Author: YASHU GOLA Source: cointelegraph

The price of Bitcoin continues to fall, down 1.5% intraday and 7.65% over the past week, reaching $62,130 on June 24. The chances of recovering these losses in the coming days seem slim, with several indicators hinting at further price declines ahead.

Will Bitcoin Price Drop to $60,000 Next?

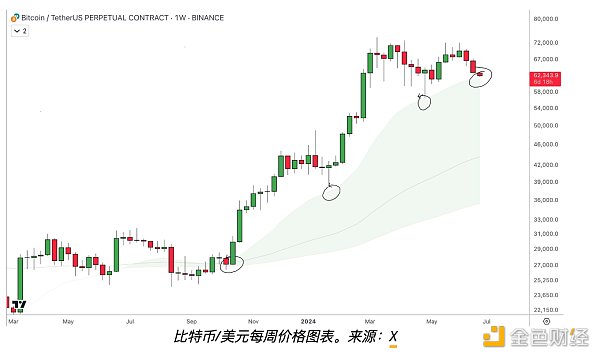

Bitcoin has been consolidating within a descending parallel channel since the bull run to new record highs around $74,000 in March 2024. Every time Bitcoin tests the upper trendline as resistance, it retraces towards the lower trendline, only to bounce back when it touches that trendline.

As of June 24, BTC price has experienced a similar situation, correcting after hitting the upper trendline around $72,000 two weeks ago. BTC/USD is currently heading towards the lower trendline, which aligns with the psychological support level of $60,000.

Interestingly, the downside target of $60,000 is closer to Bitcoin’s 200-day exponential moving average (200-day EMA; blue wave), which is around $58,000. This confluence increases the likelihood that BTC will approach the $58,000-60,000 range in July.

Independent market analyst Teddy Cleps expects Bitcoin to fall towards $61,000 as this level is the 21-week EMA and historical support.

Cleps believes that “every correction since the start of the BTC bull run has fallen on the 21-week EMA and bounced off it,” adding: We are approaching it as we speak, and if history repeats itself, 61k is the bottom.

BTC price will reach $55,000

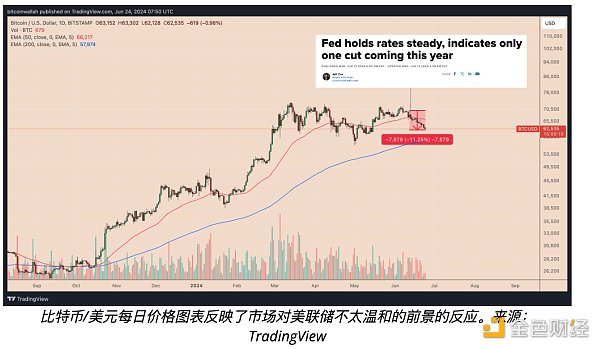

Bitcoin’s continued consolidation trend is in line with a prediction made in May by Galaxy Digital Holdings Ltd. founder Michael Novogratz that BTC will trade in the $55,000-75,000 range in the second quarter of 2024.

Novogratz expects new market events to push prices higher after the launch of a spot U.S. Bitcoin ETF and the stalling of the bull run driven by Bitcoin’s halving. Novogratz said strong economic data and fading optimism aboutthe Federal Reserve’s rate cuts are the reasons for the current market pause.

The investor said the $55,000-75,000 consolidation will continue until the economy slows or there is regulatory clarity after the election.

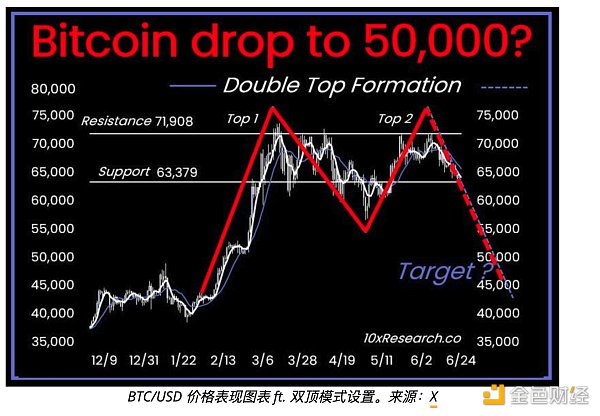

Double Top Teases $50,000 BTC Price Target

Unlike Novogratz, 10x Research founder Markus Thielen predicts that Bitcoin will break out of the consolidation range and fall towards $50,000, citing the possibility of a Double Top pattern.

A Double Top pattern forms when price reaches two similar peaks with a slight decline in between, maintaining support above a common line called the ‘neckline.’ This pattern usually breaks down when price breaks below the neckline, and the decline can be equal to the distance between the peak and the neckline.

As we have observed over the past three months, range trading is a complex phase that is often marked by several false breakouts. Historically, top formations have made regular retail investors vulnerable, and many Altcoin have experienced significant declines.

Bull Flag Puts BTC on Track for a Rally to $88K

Meanwhile, the descending channel range looks like a classic bull flag pattern, which is a bullish continuation setup that forms after the price consolidates within a downward sloping range after a strong rebound.

A bull flag pattern usually ends after the price breaks out of the upper trendline and rises to the height of the previous uptrend. If this bullish scenario is realized, Bitcoin price will target $88,000 (all-time high) as the main upside target in July or August.

Additionally, Bitcoin’s daily relative strength index is the most oversold since August 2023. This could be a precursor to a potential recovery period, improving BTC’s chances of reaching its bull flag target.