Despite continued favorable price action from major cryptocurrencies and the U.S. stock market, sentiment towards Altcoin appears to be at unusually low levels . Expectations instilled by previous cycles have left many feeling disappointed and incredulous while their portfolio returns have stagnated in an uptrend.

status quo

Market sentiment in the crypto space tends to be fickle, as people often exaggerate, especially when overexposed. Biases can change at a whim, so sentiment on social media cannot be a reliable indicator of forming an accurate market outlook. However, what we can do is plot some relevant data on a chart and analyze it to determine how dire the situation really is.

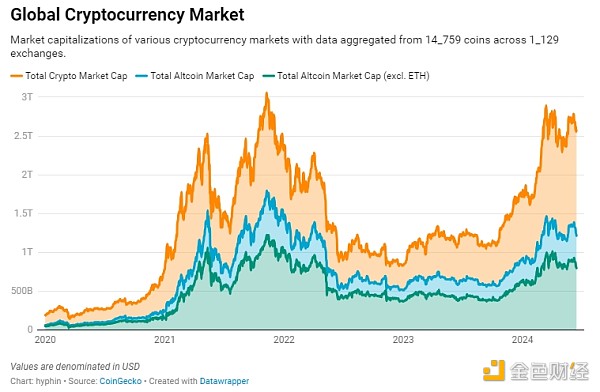

Indices and aggregate charts that track various global indicators give us a broad view of the entire market, helping to determine where most of the value is and how it is moving.

The total cryptocurrency market capitalization has grown significantly over the past year and a half, but volatility has been surprisingly low. Despite Bitcoin's record highs, the levels seen during the 2021 frenzy have yet to be breached, largely because Altcoin have been unable to keep up with Bitcoin's growth. The flow of capital to more speculative assets has been lower than expected, catching many off guard.

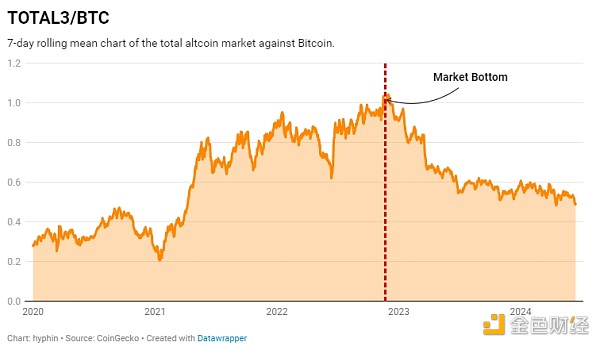

This phenomenon can be better illustrated by directly plotting the market capitalization of Bitcoin against all other Altcoin(excluding Ethereum), showing that Bitcoin's market capitalization share continues to increase.

Needless to say, this time around, Bitcoin stole the show, coming out on top by gaining more and more market share during its ascent. Basically leaving Altcoin in the dust. The once lucrative game of catch-up between Bitcoin and the rest of the market has now become a pipe dream. The lack of liquidity has dampened any attempt to kick off a true universal Altcoin season.

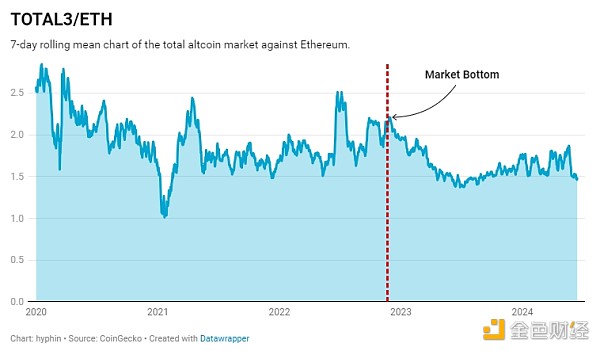

Even though Ethereum has been mocked for its lackluster price action, it has still managed to stay on top. Speculators who have positioned themselves in on-chain ecosystem tokens, aside from memecoin or anything denominated in stablecoins, have been having a great time in purgatory. Our sincerest tribute goes out to those who have fallen in love with the ETH beta baby.

