The price of Bitcoin (BTC) rose above $70,000 for 19 consecutive trading days earlier this month as funds flowed into exchange-traded funds (ETFs).

However, this rally has stalled and prices are currently trending lower. This is likely to lead to the second negative monthly close this year.

Miners sell $2 billion worth of Bitcoin

Market analysts attribute the poor performance to massive selling by Bitcoin miners and recent outflows from spot ETFs.

“Almost all Bitcoin miners are selling 100% of their coin holdings,” said Matthew Siegel, head of digital research at Bitcoin ETF issuer VanEck. Blockchain analytics firm IntoTheBlock supported this observation, reporting that top miners’ Bitcoin holdings have been significantly depleted.

The Bitcoin holdings indicator is used to measure the financial health of miners. A decline usually indicates that miners are selling assets instead of accumulating them. This month alone, miners sold about 30,000 BTC, worth about $2 billion, dropping reserves to an all-year low of 1.9 million BTC.

“Bitcoin miners have sold more than 30,000 BTC (about $2 billion) since June, the fastest pace in a year. The recent halving has triggered this sell-off as margins have tightened,” IntoTheBlock explained.

Read more: 7 Best Cryptocurrency Exchanges in the US to Trade Bitcoin (BTC)

The increased selling by miners is due to profits still being low following the recent halving event . The halving that occurred last April reduced the block reward by 50% to 3.125 BTC. As a result, daily miner revenue plummeted from a peak of $78 million in March to about $35 million, a 55% decline.

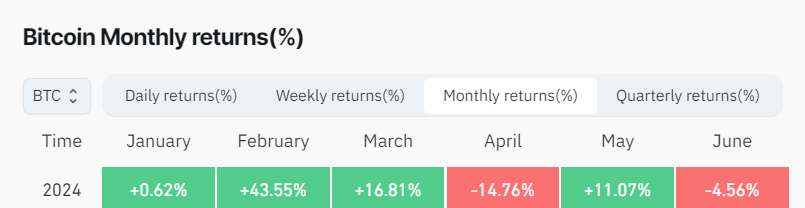

This trend has intensified downward pressure on the Bitcoin price and suggests it could go into negative territory if its current performance continues. Bitcoin is expected to fall 4.56% in June, marking its second negative monthly close in 2024, according to Coinclass data. Bitcoin has already recorded a 14% drop in April.

Read more: Bitcoin (BTC) price prediction for 2024/2025/2030

However, Bitcoin analyst Willie Wu believes that Bitcoin can reverse this downward trend by recovering its hash rate and eliminating the bear market.

“If Bitcoin weakens, inefficient miners with outdated hardware and high costs will go bankrupt. Meanwhile, other miners must upgrade to more efficient hardware. Why is that so? This is because the income has been cut in half for the same expenses. In both cases, miners will have to sell BTC to pay for losses or hardware upgrades. When that happens, the selling ends and only the strong remain, who are left waiting for higher prices,” explains Wu.