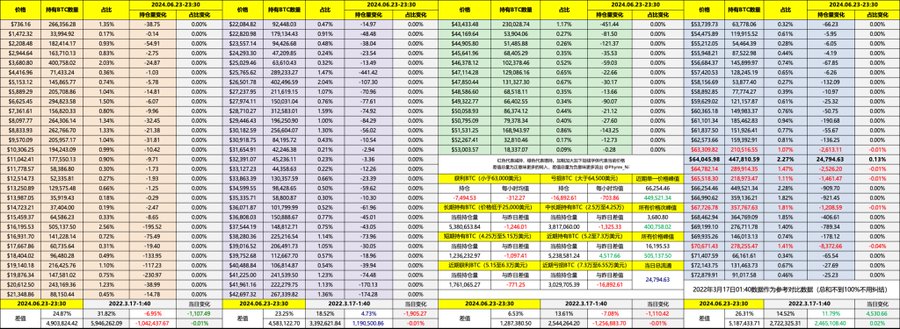

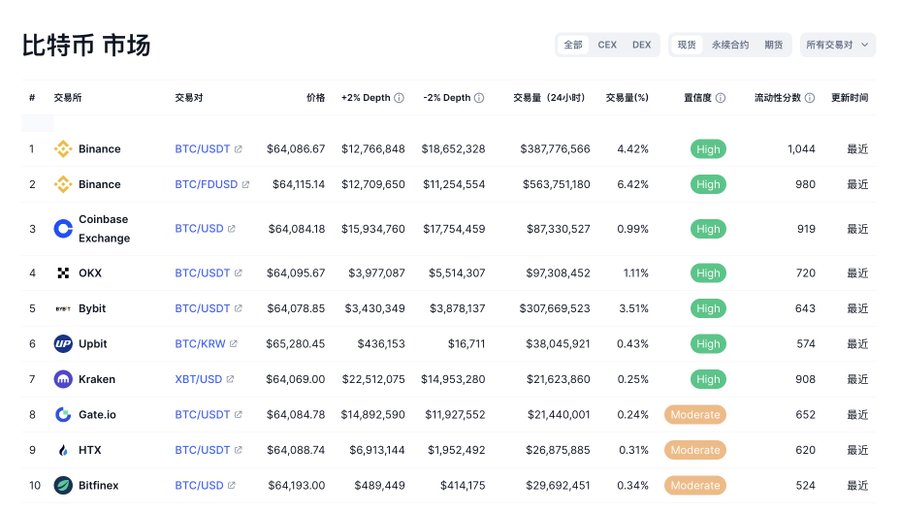

The next day after I was exhausted , I just got home at 3 a.m. Beijing time. I was worried that the data would be distorted because it was obtained too late. But after reading the data, I realized that I had thought too much. It was actually quite interesting. I went to do something today. At that time, a friend told me that the server of Binance was not down, but why the time-sharing chart of BTC had breakpoints. A comparison of the results showed that it was caused by a sharp drop in trading volume, and it was not just Binance, but all exchanges. In this case, the current trading volume of BTC on Binance is only 380 million US dollars, still ranking first, and the others can be imagined.

This is also a concept that has been conveyed to friends in the past two months. The current data has been getting closer and closer to the bear market , and the reason is that liquidity continues to decline, and the reason for the continued decline of liquidity is that the purchasing power of entering the currency market gradually declines. , there are two reasons for the decline in purchasing power. One is that there is no new positive driver.

Today, the first half of the year is actually full of good news, not only the emergence of spot ETFs , the halving of BTC , but also three interest rate cuts in March, and the financial reports in April and May are confusingly strong.

In the second half of the year, the only positive thing that can be seen in the currency market may be that the ETH spot ETF has passed, and it has been divided twice. Macroscopically, the dot plot in June has also changed from expected three interest rate cuts to one interest rate cut, which leaves only one. We can still look forward to the next U.S. election, so when expectations drop, a large amount of funds will inevitably leave the market, resulting in a decrease in purchasing power. In fact, we should think about it. Without the passage of spot ETFs , BTC is likely to still be at $ 30,000 . Around US$ 30,000, then it is normal for the current liquidity to be around US$30,000 .

The same is true from the on-chain data of BTC. Even at three o'clock in the morning Beijing time, the exchange of hands of BTC on the chain in 27 hours was still the same as when the price of BTC was less than 20,000 US dollars at the end of 2022. It is interesting. At that time, we were also betting on when the Fed would enter the stage of suspending interest rate increases. As a result, it announced that it would suspend interest rate increases at the end of 2022. It was not until the beginning of 2023 that the market began to gradually strengthen, so the two stages are now very similar.

