Infrastructure never sleeps, and there are more chains than applications.

While the market is complaining bitterly about the PUA of airdrops from various super-projects, the primary market is still rushing on the road of "creating super-projects".

Last night, another L2 with an explosive lineup emerged - MegaETH, which raised $20 million in seed round financing, led by Dragonfly, with participation from Figment Capital, Robot Ventures and Big Brain Holdings, and angel investors including Vitalik, Cobie, Joseph Lubin, Sreeram Kannan, Kartik Talwar and others.

Top VCs led the investment, Vitalik and other industry giants served as angel investors, and the project name was directly named ETH... In the crypto market with limited attention, these labels are all trying to give the project " legitimacy ."

Judging from the official project description, MegaETH can still be summarized in one familiar word - fast.

The first real-time blockchain, transmitting transactions at lightning speeds, sub-millisecond latency and over 100,000 transactions per second...

Now that all market participants are tired of the public chain performance narrative, how can MegaETH stand out?

We dug into MegaETH's white paper to try to find the answer.

There are many chains, but none of them can achieve "real-time"

Assuming that narratives and hype are removed, why does the market need a blockchain called MegaETH?

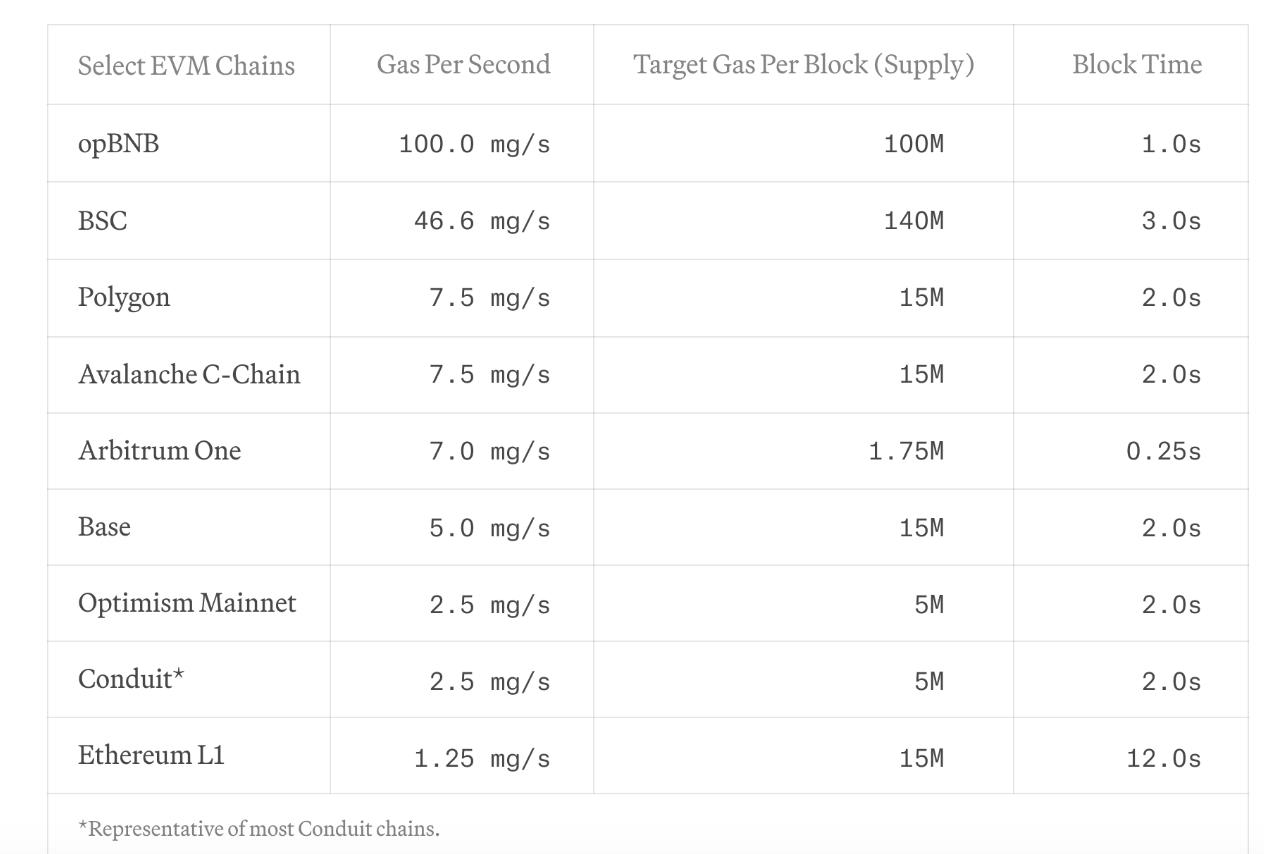

MegaETH’s own answer is that simply creating more chains cannot solve the blockchain scalability problem. The current L1/L2 are facing common problems:

- All EVM chains exhibit low transaction throughput;

- Second, complex applications cannot be put on-chain due to the scarcity of computing power;

- Finally, applications that require high update rates or fast feedback loops are not feasible with longer block times.

