PEPE prices have declined significantly from their all-time highs in late May.

The meme coin is now trying to recover these losses by starting to rise with the help of investors.

Changes in the position of PEPE holders

Trading at 0.00001163, PEPE price is above the key resistance level, suggesting that the meme coin may change its course of action. This can be seen in Chaikin Money Flow (CMF) rising above zero, indicating a significant increase in buying pressure.

This indicator, which measures the accumulation and distribution of fund flows over a specific period of time, indicates that buyers are actively entering the market. When CMF rises above 0, it means that buying volume is greater than selling volume, reflecting the bullish sentiment of traders and investors.

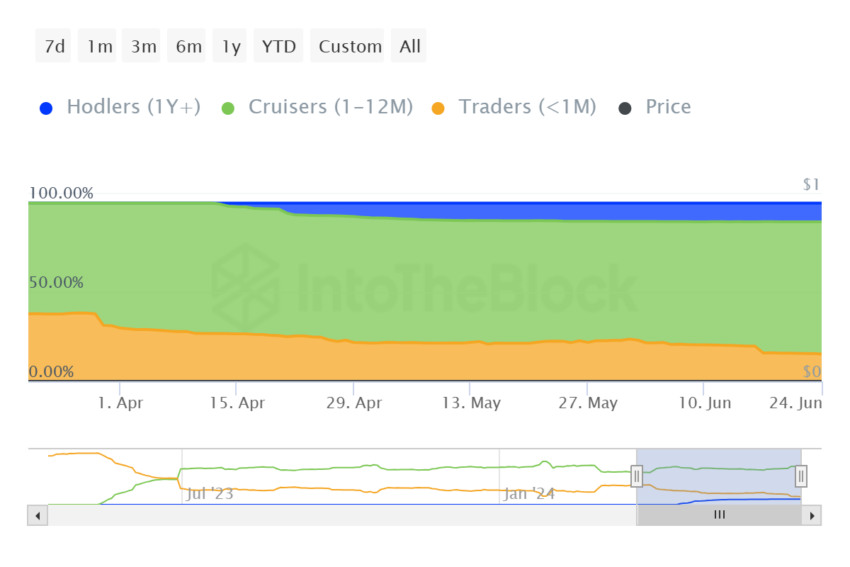

In addition to the rise in CMF, there is also a noticeable change in the short-term supply of PEPE tokens. These tokens are moving to the wallets of medium-term holders. Based on balances held by PEPE investors , approximately 7% of short-term supply (held for less than 1 month) is not medium-term supply (held for more than 1 month but less than 1 year).

This movement suggests that investors who initially held tokens short-term are extending their holding periods. Transferring tokens from a short-term holder to a medium-term holder often signals increased confidence in the future performance of the asset and a willingness to hold on to it longer.

These changes in holding patterns are a strong indicator of market confidence. When investors move tokens into long-term storage, they demonstrate faith in the asset's future earning potential. This action can reduce immediate selling pressure, contributing to price stability and potentially promoting an upward trend. The shift to medium-term holdings can be seen as an expression of confidence.

Read more: Pepe: A comprehensive guide to what it is and how it works

This dual development could lead to further price increases by creating a more favorable environment for PEPE's continued growth through reduced selling pressure and increased investor confidence.

PEPE price prediction: a long way to go

PEPE, which is trading at 0.00001163, is currently attempting to bounce off support at $0.00001146. This could lead to a rise to $0.00001369, which is the next important resistance level for MEM Coin.

The aforementioned factors suggest that this outcome is possible if investors remain bullish.

Read More: Pepe (PEPE) Price Forecast 2024/2025/2030

However, if the breach fails, the PEPE price could fall back to $0.00001007. Although it is unlikely to break below, the support of 0.00001146 could form a bottoming area for PEPE, invalidating the bullish logic.