Where is the progress of the Ethereum spot ETF? Why hasn’t it been listed yet after it passed?

On May 24 this year, the SEC officially approved the 19b-4 application documents for Ethereum spot ETFs from eight institutions, allowing institutions to list Ethereum spot ETFs on various U.S. exchanges. However, the applicant cannot begin trading until it obtains the required S-1 registration statement approval.

(S-1 document refers to the registration statement document that companies must submit when conducting an initial public offering (IPO) or other forms of securities issuance according to the regulations of the U.S. Securities and Exchange Commission (SEC). The main purpose of this document is to provide Provide potential investors with comprehensive information on the company's business, financial status, management team, risk factors and securities issuance details to help investors make informed investment decisions).

To put it simply, the Ethereum spot ETF has been confirmed and its listing is certain, but the complete process has not been completed yet, and it is only a matter of time before it is opened for trading .

When can you start buying and selling Ethereum spot ETFs: Early July at the earliest, end of September at the latest

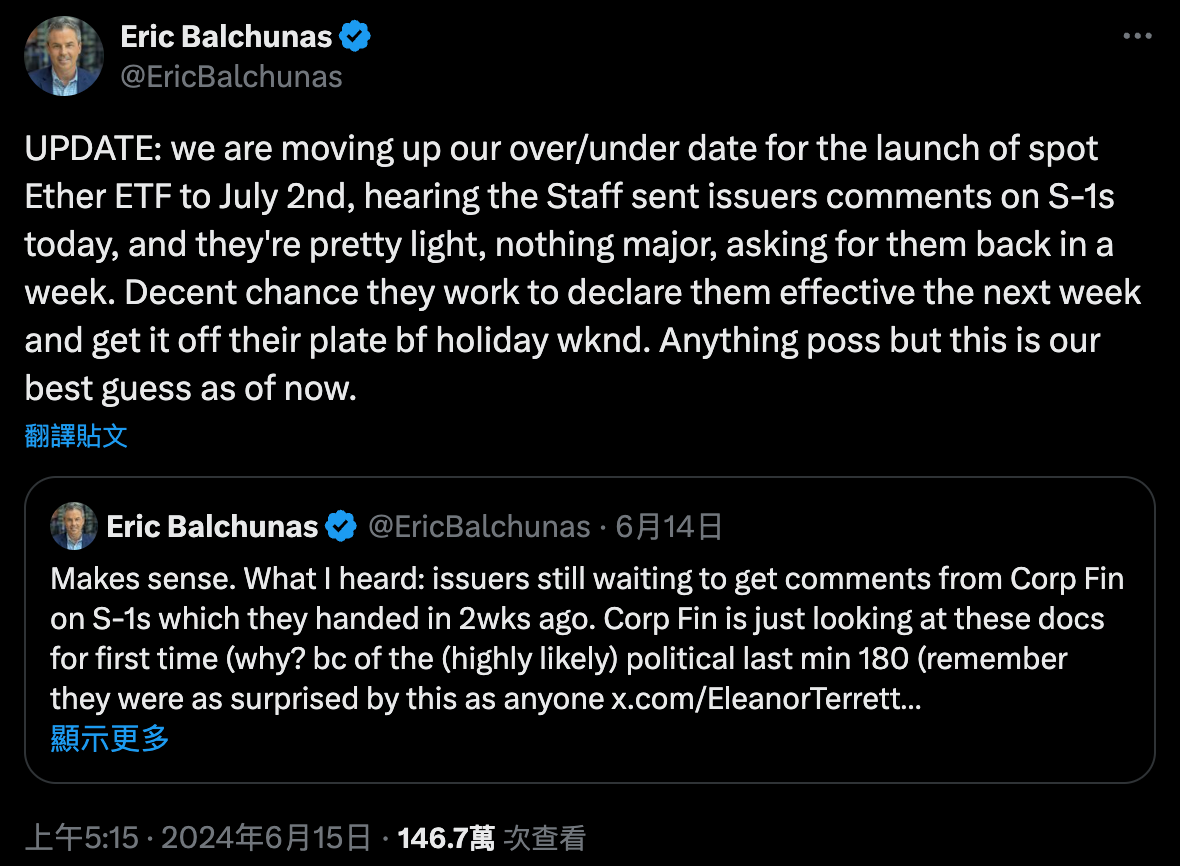

Eric Balchunas, a Bloomberg analyst who has been paying attention to cryptocurrency ETFs for a long time, believes that we may get the latest progress on the Ethereum spot ETF on July 2. According to the revised feedback given by the SEC to various institutions, there may not be many parts that need to be adjusted. Therefore, it is possible to receive news of listing approval at any time.

According to SEC Chairman Gary Gensler’s speech at a recent Senate Appropriations Committee subcommittee hearing, the Ethereum spot ETF should complete all preparation procedures and be approved for listing before the end of this “summer”.

In other words, the Ethereum spot ETF can be seen open for trading on the U.S. stock market around September this year at the latest.

Will the Ethereum spot ETF rise after it is launched: The market is indeed bullish

After the Ethereum spot ETF is listed, it will be equivalent to providing a legal and regulated investment channel for Ethereum. Funds from traditional financial institutions and investors can flow into the market in a way that is considered safer, and there is an opportunity to promote the price of Ethereum. rise.

On the other hand, the regulatory guarantee, coupled with the liquidity and transparency of ETFs, will increase the market's trust and visibility in Ethereum. In particular, Ethereum itself and the characteristics of DeFi on the chain that can obtain additional income through staking may further attract more investors who are not satisfied with the traditional market.

