Author: Jay, Source: Author's Blog; Translated by: Baishui, Jinse Finance

Bitcoin has been hovering between $60,000 and $70,000 for nearly four months.

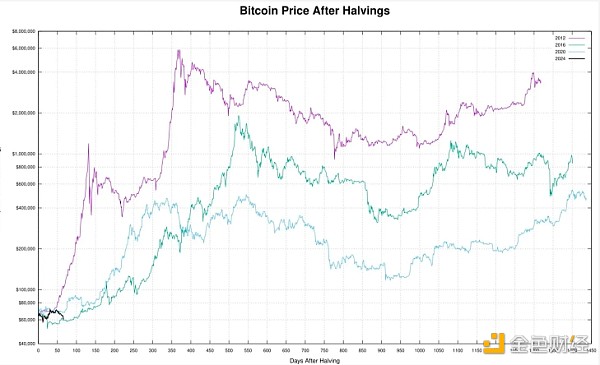

Although surprising, this is really not uncommon. We typically see a lull after a halving. If you look at the price after the 2016/2020 cycle halving, we experienced a similar consolidation before entering the banana zone (the final parabolic rise).

But let’s not settle for “this is how it used to be”, and try to dissect what happened here so we can learn from it (profit*).

"But what about Altcoin? What about airdrops? What about the ETH ETF?"

I’ll cover these in a future post — hopefully elaborating on some of the ideas I’ve come up with for Bitcoin.

If we take this question at face value and try to answer — why do we have a lot of supply around 70k, the naive (and more obvious) answer is:

Many USD are ahead of the halving event;

Miners’ income was halved and they were forced to sell;

US taxes.

We could go on and on – the reasons are endless, but it makes sense to consider more objective metrics.

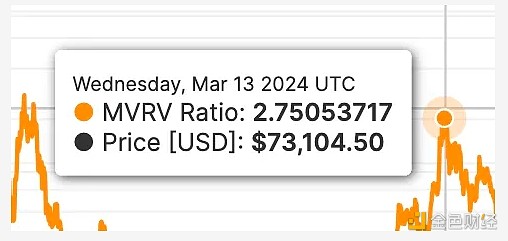

If we look at the Market Value to Realized Value (MVRV) - this is the ratio between the weighted average purchase price of Bitcoin (marking the purchase price as the price when Bitcoin last moved) and the current market price. In short, this is looking at the unrealized profits in Bitcoin.

MVRV boomed in March — the ratio peaked at 2.75 — 2.75 means the average purchase price was 26.58 when the Bitcoin price was 73.1. This metric is not completely accurate (e.g., CEXs may not move tokens but just update their database entries), but it usually peaks with market prices. At some point people need to take profits, right?

Another interesting metric is the long-term holder position change - this defines a long-term holder as any wallet that has held Bitcoin for more than 155 days. Tops are usually formed when these holders finish selling, and bottoms are formed when they start buying. You can clearly see a sharp increase in selling from late January to late March. More importantly, they also started buying again.

Finally, given that the supply of dollars is what Bitcoin is priced on, it is important to focus on the supply of dollars. How much “money” is actually moving around? But more importantly, is the amount increasing or decreasing? What about the pace? Is it rushing or slowing down?

I think this chart says it all - the pace at which global M2 (a key element of global liquidity) has increased has slowed since late March/early April. Markets are forward-looking, and if the forward-looking forecast for M2 is slowing, markets will be pricing in a stronger USD relative to our cryptocurrencies (all things being equal).

