Cryptocurrency enthusiasts and investors are wondering when altcoin season will begin.

Top analysts offer varying perspectives on the timing and indicators that signal these changes.

There is no altcoin bull market yet

Crypto analyst Myles Deutscher shared his latest insights, emphasizing that the market is far from an altcoin bull market . He explained that while Bitcoin is hitting all-time highs and meme coins are showing strength, altcoins are significantly underperforming.

“Most retailers don’t hold Bitcoin in large quantities, but rather as an altcoin. And altcoins have performed quite poorly so far this cycle,” he noted.

Doiser showed several important data points:

- The Other/BTC ratio is lower than it was in October 2023, indicating poor performance for altcoins.

- Since the FTX collapse , only eight altcoins have reached all-time highs against Bitcoin.

- YouTube views for Bitcoin are disproportionately low compared to the price surge, suggesting retail apathy.

- While Bitcoin hit new highs in March, the altcoin is still about 70% off its previous highs.

- Since the Bitcoin price rose from $27,000 in October 2023, altcoins have yet to see a sustained upward trend.

Read more: What are the best altcoins to invest in June 2024?

Deutscher attributed this market movement to the Bitcoin-led cycle driven by the story of cash exchange-traded funds (ETFs) and strong inflows.

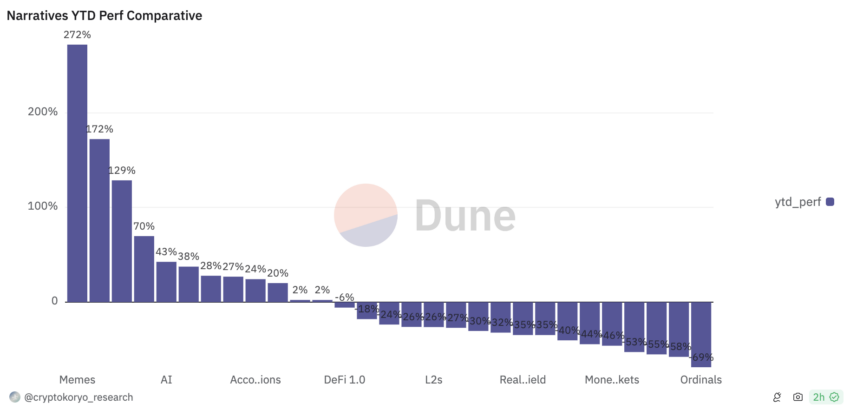

“This is a cycle driven by the Bitcoin narrative… Certain narratives have performed quite well (with the majors lagging behind). Memes, AI and RWA were the clear leaders this cycle,” he added.

Altcoin season is coming

Despite the current scenario, cryptocurrency investor Leia Heilfern pointed out several bullish factors for cryptocurrencies, including the approval of Bitcoin and Ethereum ETFs and endorsements from celebrities. She argued that the market is shaking off the bear market and preparing for the next big move.

“Imagine not being optimistic about cryptocurrencies right now. The Winklevoss twins donated $2 million to Donald Trump. Bitcoin and Ethereum ETFs approved. Trump supports cryptocurrency. The half-life is over. Ethereum is not a security,” Heilfern said.

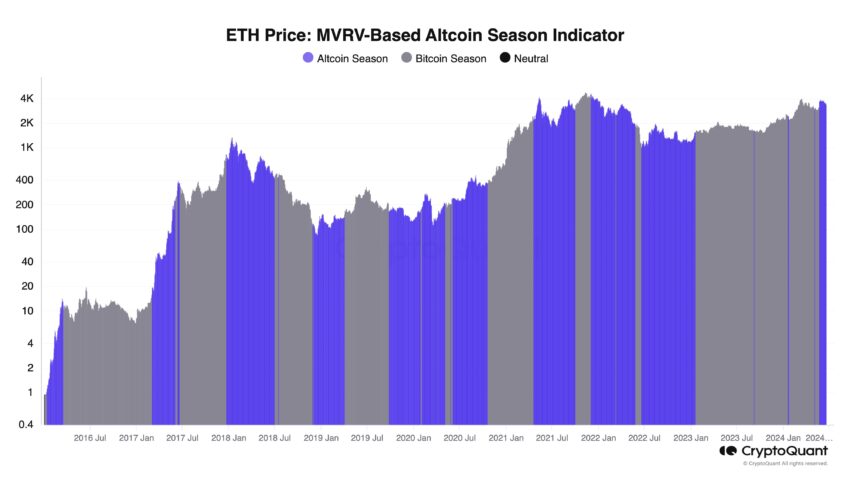

Meanwhile, CryptoQuant CEO Joo Ki-young and technical analyst Mr. Crypto see signs of an early altcoin season . Representative Joo said that Ethereum's MVRV ratio is rising faster than Bitcoin, indicating that Ethereum is rising relative to on-chain fundamentals.

This could signal an altcoin season led by Ethereum, especially considering the current ETF landscape.

“Given the current ETF landscape, this could be Ethereum’s own season. Historically, when Ethereum surges, other altcoins tend to follow,” explains Joo.

Read more: 11 cryptocurrencies to add to your portfolio before altcoin season

Given the potential of the altcoin season, Michael van de Popp explained that he is bullish on Chainlink (LINK), citing past patterns and predicting a significant rally in the second half of the year. He noted that LINK formed a solid weekly candle at the cycle low, similar to a pattern seen over the past few years that led to significant gains.

“LINK is forming a very nice weekly candle at the cycle low… Similar price patterns have occurred over the past few years, resulting in rallies of 150%. I am hoping for the same results,” said van de Popp.

Meanwhile, Rect Finance cited Polkadot's entry into the artificial intelligence competition as a strong indicator. As projects like Origin Trail and Pala Network leverage Polkadot's AI technology, Polkadot can become a central hub for AI projects, potentially increasing its value.

Read more: 10 Best Altcoin Exchanges in 2024

Although analysts disagree about exactly when, they agree that altcoin season is just around the corner. Investors must stay informed and consider market trends and expert insights.