Once considered a speculative experiment, Bitcoin has grown into a safe and trustworthy digital asset.

A closer look at why Bitcoin risks are at an all-time low.

Why Bitcoin Risk Is Lower Than Ever

Proven technical robustness

Initial doubts about Bitcoin's technical foundations have now disappeared. Satoshi Nakamoto's engineering decisions, such as 1 megabyte block size and 10-minute block cycle, have proven effective. The network has proven its resilience and security, mining over 846,448 blocks without any major hacks.

Additionally, many protocols are exploring ways to leverage Bitcoin’s security to enable staking on various blockchain platforms. Implementing Bitcoin, a proof-of-work (PoW) asset, into a proof-of-stake system will help strengthen the security of other networks.

“In the beginning, questions continued to arise about Satoshi’s engineering abilities. Was a 1 megabyte block size a good idea? What about 10-minute blocks? Is Encryption Enough? Is hacking possible? But over time, Satoshi’s programming skills were proven.” Komodo Chief Technology Officer Kadan Stadelman said in an interview with BeInCrypto:

Read more: How to Buy Bitcoin and Everything You Need to Know

Bitcoin's hash rate, a measure of computer security, continues to hit record highs. This increase in mining power enhances the security of the network, making it more reliable against potential attacks.

regulatory acceptance

Initial uncertainty surrounding Bitcoin's regulatory status has been resolved. In 2014, the U.S. Internal Revenue Service designated Bitcoin as an asset, eliminating concerns about taxes on unrealized gains. The U.S. Commodity Futures Trading Commission also followed suit in 2015, declaring Bitcoin a commodity. This regulatory clarity has provided a stable environment for OG cryptocurrencies to thrive.

Once BTC's regulatory status became clear, attention shifted to the potential threat of copycat digital assets. This has led to the emergence of numerous altcoins. However, the presence of altcoins has only strengthened Bitcoin’s position. Today, Bitcoin and the broader cryptocurrency market are considered separate industries, with Bitcoin coming into its own.

institutional support

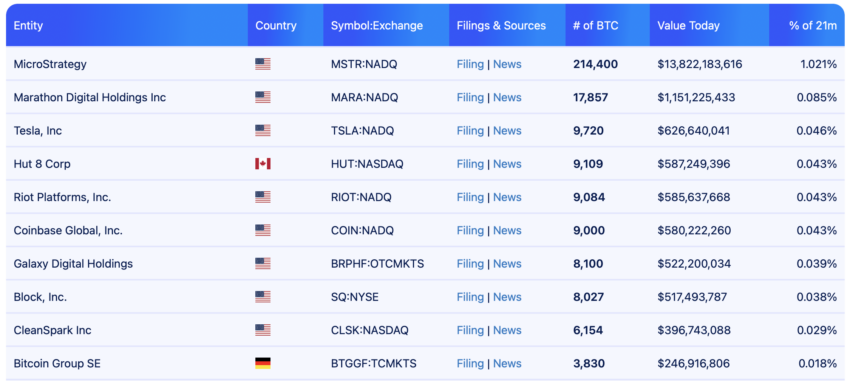

Perception of Bitcoin changed dramatically as institutions began investing. MicroStrategy showed confidence in the stability of Bitcoin by purchasing $250 million worth of Bitcoin in August 2020.

“Bitcoin is a swarm of cyber hornets serving the Goddess of Wisdom, feeding on the fire of truth and growing exponentially smarter, faster and more powerful behind walls of encrypted energy,” said Michael Saylor, CEO of MicroStrategy. says:

Saylor's comments supporting Bitcoin as a powerful decentralized asset further strengthened Bitcoin's reputation. Following MicroStrategy, Tesla and Square made large-scale investments in Bitcoin, further increasing the trustworthiness of Bitcoin.

Read more: Top 11 Listed Companies Investing in Cryptocurrencies

adoption by the state

Three years ago, El Salvador's President Nayib Bukele garnered global attention when he decided to legalize BTC . On September 7, 2021, the ‘Bitcoin Law’ went into effect, making El Salvador the first country to adopt it as its official currency.

Recently, President Naib Bukele reaffirmed his pro-Bitcoin stance by winning a second term . El Salvador continues to purchase Bitcoin, purchasing up to 30 BTC per month. As of May, unrealized profits from cryptocurrency investments in El Salvador amounted to over $70 million.

Despite some criticism, surveys show that awareness and usage of BTC wallets is quite high, suggesting successful integration is taking place. Cardan Stadelman said the blockchain analytics company conducted a direct survey of 1,800 representative households and found that about 68% of potential users are aware of Tchibo Wallet, and 78% of them have at least tried to download the app. He said it appeared .

In 2022, the Central African Republic (CAR) joined El Salvador's steps. The mineral-rich nation, one of the world's poorest countries and embroiled in ongoing civil war, also said its adoption of Bitcoin as fiat currency would ensure the country's independent financial future.

Growing Investment Potential

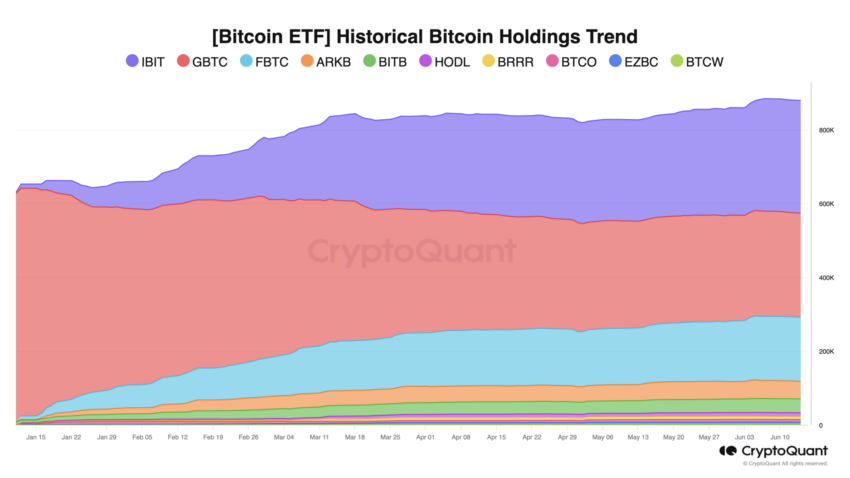

The U.S. Securities and Exchange Commission's (SEC) approval of a Bitcoin spot ETF marks a major shift in the regulatory landscape, signaling increasing acceptance of digital currencies within the traditional financial system. It's no surprise that sovereign wealth funds and other major financial institutions are starting to view Bitcoin as digital gold.

Wall Street giant BlackRock anticipates these institutions entering the Bitcoin market and is educating them about Bitcoin. The continued interest of large investors suggests a stable future for Bitcoin.

“Many interested entities, including pensions, endowments, sovereign wealth funds, insurance companies, other asset managers and family offices, are having ongoing due diligence and research conversations, and we are playing a role from an education perspective,” said BlackRock’s Bitcoin and Cryptocurrencies. Director Robert Michnick says:

Read more: How to Trade Bitcoin ETF: A Step-by-Step Approach

While government and corporate adoption is not essential to Bitcoin's success, it contributes significantly to its legitimacy. Bitcoin's appeal as a hedge is growing amid concerns about inflation and the search for safer alternatives. The establishment of Bitcoin's security and increasing mainstream acceptance suggest that Bitcoin's experimental phase is over.