Donald Trump's DJT Meme Coin Saga Unfolds

This week, the DJT meme coin , reportedly associated with Donald Trump and his son Barron, caught the attention of the cryptocurrency community after it surged 1,450% due to speculative posts. However, the coin subsequently plummeted by nearly 75% as the drama unfolded.

Controversial figure Martin Shkreli has claimed involvement from the Trump family and helped develop DJT, but this has not yet been confirmed.

“Barron said his father was involved in this. “My father loved it,” Shkreli said .

However, Trump's advisor Roger Stone completely denied the Trump family's involvement . Meanwhile, other political figures, such as New York State Rep. Ben Geller, contrasted Stone's claims.

“I understand from a reputable source that Barron was [involved] and then stepped down when the developer completely screwed things up. This was a public relations disaster,” Geller said .

Read more: 7 Popular Meme Coins and Altcoins That Will Be Trending in 2024

Analyst warning against altcoin investment

Cryptocurrency analysts are increasingly skeptical about the prospects for altcoins . Recker Capital's Quinn Thompson points to market instability and high leverage as indicators of potential risk. The massive influx of money into Bitcoin ETFs stands in sharp contrast to the struggling altcoin market.

New altcoins are facing extreme selling pressure due to oversupply and declining demand. Experts say altcoins face a more challenging environment, potentially making them less attractive as investments.

“Altcoins are under constant selling pressure. As we head into the summer months, which already have low trading volumes, the combination of significant token supply unlocks and selling pressure from venture capitalists will likely result in too strong upside for most tokens,” Thompson said.

Since March, the total cryptocurrency market capitalization excluding Bitcoin and Ethereum (ETH) has decreased by 22.42%. This means that all other cryptocurrencies except Bitcoin and Ethereum are suffering.

Read more: 11 cryptocurrencies to add to your portfolio before altcoin season

Financial Advisors Cautious About Bitcoin ETFs

Bitcoin ETFs are growing in popularity among self-directed investors, but financial advisors are taking a cautious approach. Samara Cohen, BlackRock's ETF chief investment officer , emphasized that advisors are meticulously analyzing the risks associated with Bitcoin price volatility.

Taking a cautious approach, the Advisor is prioritizing its fiduciary duties over the high-risk, high-reward appeal of Bitcoin investments. Despite optimism about Bitcoin's potential, the cautious stance of professional advisors highlights the challenges of incorporating the cryptocurrency into existing investment portfolios.

Meanwhile, the Bitcoin spot ETF is struggling this week. To date, it has recorded outflows of more than $438 million.

Read more: How to Trade Bitcoin ETF: A Step-by-Step Approach

| date | IBIT | FBTC | BITB | ARKB | BTCO | EZBC | BRRR | HODL | BTCW | GBTC | DEFI | Sum |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| June 17, 2024 | 0.0 | (92.0) | 2.9 | (50.0) | 0.0 | 0.0 | 0.0 | (3.8) | 0.0 | (3.0) | 0.0 | (145.9) |

| June 18, 2024 | 0.0 | (83.1) | (7.0) | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | (62.3) | 0.0 | (152.4) |

| June 19, 2024 | – | – | – | – | – | – | – | – | – | – | – | 0.0 |

| June 20, 2024 | 1.5 | (51.1) | (31.5) | 0.0 | (2.0) | 0.0 | 0.0 | (3.7) | 0.0 | (53.1) | 0.0 | (139.9) |

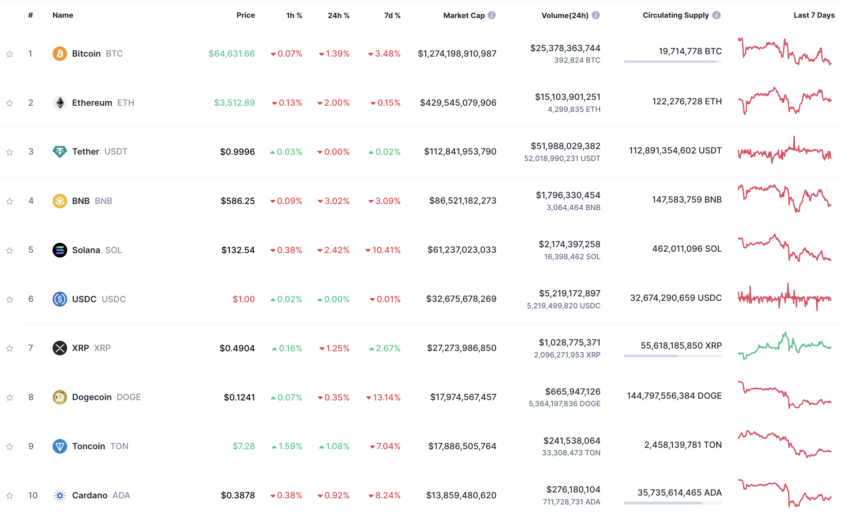

Top 10 cryptocurrencies this week

The cryptocurrency market continued its downward trend this week, with the total market capitalization falling to $2.35 trillion. In particular, Bitcoin and Ethereum fell 3.48% and 0.15%, respectively.

Dogecoin (DOGE ) and Solana (SOL ) had the steepest declines among the top 10 cryptocurrencies. However, Ripple reversed the trend by rising 2.67%, showing resilience even amid market volatility.

Trusted

The information contained on the BeInCrypto website is published in good faith and for informational purposes only. Users are solely responsible for any consequences arising from their use of information on the website.

In addition, some contents are AI-translated English versions of BeInCrypto articles.