Author: Andrew Kang

Compiled by: TechFlow

The BTC ETF opened the door for many new buyers to allocate Bitcoin in their portfolios. The impact of the ETH ETF is less obvious.

When the Blackrock ETF application was submitted, the price of Bitcoin was $25,000. I was very bullish on Bitcoin at the time. Now Bitcoin has returned 2.6 times, while ETH has returned 2.1 times. Since the bottom of the cycle, BTC has returned 4.0 times, and ETH has also returned 4.0 times. So, how much upside can the ETH ETF bring? I don't think it will be too much unless Ethereum develops a convincing way to improve its economic efficiency.

Traffic Analysis

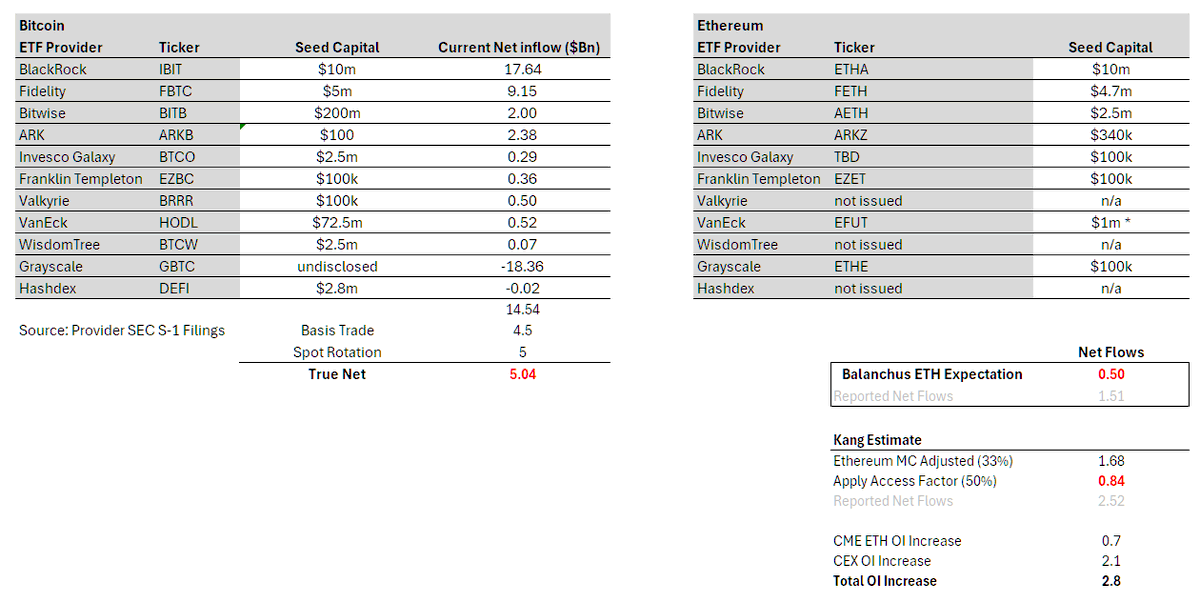

In total, Bitcoin ETFs have amassed $50 billion in AUM, which is a staggering number. However, if you break down the net inflows since the launch of the Bitcoin ETF, excluding the existing GBTC AUM and rotation, the net inflows are $14.5 billion. However, this is not a true inflow, as there are many delta-neutral flows that need to be accounted for, namely basis trades (selling futures, buying spot ETFs) and spot rotations. Based on CME data and analysis of ETF holders, I estimate that about $4.5 billion of net inflows can be attributed to basis trades. ETF experts suggest that large holders such as BlockOne have also converted a large amount of spot BTC into ETFs - a rough estimate of $5 billion. Netting out these flows, we can conclude that the true net buying of Bitcoin ETFs is $5 billion.

From this we can easily extrapolate to Ethereum. @EricBalchunas estimates that Ethereum flow may be 10% of BTC. This makes the true net buy flow of $500M in 6 months, while the reported net flow is $1.5B. Although Balchunas is biased in his approval odds, I believe his lack of interest/pessimism about the ETH ETF is informative and reflects broader traditional finance interest.

Personally, my benchmark is 15%. Starting with BTC's $5 billion real net value, adjusting for ETH market cap (33% of BTC) and a 0.5 visit factor*, we get $840 million in real net buying and $2.52 billion in reported net value. There are some reasonable arguments that ETHE has less turnover than GBTC, so in an optimistic case, I think real net buying is $1.5 billion and reported net buying is $4.5 billion. This is about 30% of BTC flow.

In either case, the true net buying is far less than the derivatives flows on the ETF front ($2.8 billion), not including the spot front flow. This means that the ETF is already overpriced.

* The access factor adjusts the ETF flows because the ETF can benefit BTC significantly more than ETH due to the different holder base. For example, BTC is a macro asset and is more attractive to institutions with access issues - macro funds, pensions, endowments, sovereign wealth funds. Whereas ETH is more of a technology asset and is attractive to VCs, Crpyto funds, technologists, retail investors, etc. who don't have as many restrictions on exposure to cryptocurrencies. 50% is derived by comparing the CME OI to Market Cap ratio of ETH to BTC.

