TLDR

- The U.S. market sentiment continues to be optimistic. The market retreated slightly last Friday, but it still did not change the current pattern of continued capital parties.

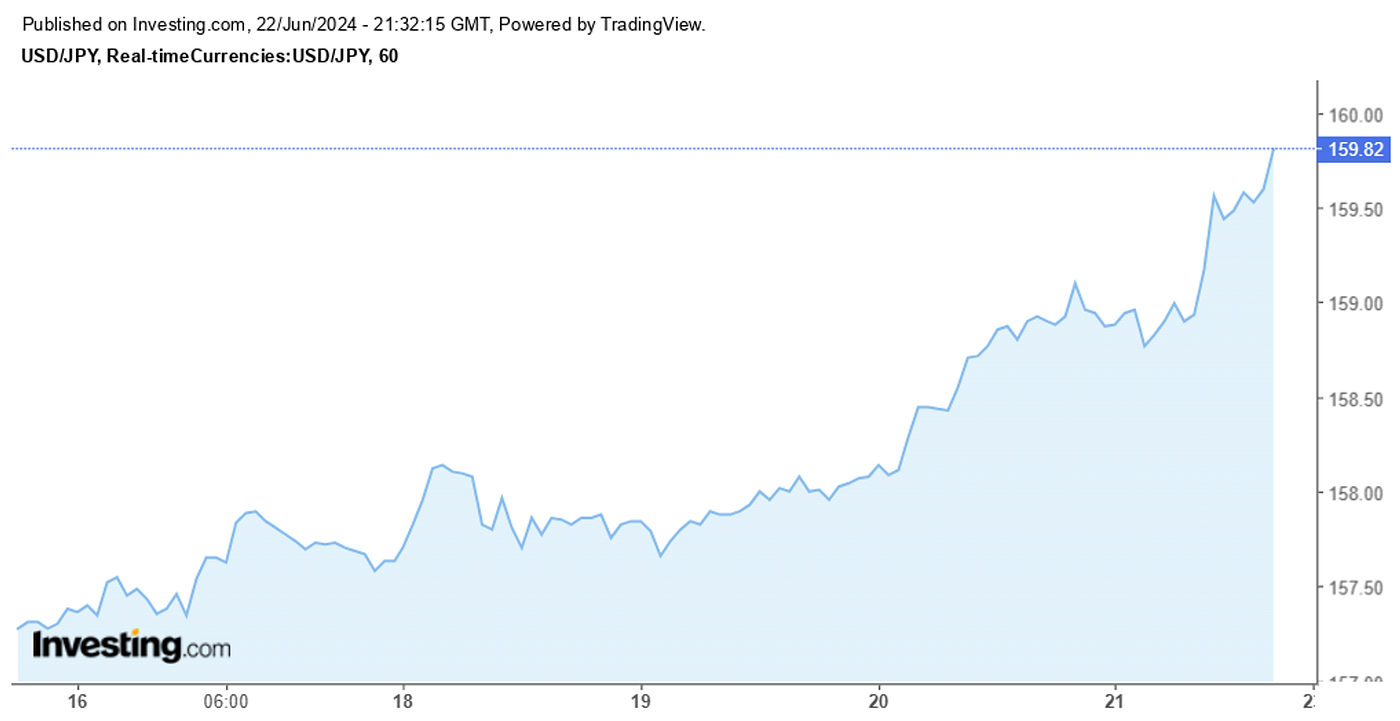

- Non-U.S. countries are slowly entering a cycle of interest rate cuts; the Bank of Japan and the Ministry of Finance are weak and dare not carry out too much foreign exchange intervention and tightening funds, so as not to destroy the hard-won economic growth and inflation that have lasted for more than two decades, and the yen is weakening .

- This week will be a relatively quiet period. There is not much news. Currently, the ones that can be observed may have violent fluctuations. It is still the Japanese yen and other small currencies, or the impact caused by the announcement of PCE details on Friday night. The bullish streak in mainstream currencies and technology stocks continues.

- The recent lack of liquidity in the crypto market has been obvious. BTC volatility has dropped significantly and trading volume has shrunk. Apart from expectations for the approval of ETH spot ETFs, there are no other large catalysts in the industry. Expectations of interest rate cuts have become the main factor dominating price trends in the short to medium term.

Important information from last week

The United States adds seven countries, including Japan and Taiwan, to a currency manipulation watch list

In its semi-annual report, the U.S. Department of the Treasury included seven countries, including Japan and Taiwan, on a currency manipulation watch list . Even though the Japanese Treasury and the Bank of Japan intervened in the foreign exchange market less frequently than the market imagined.