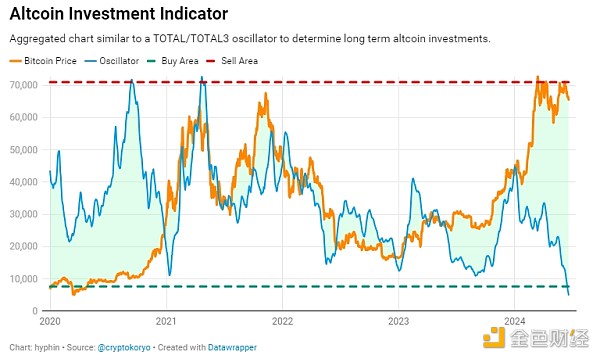

Indicators widely used to find favorable conditions to enter or exit alternative markets have been sending worrying signals, suggesting that the prevailing view on market dynamics may not apply to current circumstances.

The correlation between the main asset and other assets has proven to be very useful in determining the current state of the market. By incorporating an oscillator that tracks the difference between the two (blue line), participation levels can be configured and subsequently used for convergence. Low oscillator values coupled with rising Bitcoin prices are often seen as a reason to buy, as it is assumed that Altcoin are undervalued and will eventually correct and follow Bitcoin. Recent data shows that bullish periods for Altcoin are gradually becoming shorter and weaker, incentivizing short-term investments rather than uncertain longer timeframe investments.

Although many seemingly promising tokens have high upside potential, they still struggle to deliver exceptional returns.

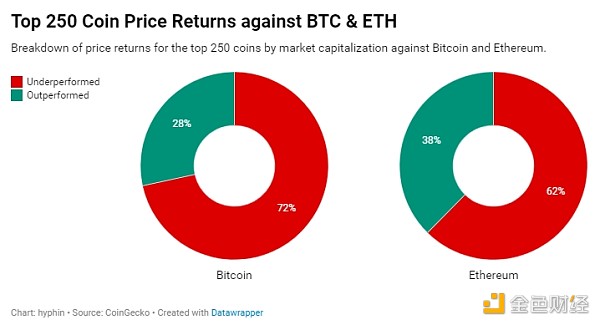

The disappointing performance of the top 250 market cap tokens compared to Bitcoin and Ethereum, reflecting the fact that these two assets are overvalued and ignored by many players in the space, further weighed on market sentiment.

Finding a needle in a haystack

It’s clear that things have changed over time, and identifying trends and narratives has become more important than ever in order to outperform the index. The days of a general rise in all cryptocurrencies appear to be over. Liquidity fragmentation and falling trading volumes have concentrated most of the significant gains into a few sectors. While general indicators show that Altcoin as a whole are struggling and have gained little value, they do mask the different growth of individual asset groups.

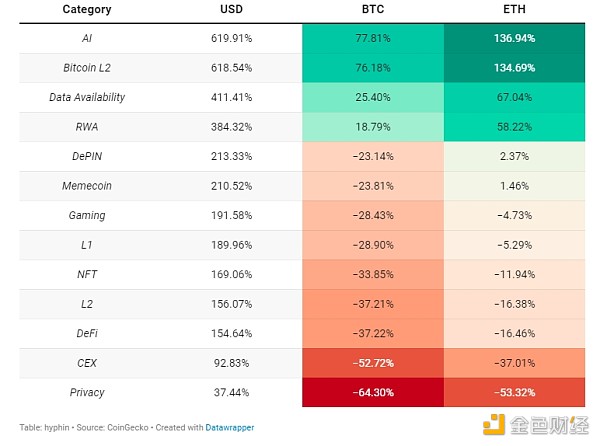

Growth of different categories of cryptocurrencies

The market capitalization growth of different asset classes relative to various other currencies since the market bottom.

A strict look at the market capitalization changes in each category since the start of the rally shows that most mature categories have fallen below the benchmark. On the other hand, emerging sectors with a lot of opportunities, traction, and new developments have performed very well. It is important to note that outliers can exist in any industry, and growth within a curated group is only a vague representation of the performance of the covered assets.

