When I first came across SOFA, I thought it was a high-risk product and did not study it in depth. Later, I saw that many people were discussing it in the group and found that there was a capital preservation mechanism, so I went to try it out. The following is my evaluation experience, which I share with you for reference.

💡 Important Information:

1. For hybrid derivative products, the key is to choose the price range, and the return is more volatile.

2. The mining cycle is flexible and optional. The shorter the mining cycle, the higher the certainty of the profit, but it also requires more frequent operations.

3. The income changes from time to time. Earn mode has a guaranteed income, while Surge mode has the risk of losing all the principal.

4. Links to the team:

Earn(principal protection):

https://earn.sofa.org/?sfg=qz2wi

Surge (not principal protected):

https://surge.sofa.org/?sfg=qz2wi

5. Team benefits:

Additional bonus pool for current and final users, settled at the end of each month:

Additional 2% RCH for all RCH airdrops during the month

Users who trade through referral links will be allocated this 2% bonus pool based on their trading volume.

Before sofa token issuance, if the total team reward exceeds a certain amount of RCH, you can get additional sofa allocation (users share according to transaction volume)

This article will be divided into three parts: platform introduction, operation tutorial, and strategy sharing.

Platform Introduction

As an on-chain structured product, SOFA’s positions of all participants are recorded on the chain, and no single participant can easily tamper with or move assets.

Current Earn TVL 2000W +

TVL data dashboard: https://dune.com/chinpaca/sofa-dashboard

Official links for audit, social media, etc.: https://docs.sofa.org/links/

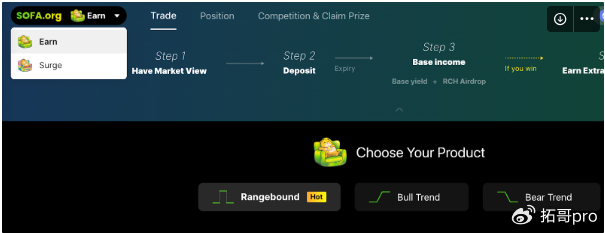

SOFA mainly provides two products: principal and interest guaranteed structured products (Earn) and direction betting lottery (Surge)

Token model: The SOFA project has a dual-token model, in which $SOFA is a governance token. As a pure governance token, $SOFA will not participate in any profit sharing within the ecosystem and has not yet been issued.

$RCH is the application token, and $RCH is the main source of income for SOFA’s two products.

The current price is $0.84 and can be traded on Uniswap

Contract address: 0x57B96D4aF698605563A4653D882635da59Bf11AF

Total supply: capped at 37,000,000 $RCH

Pre-minted supply: 67.6% (25 million) locked in Uniswap liquidity pool with $ETH

Airdrop supply: 32.3% will be distributed to users according to the set schedule

Income use: All SOFA protocol income will be used to purchase $RCH on Uniswap and destroyed

Deflation mechanism: Increased trading volume will increase $RCH Destruction volume and reduce supply

At launch, 67.6% of $RCH (25 million tokens) were pre-minted and added to Uniswap’s V3 liquidity pool on Ethereum with 600 $ETH as the initial liquidity pool (currently 600 $ETH, which may increase before launch).

The initial liquidity in the pool does not belong to anyone. After the project party deposits LP, the corresponding Uniswap LP tokens will be destroyed in a timely manner to ensure that the initial liquidity pool of the token can never be withdrawn.

This ensures that the amount of $RCH circulating in the market will be far less than the amount initially locked in LPs, setting an effective floor for the initial price of $RCH.

Differences between protocols :

Earn Protocol: Principal-protected product. Users can enjoy maximum downside protection while earning stable interest on their deposits. When the market moves in your favor, you can enjoy additional profits.

Surge Protocol: Risky product. This protocol can provide higher returns, but it is also possible to lose your entire deposit. If the market remains within the selected range, the returns will be greatly increased. Otherwise, the purchased funds will be lost.

For Earn products (Secured), all deposited amounts will be staked in the Aave protocol to generate passive income. In addition, part of Aave's returns will be retained as base yield, and the rest will be used in option strategies to generate potential enhanced yields.

There are two product options under Earn and Surge, namely Range Treasure and Bull/Bear Trend.

Rangebound Product Overview

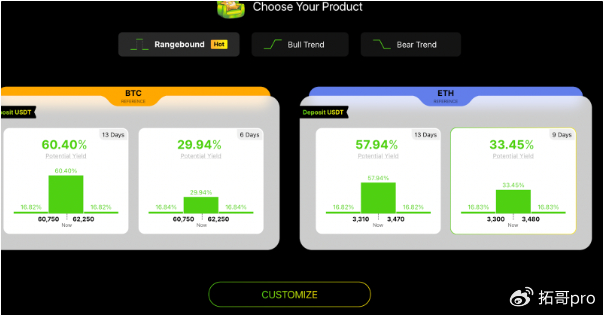

Rangebound products can help earn extra income if an underlying asset (such as Bitcoin) remains between two set prices (upper and lower limits) during the trading period (American options). Users can customize the range themselves: a narrower range means more profit but higher risk, a wider range means less profit but a higher chance of winning. If the user purchases the Earn protocol, even if the asset price exceeds the upper and lower ranges, you can still get the minimum base yield (Base Yield) and RCH airdrop.

Bull Trend / Bear Trend Product Overview

Trend products are suitable for users who expect the market to show a clear unilateral trend. By setting the upper and lower price ranges, users can obtain gradually increasing additional income as the market moves. If the market trend is judged accurately, the greater the volatility on the future settlement day, the greater the profit potential. This product is mainly divided into two types: bullish (bull market) and bearish (bear market). Unlike Rangebound products, Trend only observes the price of the underlying asset at the time of expiration and settlement to determine the final profit (European option).

Operation Tutorial

This tutorial takes the interval treasure in the "Earn" mode as an example. Since the surge risk is relatively high, it is not recommended for the time being.

1. Enter the SOFA official website through the link of the team: https://earn.sofa.org?sfg=qz2wi

💡After entering, confirm that it is "Earn" mode in the upper left corner. Currently, ETH and Arb chains are supported. You can switch in the upper right corner

2. After entering the page, there are two trend prediction products to choose from: BTC and ETH. If you are a novice user, you can directly choose the product displayed on their homepage

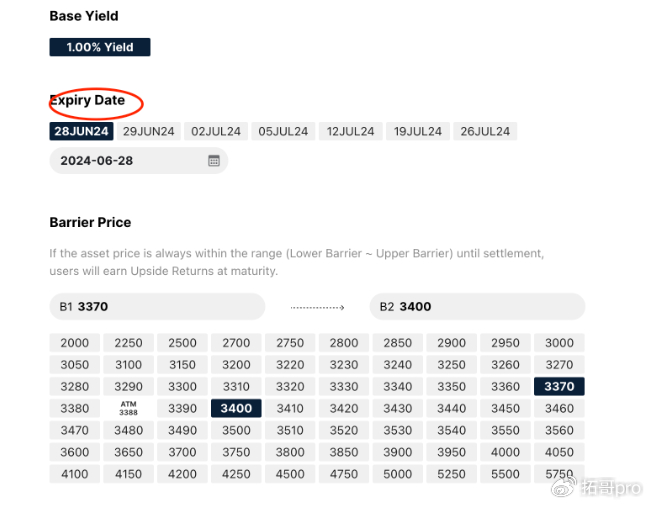

- Customized product selection page "CUSTOMIZE", manual selection of time and interval

When choosing the time, you should pay attention to the best time to invest before 16:00 every day, because 16:00 of the same day to 16:00 of the next day is a settlement cycle.

The range can be selected based on the expected profit and the market conditions of the day. After selection, you can authorize the wallet and the profit will be settled on a daily basis.

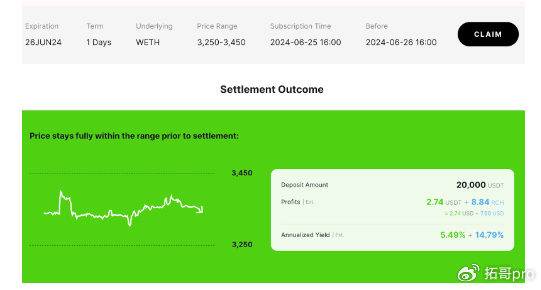

When I tested, I chose the range of [3250-3450] of ETH. The test lasted for one day, and the actual U profit was 20%.

The income settlement is determined based on the price within the cycle, not the price at the time of settlement.

For example, if I invest money at 16:00 on June 25th and it expires at 16:00 on June 26th, if the ETH price is within the range I selected between 16:00 on the 25th and 16:00 on the 26th, I can get higher returns. If the ETH price is higher or lower than the range I selected within 24 hours, I can only get the basic return.

💡Please note: the income is floating in real time, and the estimated rate of return on the website when you invest will be different from the actual income

Affected by factors such as RCH price and total platform pledge funds on that day

Maybe because big investors increased their positions in the past two days, the returns are not high, but the advantage is that the profits are settled daily.

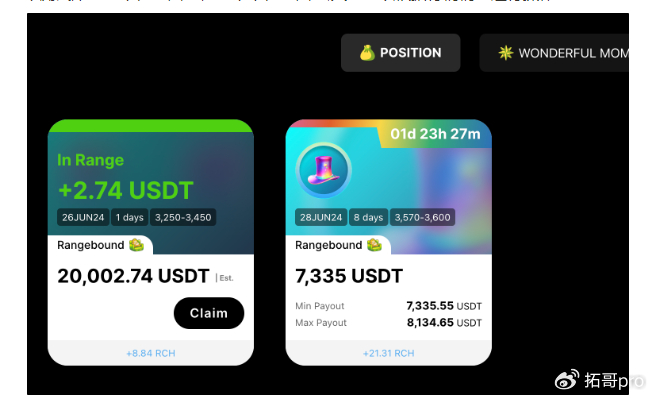

4. After the pledge is completed, click "Position" to view the income

The income is divided into two parts: RCH + USDT

One of my two test accounts is within the range, and the other is not. You can operate according to the market situation.

Strategy sharing

In view of the current market situation, we discussed three strategies with the authorities.

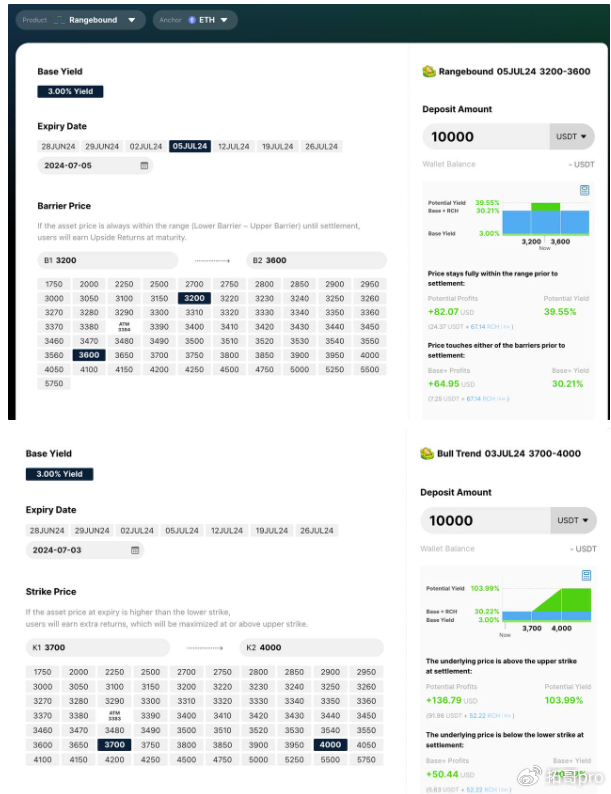

Figure 1 is ETH's range treasure

Figure 2: Bullish on ETH

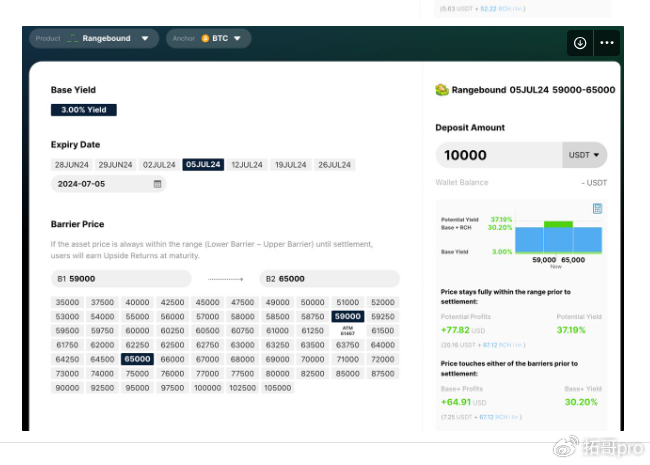

Figure 3 is the interval treasure of BTC

Please refer to the picture for specific interval selection and time, the cycle is 7 days.

🌟Risk Warning:

The crypto industry itself is a field with great risks and opportunities. The once-prosperous FTX collapsed in just a few days, and hacker attacks on leading protocols still occur from time to time.

We are happy to serve as a bridge of communication between users and projects in the community, and are willing to provide a communication platform for more DeFi peers. We will also share projects that we think are good from our perspective. Before sharing, we will conduct a basic review of the project's contract audit, team background, original funding size, and other dimensions.

Community sharing of information can be used as one of the judgments, but it should not be the only one.

Don't blindly believe in authority, and consider the losses you can afford before making any investment decisions.

Okay, that’s all for today. If you are interested, please follow us!

WeChat 1: victeam005

WeChat 2: shijie20170405

Twitter: https://twitter.com/VICOINDAO