In other words, all current blockchains are actually unable to do:

- Real-time settlement: Transactions are processed as soon as they hit the blockchain and results are published almost instantly.

- Real-time processing: Blockchain systems are able to process and verify a large number of transactions in a very short time.

What does this real-time nature mean in practical application scenarios?

For example, high-frequency trading requires the ability to place and cancel orders within milliseconds. Or real-time combat or physical simulation games require blockchain to update status at a very high frequency. Obviously, current chains cannot do this.

Node specialization and real-time performance

So, to achieve the above-mentioned "real-time", what is the general idea of MegaETH? The long version is:

Node Specialization: Reduce consensus overhead by separating transaction execution tasks and full node responsibilities.

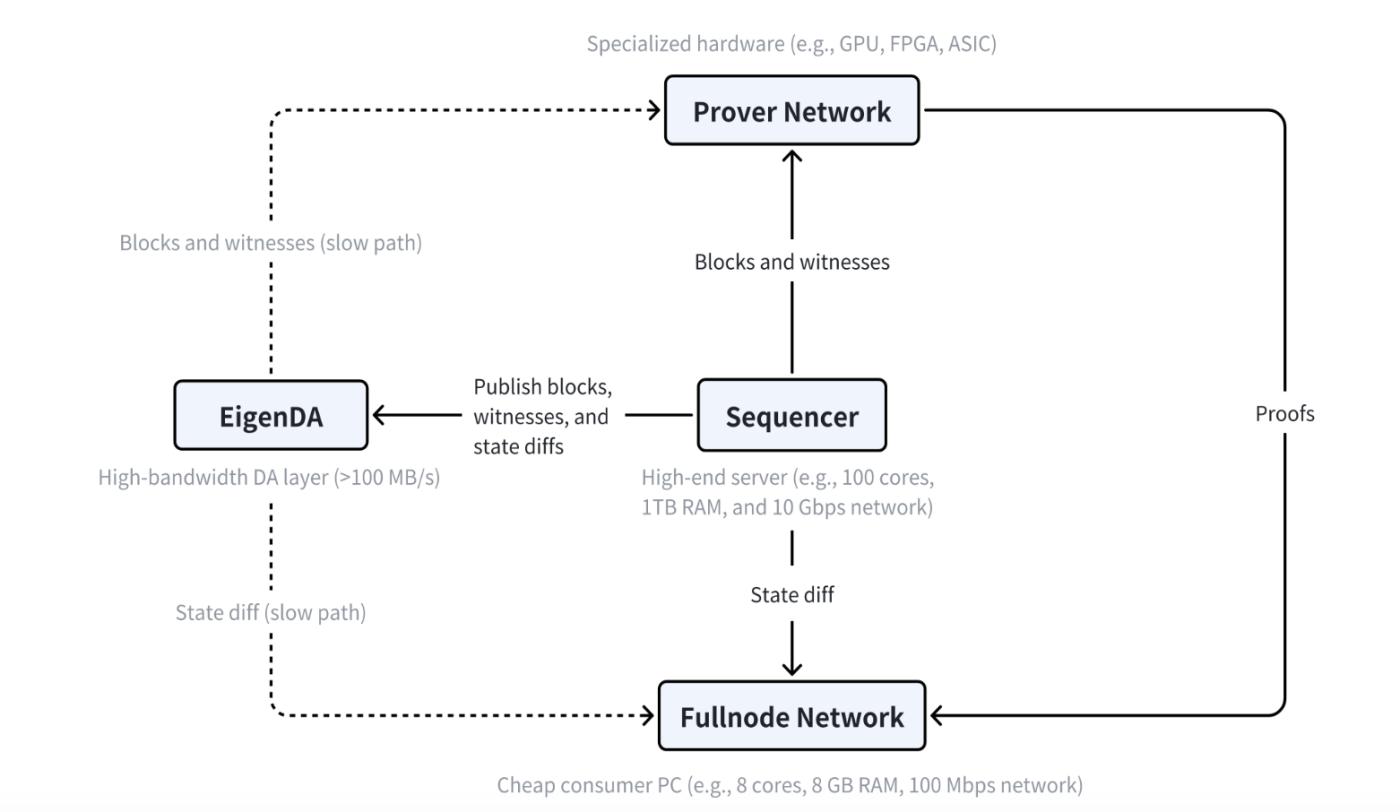

If we want to be more specific, we can see that there are three main roles in MegaETH: sorter, prover, and full node .

