Futures traders who bought Solana (SOL) in anticipation of a rally are facing liquidation recently as the value of the coin continues to decline.

At press time, the value of the altcoin had fallen 19% in the past month to $135.56 .

Solana Long Trader Loss Calculation

Liquidation occurs when a trader's position is forced to liquidate due to insufficient funds to hold the position in the derivatives market for an asset.

Long liquidation occurs when the value of an asset falls unexpectedly, forcing traders who opened positions expecting the price to rise to liquidate them.

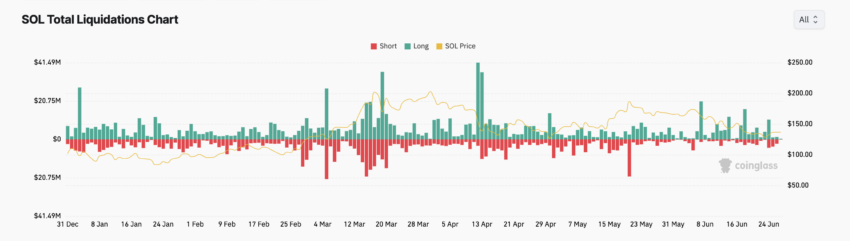

The steady price decline of SOL has resulted in a total liquidation of longs of $27.36 million in the past six days alone.

Read more: How to Buy Solana (SOL) and Everything You Need to Know

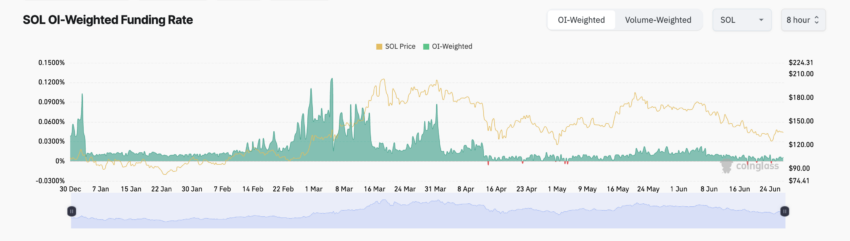

But despite this, demand for long positions from market participants remains strong. SOL's funding ratio remains broadly positive. As of this writing, it is 0.0063%.

The funding rate is used in perpetual futures contracts to ensure that the contract price remains close to the spot price.

A positive funding ratio for an asset indicates strong demand for long positions. This means that there are more traders who buy coins expecting to sell them at a higher price than there are traders who buy coins expecting the price to fall .

SOL Price Prediction: Will it drop to $122.80 or rise to $148.15?

For long traders in SOL, it is important to point out that the altcoin is exposed to the risk of further price declines. Figures from Chaikin Fund Flow (CMF) show steady liquidity outflows from the spot market.

This indicator measures the flow of funds into and out of an asset. A negative CMF value indicates circulation, which means that the market's selling pressure is greater than buying.

If both asset prices and CMF fall, it means that the current downward trend may continue or strengthen. Traders interpret this as a signal to enter short positions and exit long positions.

Read More: Solana (SOL) Price Prediction 2024/2025/2030

If this distribution trend continues, the price of SOL may plummet further and trade at the $130 level. It may be trading at $122.80.

However, if market sentiment switches from bearish to bullish and accumulation surges , the price of the coin could rise to $148.15 .