Historically, Bitcoin (BTC) price corrections are inevitable, whether in a bull market or a bear market. However, this cycle was different, especially with BTC hitting all-time highs before the April halving.

After a boom in the first quarter of 2024, cryptocurrency prices are going downhill. We look at Bitcoin price prediction through on-chain analysis. Will we take a breather or face another downturn?

Bitcoin falls at a critical point

Inflows into Bitcoin ETFs approved in the first quarter drove the price of Bitcoin to $73,750. Institutional capital has been tight over the past few months. Therefore, the ETF no longer determines the direction of the coin.

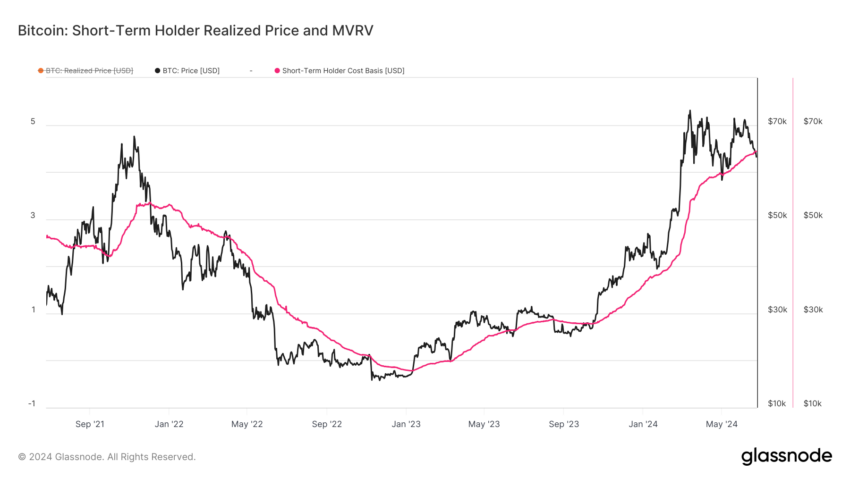

Instead, the activity of short-term holders (STH) moves BTC. STH refers to investors who have purchased Bitcoin within the past 155 days. We analyze STH realized prices to evaluate Bitcoin’s potential in the near term.

STH realized price, also known as on-chain cost basis, refers to the average price of STH supply evaluated based on when each coin was last traded on-chain.

As of this writing, BTC is trading at $62,367. However, according to Glassnode, the STH realized price is $64,410.

Read more: Who will own the most Bitcoin in 2024 ?

Historically, when an indicator falls below the value of a coin, it supports the price. Therefore, it leads to higher value in a short period of time. On the other hand, if it rises above the Bitcoin price, the cryptocurrency will fall further.

BeInCrypto found evidence of this after examining performance in 2018 and 2021. For example, the STH realized price in December 2021 was $52,967. At the time, BTC was trading at $50,492.

Less than two months later, the price dropped to $42,721. The situation was no different in January 2018, with a realized price of $11,012 and BTC at $9,965. Before March, the price had plummeted to $7,852.

Whale holds a vote of no confidence in Retail Pass

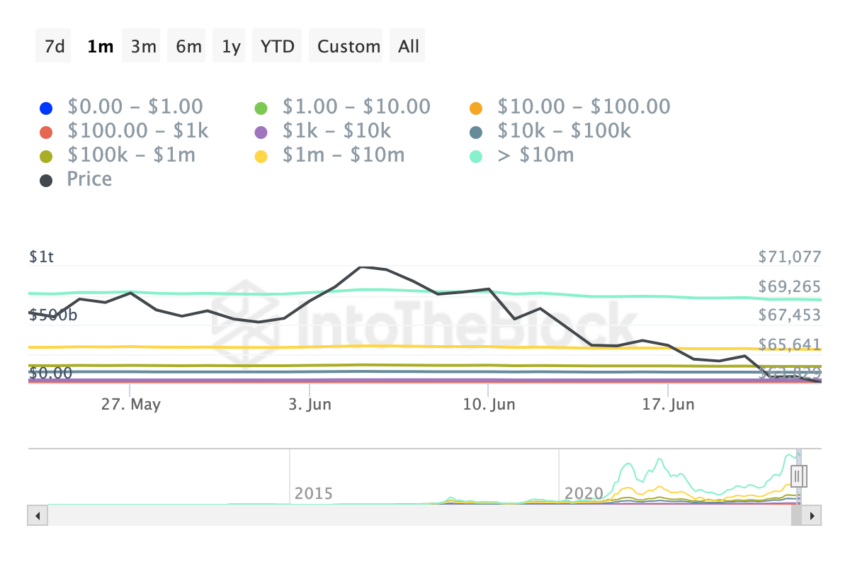

If Bitcoin fails to rise above the above-mentioned indicators, it could fall further to $60,000. The price of Bitcoin has been trending lower for some time, but the volume built up by whales has helped it avoid a notable correction.

However, looking at the balance indicators by holdings, the position appears to have changed. This on-chain indicator tells us whether holders are increasing their balances and selling their coins. But this time, the whale isn't just getting rid of some of its coins. The same goes for retail collectives.

Addresses holding between $1 and $10 million worth of BTC are selling in the last 30 days. Following the basic laws of supply and demand, this selling puts Bitcoin at risk of a significant downside.

Meanwhile, anonymous analyst Checkmity posted on

“After 18 months of pure uptrend, a period of several months of bottoming and correction is not only necessary but expected.” He wrote:

BTC Price Prediction: No Visible Support

On the 4-hour chart, Bitcoin is reflecting the pattern that led to the price drop on June 12th. By that time, BTC had fallen from $69,747 to $66,633. Something similar happened on June 20th, when the price fell from $66,292 to $63,811.

If this move is confirmed, BTC could first fall to $61,560. If the bulls fail to defend it, the coin price could fall below $60,000.

Also, the Arun indicator suggests a decline. The Arun indicator allows traders to determine the direction of the cryptocurrency trend. This indicator is divided into Arun Up (orange) and Arun Down (blue).

A high arun up means prices will rise. Conversely, if Arun Down surpasses the opposite number, the price will fall. Arun Down is much higher at press time, indicating that Bitcoin will continue to fall.

Read more: What is a Bitcoin ETF ?

However, Bitcoin ETF inflows could invalidate these predictions. Last week, financial instruments recorded net outflows, putting downward pressure on the price of Bitcoin.

Bitcoin could rebound if inflows into the instrument increase this week. Another catalyst is retail engagement and network growth. Compared to previous bull markets, Bitcoin lacks these factors. This is evidenced by the decreasing number of new unique addresses .

If retail market participants start buying BTC in large quantities, the price may not fall to $60,000. Instead, it could bounce back to $66,000 or $67,000 in the near term.