How much may ETH rise after the Ethereum spot ETF is listed: Analysts believe 5,000~5,500

A research report from cryptocurrency analysis company K33 Research stated that capital inflows are expected to be between US$3 billion and US$4.8 billion within the first five months of the listing of the Ethereum spot ETF, showing strong market demand.

This speculation is based on ETH AUM's global relative market share of 28% compared to BTC, and CME's ETH OI compared to BTC's current 23%. Comparing these weights to cumulative spot BTC ETF inflows of $13.8 billion yields a range of ETH net inflows between $3.1 billion and $4.8 billion. Our research suggests that the newly launched US ETF will absorb between 750,000 and 1,000,000 ETH, equivalent to 0.65-0.85% of the circulating supply of ETH.

JPMorgan Chase, a well-known traditional financial services institution, believes that the Ethereum spot ETF is slightly less attractive than Bitcoin, but there may still be a net inflow of US$3 billion in 2024, but if the approved version allows staking, this number It could top $6 billion.

Various signs show that although Ethereum has not grown as much as Bitcoin since the beginning of this year, there is a chance that the trend in the second half of the year will outperform Bitcoin after spot ETFs are opened for trading.

( InvestingHaven , a website that has been predicting the price of Ethereum since 2016, believes that Ethereum has a chance to hit more than $4,000 before the end of the year)

Other potential positives for Ethereum in the future: regulatory crackdowns weaken, ETP inflows perform well

SEC ends investigation into Ethereum

In April this year, Consensys, a blockchain technology company that has been focusing on developing applications and infrastructure in the Ethereum ecosystem for many years, such as MetaMask, Infura and Truffle, filed a lawsuit against the SEC, accusing the SEC of trying to decentralize Ethereum (ETH). ) are recognized as securities, and regulatory powers are abused to suppress specific tokens. Consensys believes that Ethereum should be treated as a commodity rather than a security, a position consistent with the U.S. Commodity Futures Trading Commission (CFTC).

Two months later, after the Ethereum spot ETF was approved, Consensys sent a letter asking the SEC to confirm whether the ETF approval was equivalent to positioning Ethereum as a commodity. This request finally led the SEC to make the decision to end the investigation into Ethereum. . It also caused the price of the Ethereum series of tokens to rise!

The market inflows of ETH and ETP in other countries are higher than that of BTC

According to data from K33 Research, despite the recent downturn in the overall market, the flows of ETH and BTC investment vehicles are in sharp contrast. Driven by optimistic expectations for the launch of the U.S. Ethereum spot ETF, global ETH ETP saw a net inflow of 16,911 ETH, marking the fourth consecutive week of net inflow. In comparison, the BTC ETP saw a net outflow of 12,523 BTC last week, which was the third largest weekly outflow to date.

In the past four weeks, Ethereum spot ETFs in other regions have seen a net inflow of 86,472 ETH, equivalent to US$300 million. The flow situation of ETH ETP is similar to the performance of BTC ETP in November 2023 (that is, before the US BTC ETF spot was passed), in which the monthly net inflow of BTC ETP was US$1.25 billion.

By comparison, it once again shows that under the best-case scenario, U.S. Ethereum spot ETF inflows are likely to reach approximately $10 billion. It is approximately 25% of the US BTC spot ETF flow size.

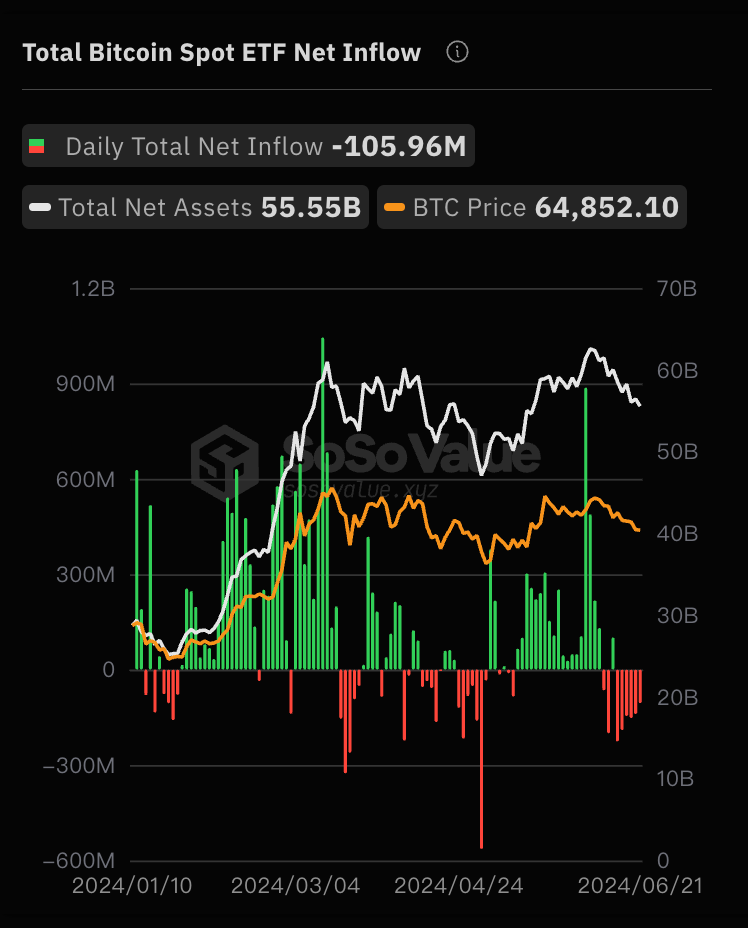

BTC spot ETF currently has a total value of 55 billion US dollars in BTC, data taken from Sosovalue