From CME data, ETH had significantly less OI than BTC before the ETF was launched. OI was about 0.30% of supply, while BTC was 0.6%. At first, I thought this was a sign of "prematurity", but one could also say that this masks a lack of interest in the ETH ETF from smart money. Street traders make a good trade on BTC, and they tend to have good information, so if they don't repeat the trade on ETH, there must be a good reason, which could mean weak liquidity intelligence.

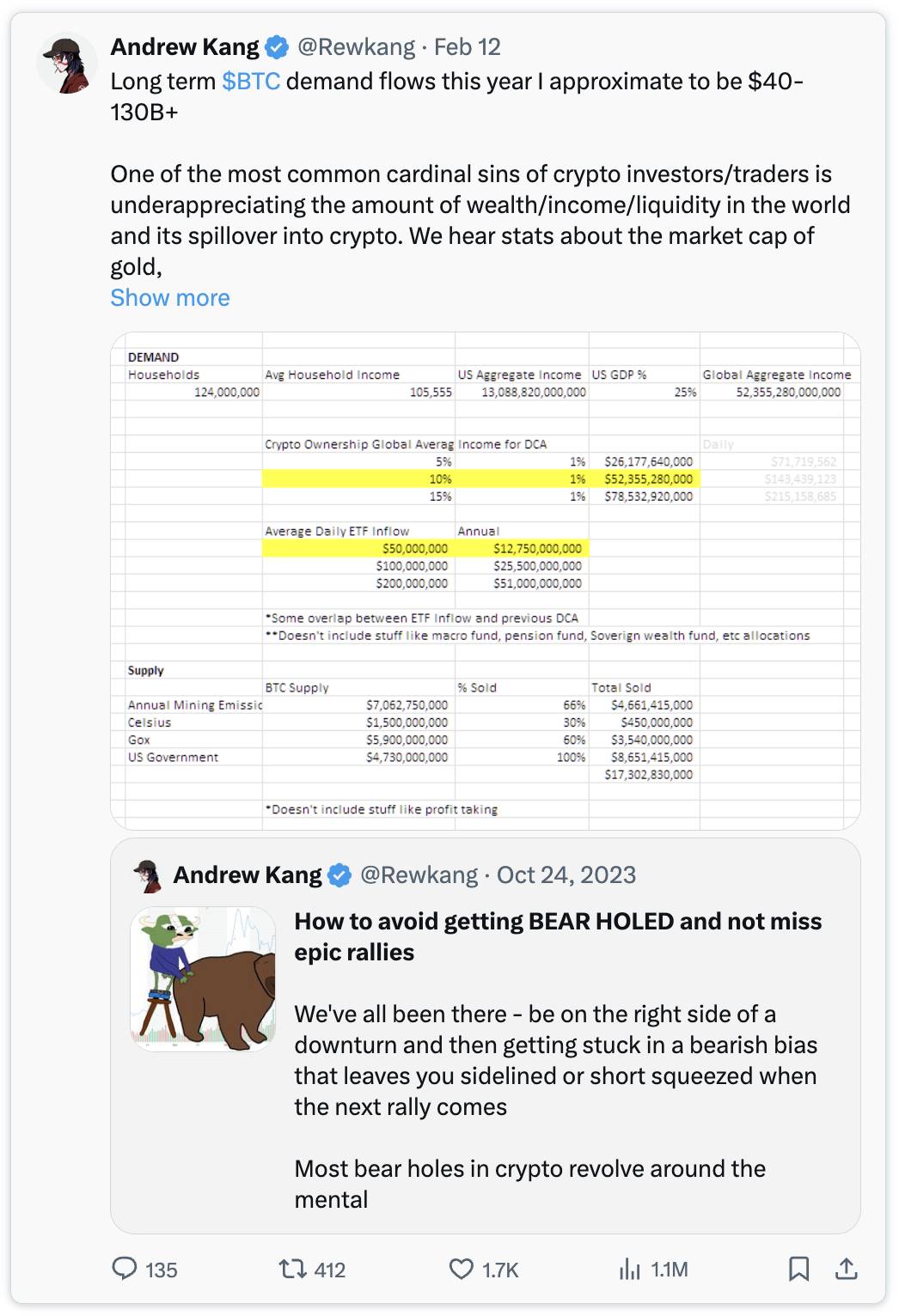

How $5 billion took BTC from $40,000 to $65,000

The short answer is no. There are plenty of other buyers in the spot market. Bitcoin is a truly globally proven asset, a significant portfolio asset, and has many structural accumulators - Saylor, Tether, family offices, high net worth retail investors, etc. ETH also has some structural accumulators, but I would argue fewer than BTC.

Remember, Bitcoin holdings were at $69k/1.2T+ BTC before ETFs. Market participants/institutions own a lot of spot crypto. Coinbase has $193B in custody, with $100B coming from its institutional program. In 2021, Bitgo reported an AUC of $60B and Binance has over $100B in custody. 6 months later, ETFs are custodizing 4% of total Bitcoin supply, which is meaningful but only part of the demand equation.