To review everything that has happened so far and determine who was right and who was wrong, let’s highlight a few relevant categories and measure the price returns of their most valuable assets.

Price return calculation method:

To take into account recent launches that have risen to the top of their category, starting prices are either queried from November 21, 2022, or from the first entry on Coingecko. Current prices are queried at the time of writing (June 18, 2024).

Price_return_% = ((Current Price - Starting Price) / Starting Price) * 100

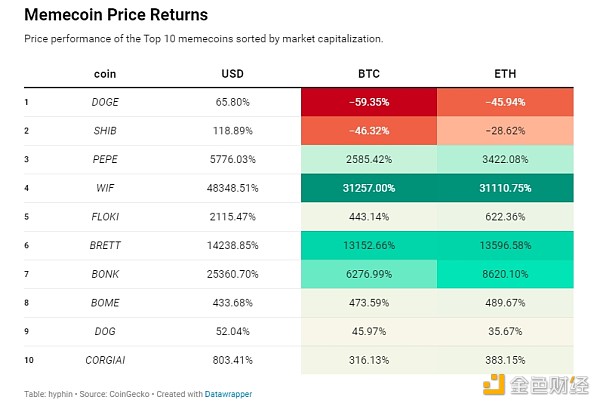

Memecoins

Memecoins are undoubtedly the theme of this cycle. Last year, Memecoins gave rise to more overnight fortunes than lottery tickets, while also taking away enough wealth.

The percentage change in total valuation of memecoins has not been as large as one might expect, as coins like Dogecoin and Shib, which account for nearly half of the market share, have barely risen. Aside from a few very successful tokens on Ethereum, the majority of meme activity has occurred on Solana and, more recently, Base. The three meme coins with the highest returns and new entrants into the top 10 are from Solana, with two of the meme coins seeing returns exceeding five figures.

DeFi

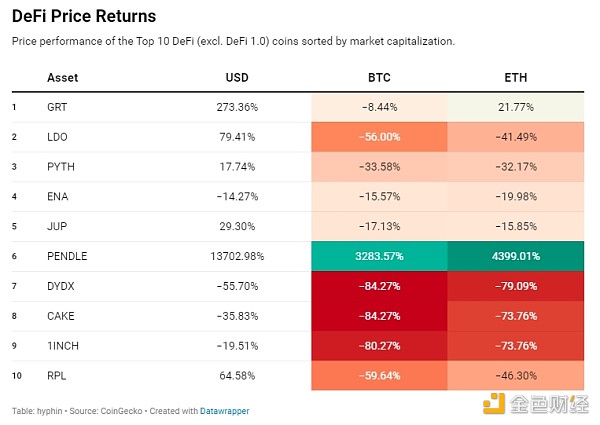

Revenues. Fundamentals. The future of finance. Protocol usage, transaction volume, and total value locked metrics are all rising as more people get involved in blockchain. Does all this mean new expansion? Not exactly.

Innovation and product-market fit aside, price returns for DeFi (excluding 1.0) tokens have been simply horrible, as all projects except Pendle and The Graph have tanked. The liquidity staking market has seen massive growth and adoption over the past few years, but governance tokens representing liquidity wrappers have not. Tokens associated with decentralized exchanges have suffered the worst price volatility of all tokens, with only Jupiter remaining in the green.

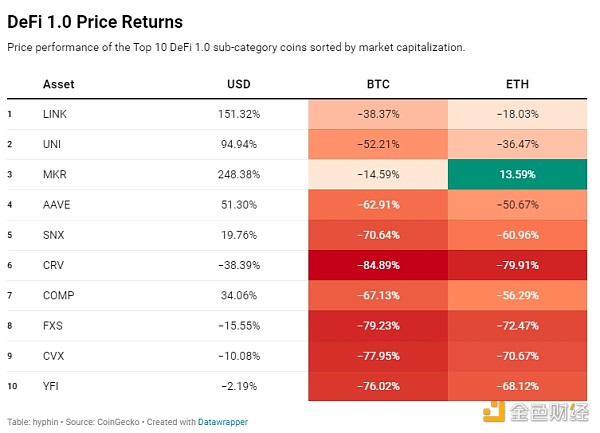

While the above chart sets a worrying precedent for the space, perhaps the granddaddy of the industry, DeFi 1.0, has managed to exceed expectations.

