Since it once rose to nearly $72,000 on June 7, Bitcoin has continued to fall recently. In the early morning of this morning (24th), Bitcoin fell below the short-term holders' realization price of $64,230, and then quickly fell to a low of $62,903. Just when I was writing this article, a negative news from Mentougou caused BTC to fall rapidly to the 60,000 mark, with a minimum of 60,567.

For more information, please visit Weibo Tuantuan Finance here .

The current market is really difficult to operate, and even the dogs have to lose some money to leave. Since the halving, most miners have not had a good time. They can only sell coins to maintain their computing power, and some have even lost money.

Bitcoin's rebound recovery is likely to start after "weak miners are eliminated" and computing power is restored. After the halving in 2020, the computing power recovered within 8 days; after the halving in 2017, it took 24 days to recover.

The pain period caused by miners’ capitulation after this year’s halving will take a long time to recover. The reason behind this may be that “Bitcoin inscriptions increase network profits.”

Judging from the 4-hour trend, although Bitcoin has rebounded slightly, it still faces resistance from the exponential moving average 20 EMA. If it fails to recover to $64,500, the probability of a subsequent decline is still very high.

Bitcoin’s relative strength index (RSI) suggests that selling pressure may ease, and if the price can recover above $64,500, the following four promising Altcoin may have a chance to move higher.

TON

Although Bitcoin’s weakness has triggered a decline in many Altcoin, TON has not fallen below the 50-day moving average ($6.83) at present, indicating strong buying at lower levels.

TON bulls are attempting to push the price above the $7.67 resistance. If successful, TON could move up to $8.29. This level might act as a stiff resistance, but if the bulls gain the upper hand, TON will have a chance to re-challenge the $10 high.

Conversely, if TON breaks below $6.6 in the near term, it will form a head and shoulders pattern that may increase the decline to the pattern target of $4.91.

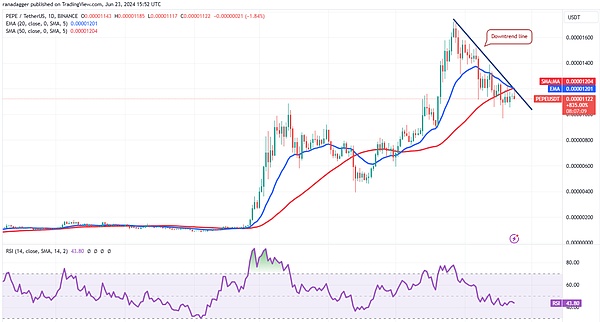

PEPE

PEPE has been pulling back recently, but it has rebounded to $0.000010. If the rebound is to continue, the bulls must push the price above the downtrend line and both moving averages. In this way, PEPE will have a chance to rise to $0.000014 and then to $0.000016.

On the other hand, if the PEPE turns down from its downtrend line or its moving averages, it will mean that the bears continue to sell on rallies and if it breaks below $0.000010, it could drop to $0.000008.

KAS

On June 18, KAS bounced off the 50-day EMA ($0.14), which indicated buying at lower levels. The bulls continued buying and pushed the price above the 20-day EMA ($0.15) on June 23.

If the buyers maintain the momentum and push the price above the downtrend line, it will mean the correction may be over. KAS is likely to try to rebound towards the $0.19 resistance.

On the contrary, if KAS continues to pull back, then the 50-day moving average key support can be paid attention to. If it falls below and closes below this point during the day, it will mean that the market may fall sharply to $0.1, at which time there may be long intervention.

JASMY

On June 21, JASMY rebounded from its 50-day moving average ($0.03), which means lower levels are attracting buying.

Currently, JASMY’s 20-day EMA ($0.03) is flat and the RSI is close to the neutral zone, indicating that selling pressure is easing. If the 20-day EMA resistance can be overcome, JASMY may rebound to $0.04.

On the other hand, if JASMY turns down from the 20-day EMA, it will mean that the bears will continue to sell on rallies. Subsequently, JASMY might spend some time oscillating between the two moving averages. A breakout and close below the 50-day SMA could lead to a further decline to $0.02.

Although institutional investors have purchased Bitcoin spot ETFs, capital inflows have stagnated since mid-March, and there has been a large-scale outflow of funds, indicating that the pace of institutional entry has slowed down. This may lead to a setback in market confidence and weakened expectations for BTC's rise in the short term. At the current price of $61,432, it is recommended that everyone remain cautious and wait for clearer market trends before making decisions.

Later, I will bring you analysis of leading projects in other tracks. If you are interested, you can click to follow. I will also organize some cutting-edge consulting and project reviews from time to time. Welcome all like-minded people in the crypto to explore together. If you have any questions, you can comment or private TTZS6308. All information platforms are Tuanzi Finance .

I plan to accept five more one-on-one classes at the end, but I won’t accept any more. To be honest, I can’t handle too many. After all, my energy is limited.

Currently, there are basically no good opportunities for retail investors to get on board BTC. The focus is to lay out high-quality copycats in the later stage and strive to achieve an overall return of no less than 10 times this year.