The yen depreciated sharply, and both CPI and core CPI were lower than expected.

The sharp depreciation of the yen led to an increase in import prices. As a result, Japan's consumer price index (CPI) annual growth rate in May reached 2.8%, lower than expected. The core inflation rate also rose to 2.5%, which has been higher than 2.2% for 26 consecutive months . % , but still lower than market expectations of 2.6%.

The market has sold the yen to the previous low of nearly 160, which is beneficial to exporters and makes Japan's recent trade surplus tend to expand.

Most central banks around the world are still waiting to see the progress of interest rate cuts, while a few have already entered a cycle of interest rate cuts.

Recently, many countries have also announced a new round of interest rate decisions. Australia, Brazil and the United Kingdom have kept interest rates unchanged, and Switzerland has cut interest rates by one point, which is fully in line with market expectations. It can be seen that most central banks around the world are still waiting to see the progress of interest rate cuts , while a few have already entered a cycle of interest rate cuts .

Eurozone CPI data released, all in line with expectations

The Eurozone CPI announced that the CPI rose to 2.6% year-on-year, while the core CPI rose to 2.9% year-on-year, both in line with expectations and causing no significant changes to the market.

U.S. retail sales fell well below market expectations

U.S. retail sales fell 0.1% month-on-month on Tuesday, far lower than market expectations for a 0.2% month-on-month increase. This continued the optimism in the stock and bond markets this week and did not pull back slightly until Friday. In the bond market, the U.S. 10-year Treasury bond yield fell to 4.20% after Tuesday's data was released, and slowly climbed back to around 4.30% in the following days. The U.S. dollar index also climbed from 104.80 to 105.50.

BTC volatility fell to historical lows, trading volume shrank, liquidity was scarce, and the market focused on expectations of interest rate cuts.

BTC volatility has dropped to historical lows, trading volume has also shrunk, and overall liquidity is lacking. The prices of BTC and ETH have maintained wide fluctuations. Compared with the two mainstream currencies with stronger consensus, the decline of small coins has been relatively sharp, and funds have been continuously withdrawn. At the same time, due to the recent strong performance of the AI sector in the US stock market, funds seem to prefer to flow to targets such as NVDA in the short term.

In short, there is no additional liquidity in the overall financial market, and there are no huge and eye-catching catalysts in the cryptocurrency circle in the short term. Therefore, the saying of "U.S. stock-sucking Altcoin" has begun to appear in the market, which is not entirely unfounded. reason. Under the current market conditions, the topic of gaming in the crypto has gradually moved closer to the entire market: "expectations of interest rate cuts", which is why we need to always maintain attention to the overall economy.

Things to do this week

- On Monday and Tuesday, a variety of Eurozone data, official talks and meeting minutes will be released. It is expected that the market will only bring the euro further down, and there will be little room for upside . The reason is that the recent weak data in Europe, the more dovish attitude of officials, and the turmoil and instability of the political situation in various places have put the euro under pressure.

- The United States will also have federal government bond auctions on Tuesday and Wednesday, as well as official speeches, new home sales and other information, but their impact on the market will be limited.

- There will be durable goods orders on Thursday and, as usual, the number of weekly initial and continuing unemployment benefits, combined with the Tokyo core CPI and industrial production released by Japan on Friday, will likely have another impact on the yen and other risky assets. .

- Finally, on Friday evening Taiwan time, the United States will release the PCE price index, the University of Michigan consumer confidence index, and inflation expectations. This will be the most important data release this week , and the financial market may be in our sleep. (Or Party) Great things happen silently in time.

Conclusion

Events such as the sharp fall of JPY, the rise of far-right forces in Europe, and uncertainty about expectations for interest rate cuts have created the current turbulent international situation and low visibility for the market outlook. The liquidity in the currency market is currently visible to the naked eye, and the attitude towards the game of interest rate cuts has obviously moved closer to the US stock market: in the absence of liquidity, a slight fluctuation in the data can cause considerable fluctuations, and operations must be maintained at a high level. alert.

Stay tuned.

The above is the content of this week’s economic weekly report. If this content is helpful to you, remember to follow it and turn on the notification.

You will not miss any views and analysis on the current macroeconomics. Please like, forward, collect, and leave comments!

If you want to communicate with us about the overall economy, you are also welcome to join the JZ Invest sharing and exchange group and discuss with everyone!

Discussion group link: t.me/JZ_Invest_Group