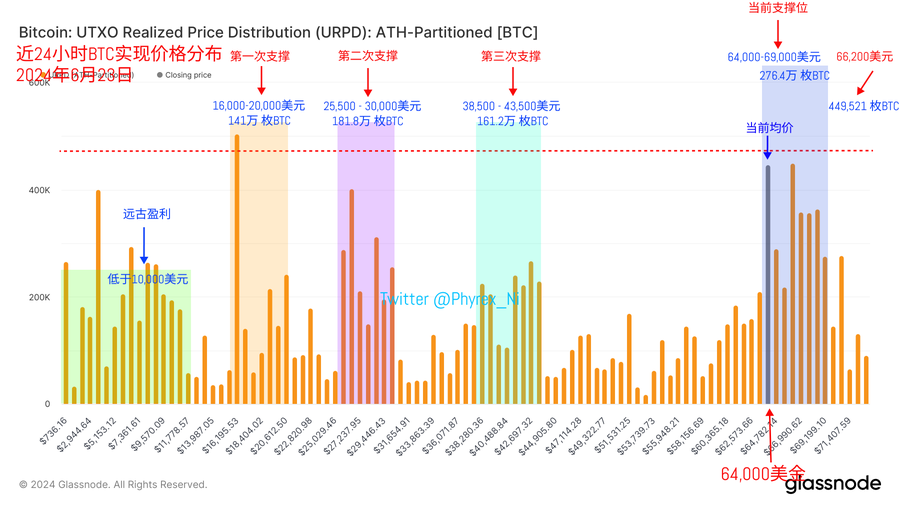

However, declining liquidity does not mean that the price will definitely fall. In fact, a large part of the reason why BTC fell to $16,000 was caused by Luna and FTX. The actual negative impact will cause large-scale panic exits, so even if the data is now back to 2022 It’s the end of the year, but there are still very few people actually involved in changing hands. Most people are still betting on the BTC halving cycle, the Federal Reserve’s interest rate cut, and the U.S. election.

The decrease in liquidity also tells us from the third time that the support we are currently seeing has not changed. In fact, it can also be seen from the price point. US$64,000 to US$69,000 is still the most important support point now, unless there is continued bad news. Otherwise, it will not be easy to continue to fall below $60,000, especially since many small partners believe that it will fall below $60,000. But in fact, the focus of this week is Friday’s core PCE. The current market expectations are not bad. If it can be realized, how much can it improve? Lift your mood. If it cannot be achieved, it will be a bad thing.

Judging from the stock on the exchange, it was slightly lower yesterday. Today’s liquidity shortage has actually increased the stock of BTC on the exchange. It is currently about 14,000 BTC more than the lowest stock value in the past six years, which is a full amount. It’s been a week and it still hasn’t been digested, which is also the current pressure.

What are your expectations for the market in the second half of the year?

The data is indeed a bear market, this is true, and the data bear market has been mentioned for nearly two months, but the data bear market does not mean a complete price bear market, especially for BTC and ETH. On the one hand, it is supported by spot ETFs ( ETH is expected), driving the purchase of funds. From the BTC data, we can see that more than 900,000 BTC have been bought so far. You must know that the current liquidity of the entire market is 3.3 million BTC. Accounted for more than 27%.

So in human terms, this is 27%. If you are still participating in the exchange of hands in the market, then the current price of BTC is definitely not what it is now and is still swinging around $64,000. So as long as this part of the chips is not sold due to panic, then the market is equal to There is less selling pressure of 27%. You must know that this group of investors did not panic when the price was $56,000.

In addition, long-term investors who have held positions for more than six months have all risen in the past three months. This shows that as the price fluctuates around US$65,000, more currency holders not only do not panic, but are more able to hold on to it. Some investors are not in ETFs. After all, ETFs have only been in existence for less than six months, so these investors are real currency market users. This is very consistent with our recent handover data.

What's more important is expectations. Although there are many drawbacks in the second half of the year, there are also many benefits, such as the effect of the halving cycle. At least a large number of investors are still anticipating it. Then at least this year will enter the interest rate cutting stage, followed by the United States. In the general election, if the Republican Party comes to power, it will be somewhat beneficial to the currency market. At least in the current American political field, the Republican Party is more friendly. Finally, there is the FASB at the end of the year, and listed companies can use the fair prices of BTC and ETH to make financial reports, so I still maintain the view that there should be opportunities in the fourth quarter.

But the fourth quarter is really explosive, but whether it breaks out on the basis of US$80,000, or based on US$70,000, or whether it breaks out on the basis of US$60,000, 50,000, or 40,000 US dollars. Who knows, the results will be completely different.