In addition, there are many other signals:

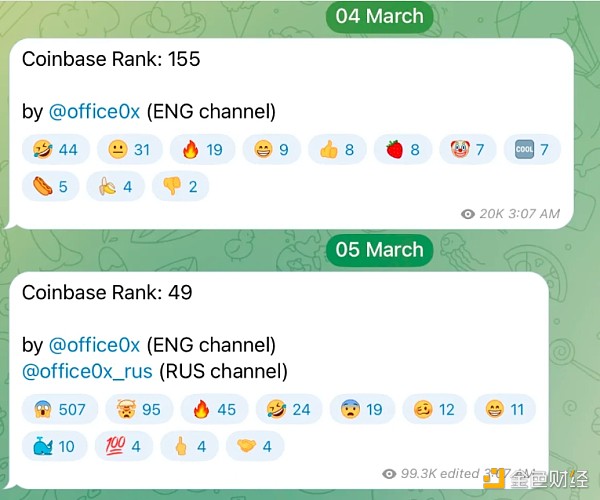

Coinbase jumped 106 positions in one day (they have a lot of app store downloads)

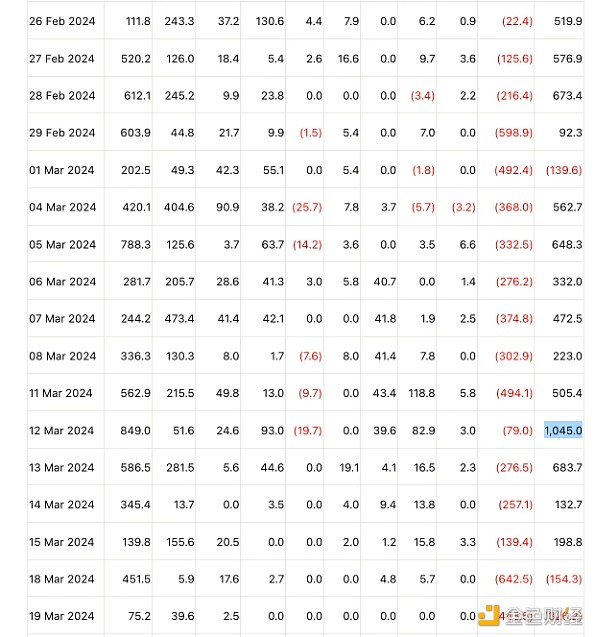

BTC ETF flows peaked at $1.045 billion and then slowed dramatically.

Lots of very positive regulatory news, and increasingly weak follow-through on price action.

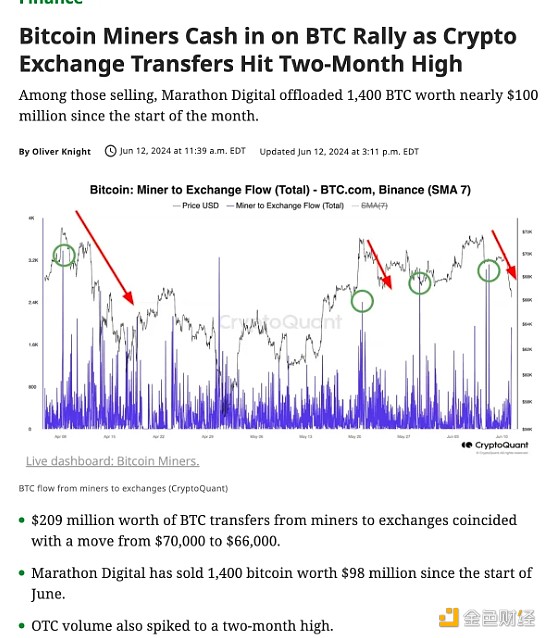

Miners sold off heavily after the halving.

It is always difficult to sell tops (local tops too) because they usually last longer (or shorter) than we expect and emotions make it hard for us to be objective. Also, the market conditions us - we are cautious during the initial breakout, then envy those who make more than us (buy the meme, turn up leverage), and finally try to copy and "catch up" at the end.

The good news is that I don’t think this is a cycle top (the concept of a cycle top still exists if you take into account factors like ETFs). As I mentioned at the beginning, I think this is fairly typical in the weeks and months following the halving. Each cycle is obviously different — but I think the principles are roughly the same:

There can only be so much unrealized profit in the system;

Long-term holders sell to create tops (buy to create bottoms);

The rate at which the supply of dollars increases/decreases;

These will manifest in different ways depending on the positioning of the participants.

This is unlikely to be a cycle top. While it's hard to say exactly *when* we'll start moving higher again, I think we're much closer to breaking out of the end of this range than the beginning (fingers crossed upwards).