Written by: Mary Liu, BitpushNews

Crypto markets rebounded across the board as traders eased selling sentiment on Tuesday.

After bottoming out at $58,433 on Monday night, Bitcoin rebounded above $61,000 in early trading on Tuesday, rising back above the $62,000 support level during the midday session. At press time, BTC is trading at $62,086, up 3.4% in the 24 hours.

Altcoin benefited from Bitcoin’s recovery, with all but eight of the top 200 tokens by market cap posting gains.

The biggest gainer was Brett (BRETT), up 26% and trading at $0.1672, followed by dog wif hat (WIF), up 23.8%, and Dog (DOG), up 22.1%. The biggest losers were Lido DAO (LIDO), down 1.9%, Tellor (TRB), down 1.8%, and Curve DAO Token (CRV), down 1.2%.

The current overall market value of cryptocurrencies is $2.29 trillion, with Bitcoin accounting for 53.5% of the market share.

Sources of recent weakness

Although many people believe that the potential selling pressure from Mt. Gox is the reason for the market correction, some analysts pointed out that Mt. Gox did not have a big impact on the market. Instead, several analysts said that the cryptocurrency market was just experiencing a typical post-halving shock, coupled with the common "summer doldrums."

ETC Group analysts analyzed the recent weakness in cryptocurrencies, noting that a variety of factors have affected market sentiment, including a decrease in funds flowing into mainstream currencies, increased selling pressure from Bitcoin whale and miners, and increased macro risks.

Bitpush data shows that Bitcoin has fallen more than 20% from its all-time high in March, and other Altcoin have suffered even more severe blows. The global Altcoin market value, excluding Ethereum, has fallen by an average of 32.6% from its recent high. Overall, the amount of funds flowing into crypto assets has slowed significantly compared to the level after the launch of the US spot Bitcoin ETF.

Slowing inflows into Bitcoin and crypto ETFs have weighed on the market, with several analysts citing positive inflows as the primary source of price gains in the first quarter of 2024.

ETC Group analysts said: "On-chain capital inflows for major crypto assets such as Bitcoin and Ethereum have fallen from about $100 billion per month in March to only $20 billion per month since April, which coincides with the pause in the current bull market and is one of the reasons why the market has failed to climb to new all-time highs again."

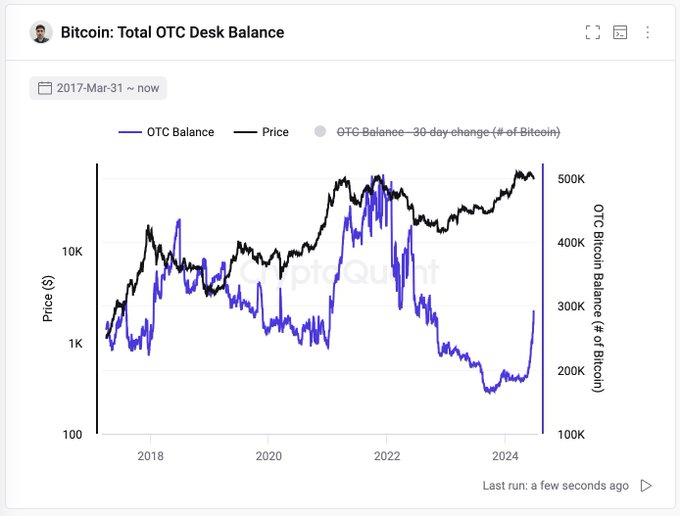

Data released by CryptoQuant shows that 103,000 bitcoins have been added to over-the-counter (OTC) counter wallets in the past six weeks. The increase in OTC wallet balances and the drop in prices indicate that these sell orders have not yet found buying.

“BTC and the broader cryptocurrency market are currently proving that the old adage ‘sell in May, sell in summer’ still holds true as prices remain depressed,” Lucas Kiely, chief investment officer at Yield App, said in a note. “In addition, macro factors have been and are likely to remain the biggest drivers of Bitcoin price action.”

Kiely said, “U.S. inflation has slowed, but remains well above the Fed’s 2% target, which means that despite this being an election year, the Fed is likely to hold off on cutting rates until inflation is fully under control, as per its mandate. Both traditional and digital asset markets are not interested in this – and are already showing it.”

As for the upcoming approval of the ETH ETF, Kiely said: "The market enthusiasm is not high. Ethereum does not receive as much demand and attention as Bitcoin. The approval of an ETF or ETH investment fund will not only not drive up the price of ETH, but may become an obstacle to increase downward pressure."

Analysts warned: "Continued downward revisions to global economic growth expectations, coupled with rising risks of a U.S. recession, are likely to continue to pose challenges for Bitcoin and other crypto assets in the short term. It is also worth noting that changes in global growth expectations have been the most significant macroeconomic driver in recent months, accounting for more than 80% of Bitcoin's performance volatility over the past 6 months."

"When others are greedy, I am fearful; when others are fearful, I am greedy"

But analysts at ETC Group say the recent price drop may have spooked traders who are less confident about the long-term prospects for Bitcoin and the cryptocurrency market, and that prices may have bottomed out.

They noted: “Wall Street wisdom holds that ordinary individual investors are most bullish at market tops and most bearish at market bottoms. In theory, excessive bullish sentiment signals market tops, while excessive bearish sentiment signals market bottoms. In fact, similar behavioral characteristics can be observed in crypto asset markets.”

Analysts said: "We believe that multiple indicators have shown that positions are unbalanced, market sentiment is bearish, and "weak hands" have mostly exited the market. Taking all these indicators into account, we believe that short-term risk/reward is becoming increasingly asymmetric and further downside risk is relatively limited. Therefore, we believe that the current market crash represents a good opportunity to increase investment in Bitcoin and crypto assets before major events occur in the coming months."