Regardless of their high valuations, high yields, and high utilization, traditional protocols have proven to be poor investments in this cycle unless a yield strategy is in place to offset depreciation. A recurring theme for DeFi protocols is the lack of use cases for their tokens beyond liquidity mining due to mediocre performance. Fee switching can be a saving grace as it creates significant buying pressure on tokens by providing users with actual yields rather than diluting their holdings.

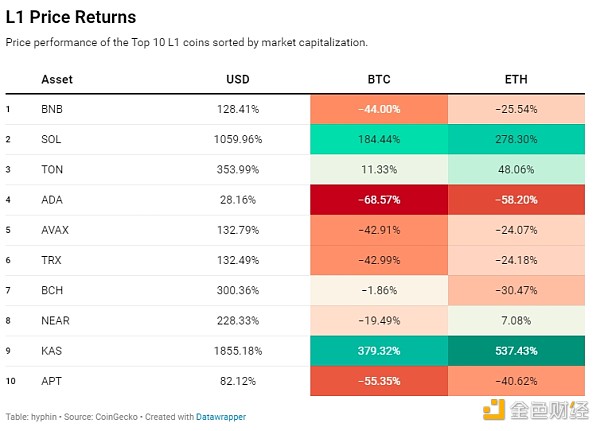

L1s

Layer 1 blockchains are by far the most popular and heavily traded category among speculators, representing the sector and historically showing solid price action, led by Bitcoin and Ethereum. Advances in the space have spawned millions of alternatives vying for market dominance. Their success is closely tied to the ability to foster a thriving ecosystem that attracts skilled builders and attracts a large user base that constantly interacts with the applications. In some cases, technical specifications alone are enough to establish a presence.

Many of the L1 tokens on the list have managed to create multiples, with three of them outperforming the rest of the category to become leaders. Solana is being hailed as the Layer 1 play of the cycle, not just because of its returns, it rose from the bottom to quickly become one of the most used chains in the market and the de facto memecoin hub. Despite Kaspa’s lack of mainstream attention and relatively low trading volume, its returns have surpassed Solana.

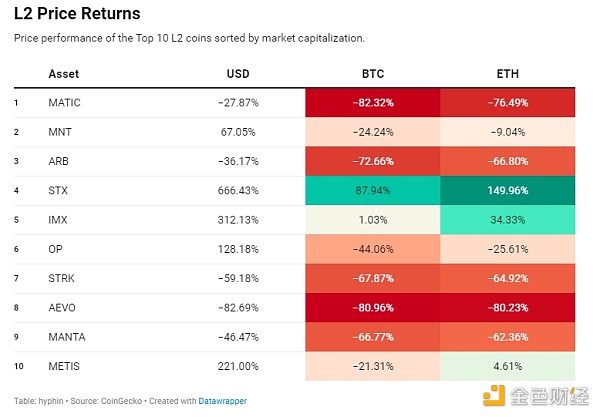

L2s

Aiming to solve the problems of scalability and expensive transaction fees, roll-ups have cemented themselves as an integral part of the on-chain ecosystem.

Unlike the base layer they leverage, L2 tokens have seen mediocre returns, while low-volume, high-valuation VC tokens like Starknet and Arbitrum have fallen into deep losses. Any significant value growth has been shown by those associated with new concepts related to zero knowledge and Bitcoin infrastructure.

in conclusion

After facing the harsh market reality and receiving the liquidation emails, one cannot be blamed for thinking that Altcoin are a thing of the past. It is clear that it is becoming increasingly difficult to win on Bitcoin and Ethereum at this moment without following some kind of trend. Unless you are always online or influential, it is impossible to take advantage of every trend. The negative sentiment brought by these prices suggests the need to rebalance the portfolio and consider the risks. The future of the Altcoin market is uncertain, but it is hard to imagine it getting worse.