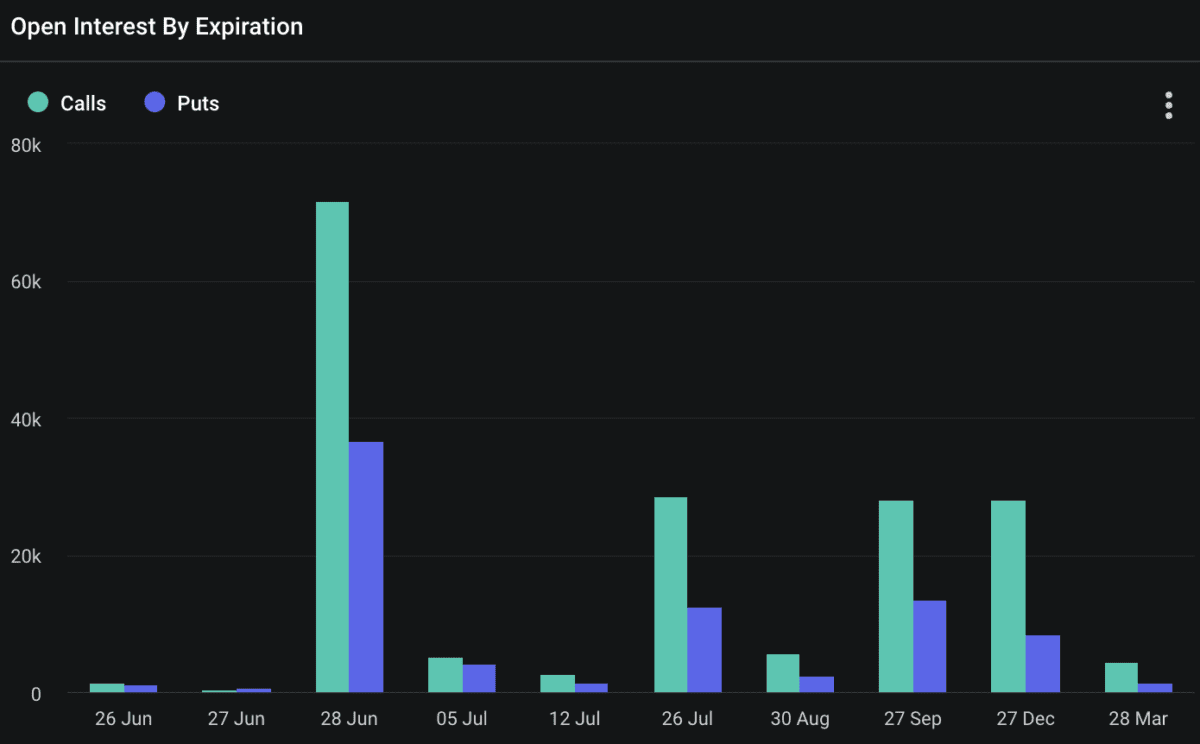

According to CoinDesk , Bitcoin (BTC) options with a nominal value of $6.68 billion and Ethereum (ETH) options with a nominal value of $3.5 billion on the Deribit exchange will expire at 16:00 Taiwan time on Friday.

It is reported that the value of options about to expire is approximately more than 40% of the total value of the current cumulative open interest (over 23 billion US dollars). In addition, the expiration of large quarterly contracts usually leads to increased volatility, so it is expected that price fluctuations this week may Becoming more unpredictable.

Deribit CEO Luuk Strijers said in an interview with Coindesk:

“As we get closer to Friday’s big quarterly delivery date, there may be risks from the ‘Quadruple Witching Curse’ of the U.S. stock market (simultaneous expiration of stock index futures, stock index options, stock options and single stock futures) and related volatility. Due to this impact, more than 25% of Deribit’s open contracts are expected to be settled in-the-money, equivalent to more than $2.7 billion in total notional value at this expiry.”

More than 25% of open contracts are expected to expire in-the-money, meaning these contracts are expected to end at a market price higher than the strike price. This means that investors who hold these contracts stand to make a profit when they expire.

Bitcoin, the largest cryptocurrency by market capitalization, has fallen nearly 9% this month and once fell below the $60,000 mark, attracting many investors to enter the market to buy the dips. Luuk Strijers said that the recent price decline was caused by miner sales, German liquidation of confiscated BTC, and Mt. Gox repayment expected in early July.

Although the market is more bearish in the short term, investors appear to be more inclined to pay higher premiums for short- and longer-term call options that offer asymmetric upside potential, compared to premiums for put options, according to Amberdata. lower. Luuk Strijers said:

“Despite the clear short-term bearish sentiment, traders expect a positive turn for Bitcoin by July 12 and Ethereum by July 5.”