Between MSTR and Tether, there have been billions of additional buys, but more than that, there have been insufficient positions going into the ETF. There was a popular view at the time that ETFs were selling news events/market tops. So billions of short, medium and long momentum sells that needed to be bought back (2x flow impact). Also, shorts needed to be bought back once there was a big move in ETF flows. Open interest actually went down going into the launch phase - it was incredible.

The ETH ETF is positioned very differently. ETH is 4x its lows, while BTC is 2.75x its pre-launch price. Crypto native CEX OI increased by $2.1B, bringing OI close to ATH levels. Markets are (semi) efficient. Of course, many crypto natives saw the success of the Bitcoin ETF, expected the same for ETH, and positioned accordingly.

I personally think that the expectations of crypto natives are overly exaggerated and out of touch with the real preferences of transaction allocators. People who are deeply involved in the crypto space naturally have relatively high awareness and purchasing power for Ethereum. In fact, Ethereum, as the main portfolio allocation for many non-crypto native capital, has a much lower purchase rate.

One of the most common pitches to traders is Ethereum as a "tech asset." The world's computer, the Web3 app store, the decentralized financial settlement layer, etc. It's a nice pitch, and one I've bought in previous cycles, but it's a hard sell when you see the actual numbers.

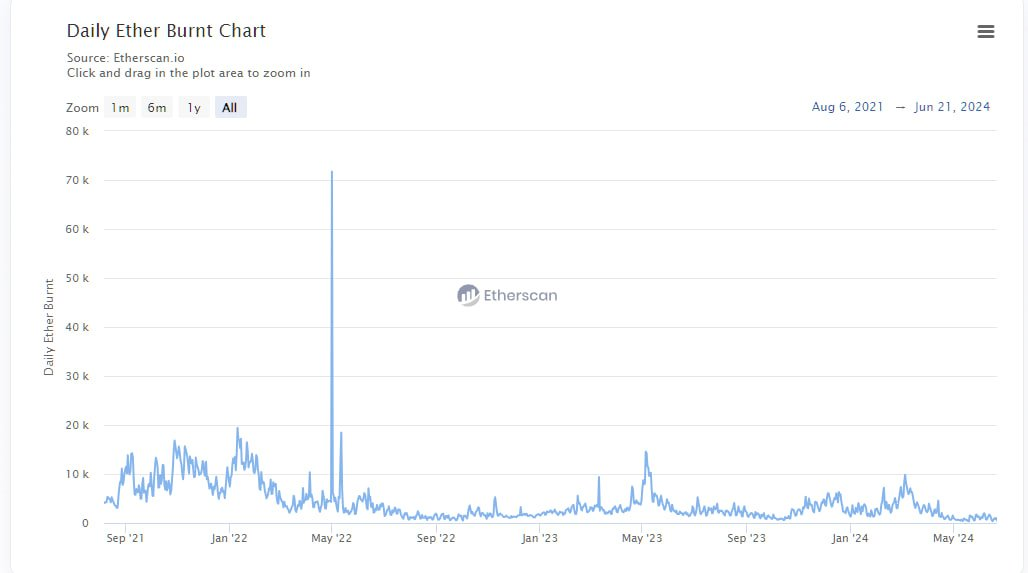

In the last cycle, you could point to the growth rate of fees and argue that DeFi and NFTs will create more fees and cash flow, etc. and make a compelling tech investment case from a perspective similar to tech stocks. But in this cycle, the quantification of fees is counterproductive. Most charts will show you flat or negative growth. Ethereum is a "cash machine", but with 30d annualized revenue of $1.5 billion, a PS ratio of 300x, and a negative earnings/PE ratio after inflation, how can analysts justify this price to their dad's family office or their macro fund boss?

I even expect the first few weeks of fugazi (delta neutral) flows to be lower for two reasons. First, the approval was a surprise and the issuer didn’t have that much time to convince large holders to convert their ETH to ETF form. The second reason is that it is less attractive for holders to convert because they need to give up the yield from pegging, farming, or using ETH as collateral in DeFi. But note that the collateralization ratio is only 25.

Does this mean ETH will go to zero? Of course not, at a certain price it will be considered good value and will also be dragged down to some extent when BTC rises in the future. Before the ETF is launched, I expect ETH to trade at $3,000-$3,800. After the ETF is launched, my expectation is $2,400-$3,000. However, if BTC rises to $100,000 by the end of Q4/Q1 of 2025, then this may drag ETH to its ATH, but the ETHBTC trading pair will be lower. In the long run, the development is promising and you have to believe that Blackrock/Fink are doing a lot of work to put some financial tracks on the blockchain and tokenize more assets. How much value this will bring to ETH and what the timing is is uncertain at this time.

I expect the ETHBTC pair to continue to decline and trade between 0.035 and 0.06 over the next year. Although our sample size is small, we do see ETHBTC making lower highs in each cycle, so this is not surprising.

Welcome to TechFlow TechFlow official community:

Telegram subscription group:

Official Twitter account:

Twitter English account: