The cryptocurrency market has continued to be weak recently , and Bitcoin even fell below the US$60,000 mark yesterday (25th), hitting US$58,402. Although Bitcoin has rebounded from its decline at the time of writing, hitting a maximum of $62,422 at 3 o'clock this morning (26th), investors are still cautious about the future of BTC.

The following dynamic zone quickly collates the current analytical views of various institutions and experts to see how they judge.

10X Research: Bitcoin is severely oversold

In response to Bitcoin’s current decline, cryptocurrency research institution 10X Research pointed out in a research report yesterday (25th) that there are indeed many factors leading to the market’s decline, including:

- Cryptocurrency exchange Mt. Gox announced that it will begin repaying creditors in early July, so the market may face selling pressure on tens of thousands of Bitcoins;

- The German government may sell its confiscated Bitcoins, with a total value of nearly $3 billion;

- Bitcoin miner sell-off;

- Outflows from Bitcoin ETFs;

- Bitcoin OG’s profit taking;

- …

However, 10X Research said that Bitcoin is currently in a severely oversold stage, and the market’s greed and fear index has almost reached its lowest level. Therefore, Bitcoin may be at a relative price low at present, or may fall further after , Bitcoin will usher in a rebound:

Many structural factors have led to Bitcoin's continued decline, but Bitcoin may rebound after further declines. After some Altcoin have experienced volatility, many KOLs are suggesting that they should buy on dips.

CryptoQuant: The market may see a V-shaped rebound

CryptoQuant analyst Mignolet said that based on the UTXO profitability percentage of Bitcoin during the consolidation phase last year, although Bitcoin is currently in the consolidation phase, the UTXO profitability percentage has clearly left its low point. Therefore, Bitcoin whale may react to panic in the market, which also indicates that the market may have a V-shaped rebound.

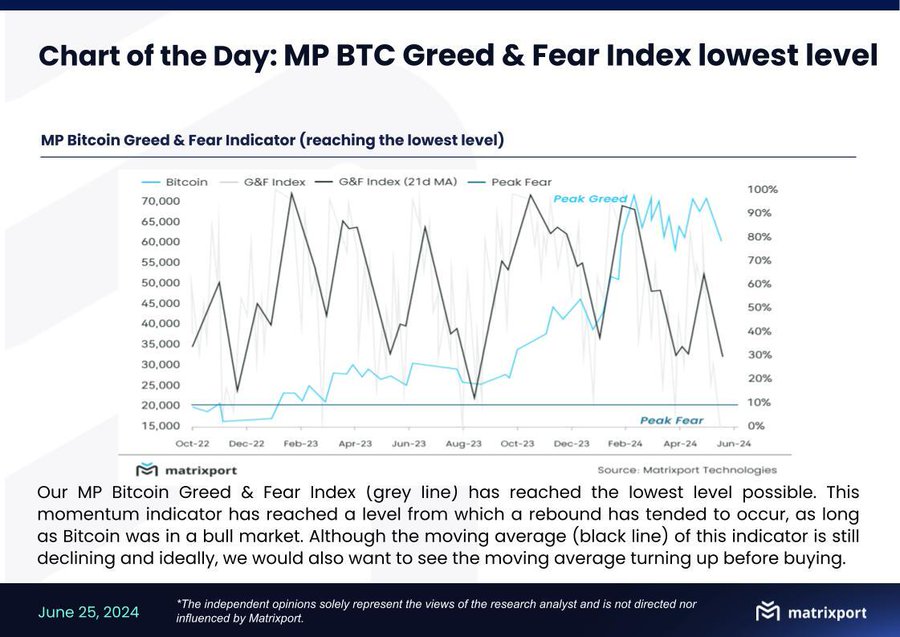

Matrixport: Bitcoin Greed and Fear Index May Have Reached Its Lowest Level

Matrixport also pointed out yesterday that Bitcoin’s greed and fear index may have reached its lowest level, which also indicates that the market may bottom out:

As long as Bitcoin remains in a bull market, this indicator will tend to rebound from current levels. Even though the moving average of this indicator is still falling, we would also like to see it turn up before buying.

Bitfinex: Short-term market sentiment remains predominantly bearish

Although many analysts have judged that the current market may have reached a bottom, the cryptocurrency exchange Bitfinex stated in its latest weekly report that the U.S. Bitcoin spot ETF continued to experience net outflows last week, amounting to more than $540 million. It shows that weak ETF investors are reacting to negative news in the market.

Separately, open interest in Bitcoin futures on CME and other trading platforms also dropped significantly, indicating that arbitrage trades related to ETF flows also declined significantly.

To sum up, the market sentiment still seems to be mainly bearish:

The decrease in Bitcoin holdings is consistent with negative funding rates on multiple exchanges over the past week, as well as net outflows from ETFs, indicating a significant reduction in arbitrage trades related to ETF flows.

Market sentiment remains predominantly bearish as Bitcoin remains weak on short-term timeframes.