Author: Brayden Lindrea, CoinTelegraph; Translated by: Tao Zhu, Jinse Finance

FTX has received court approval to ask creditors whether they would like to receive recovered funds in cash or in cryptocurrency at current market value under FTX’s current liquidation plan.

John Dorsey, a Delaware Bankruptcy Court judge, approved FTX’s voting plan on June 25.

Several FTX creditors have expressed dissatisfaction with the company’s latest liquidation plan, proposed in May, which shows that 98% of creditors (those with claims of less than $50,000) will receive a return of 118% based on the dollar value of asset prices when FTX files for bankruptcy in November 2022.

However, many FTX creditors are seeking payment in-kind in cryptocurrency as the total cryptocurrency market value has increased 165% since the exchange’s collapse.

To put some creditors’ reluctance to pay in cash into perspective, when FTX filed for bankruptcy, Bitcoin was trading at around $16,900, but as of the time of writing, the price of Bitcoin has surged 265% to $61,770.

FTX lawyer Andy Dietderich said at the court hearing that the purpose of the vote was to collect feedback from the majority of FTX customers who have not yet participated in repayment negotiations.

However, FTX’s lawyers stressed that bankruptcy law requires companies to value claims when FTX files for bankruptcy protection, which is consistent with its proposed plan.

The lawyers added that the cash repayment plan currently being proposed would be easier to implement because creditors would not be subject to capital gains tax.

It is worth noting that even if creditors vote in favor of repayments in-kind in cryptocurrencies, the courts will not be forced to approve them.

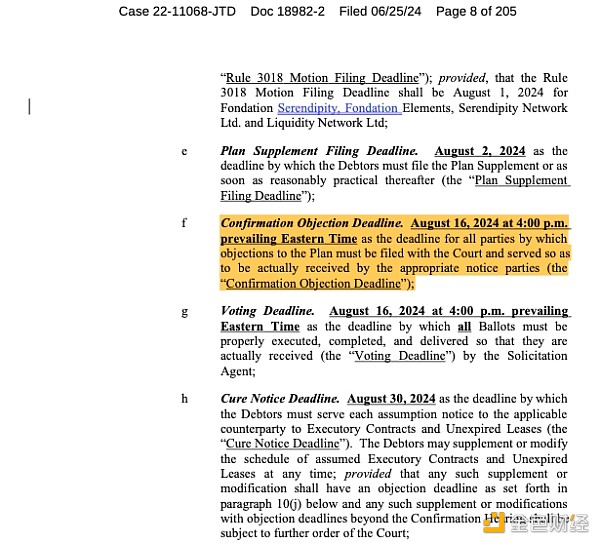

Creditors will vote on the plan by Aug. 16, and Dorsey will decide whether to approve it by Oct. 7, according to court documents.

FTX's creditors will vote on the plan by August 16. Source: Kroll

FTX has collected $11.4 billion in cash since filing for bankruptcy, but Dietderich expects that figure to rise to $12.6 billion by Oct. 31, when FTX’s bankruptcy protection plan is likely to take effect.

FTX was considered one of the world’s largest cryptocurrency exchanges before its collapse in November 2022.

Approximately $8 billion in funds from millions of customers were misappropriated. Much of the money was misused by FTX’s trading firm, Alameda Research, triggering a liquidity crisis when customers sought to cash out their assets.

The defunct exchange has been handed over to FTX’s current CEO, John Ray, a turnaround expert who remains actively involved in the bankruptcy case.

Meanwhile, the company's former CEO Sam Bankman-Fried was convicted on multiple fraud and money laundering charges in November 2023 and sentenced to 25 years in prison in March.