Specifically, there is only one active sequencer in MegaETH that executes transactions at any time, and other nodes receive state differences through the p2p network and update local states without re-executing transactions.

The sorter is responsible for ordering and executing user transactions. However, MegaETH only has one active sorter at any given time, eliminating consensus overhead during normal execution.

The prover verifies blocks in an asynchronous and out-of-order manner using a stateless verification scheme.

A simple MegaETH workflow is as follows:

- Transaction processing and sorting: Transactions submitted by users are first sent to the Sequencer, which processes these transactions in sequence and generates new blocks and witness data.

- Data publishing: The sorter publishes the generated blocks, witness data, and state differences to EigenDA (data availability layer) to ensure that these data are available in the network.

- Block Verification: The Prover Network obtains block and witness data from the sorter, verifies them through dedicated hardware, generates proofs and returns them to the sorter.

- Status Update: The Fullnode Network receives status differences from the sorter and updates the local status. It can also verify the validity of the block through the proof network to ensure the consistency and security of the blockchain.

Measure first, then execute

Judging from the other contents of the white paper, MegaETH itself has realized that the idea of "node specialization" is good, but it does not mean that it can be put into practice very easily.

When it comes to building a chain, MegaETH has a good idea: measure first, then execute. That is, first conduct in-depth performance measurements to determine the real problems of the existing blockchain system, and then see how to apply this node specialization idea to the current system to solve the problem.

So, what problems did MegaETH detect?

The following part is actually far away from the leeks. If you don’t have patience, you can directly turn to the next chapter.

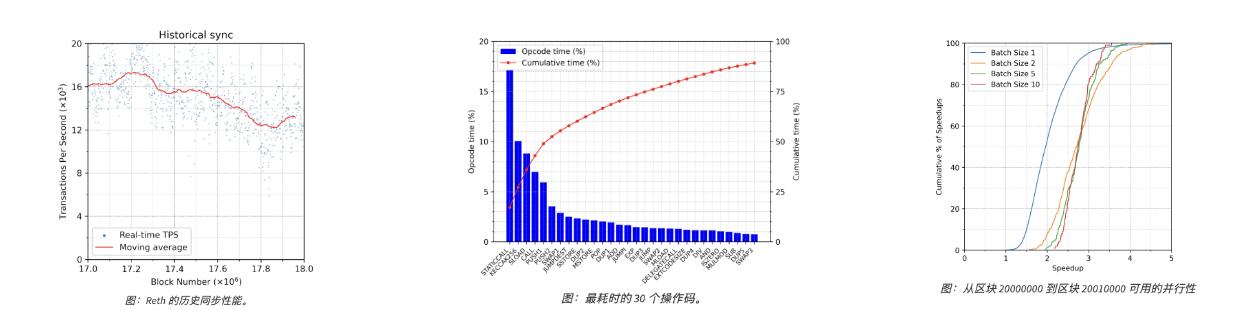

- Transaction Execution: Their experiments showed that even using a powerful server with 512GB of memory, the existing Ethereum execution client Reth can only achieve about 1000 TPS (transactions per second) in a real-time synchronous setting, indicating that the existing system has a significant performance bottleneck in executing transactions and updates.

- Parallel execution: When it comes to the popular concept of parallel EVM, there are actually some performance issues that have not been resolved. The acceleration effect of parallel EVM in actual production is limited by the parallelism of the workload. MegaETH's measurements show that in recent Ethereum blocks, the median parallelism is less than 2, and even if multiple blocks are merged, the median parallelism only increases to 2.75.

(A parallelism of less than 2 means that in most cases, less than two transactions in each block can be executed simultaneously. This shows that transactions in the current blockchain system are mostly interdependent and cannot be processed in parallel on a large scale.)

- Interpreter overhead: Even the faster EVM interpreters, like revm, are still 1-2 orders of magnitude slower than native execution.

- State Sync: Synchronizing 100,000 ERC-20 transfers per second requires 152.6 Mbps of bandwidth, and more complex transactions require more bandwidth. Updating the state root in Reth consumes 10 times more computing resources than executing a transaction. In layman's terms, the current blockchain resource consumption is a bit high.

After testing these problems, MegaETH began to prescribe the right remedy, which made it easier to sort out the solution logic mentioned above:

1. High-performance sorter:

Node specialization: MegaETH improves efficiency by assigning tasks to specialized nodes. Sorter nodes specialize in transaction ordering and execution, full nodes are responsible for state updates and verification, and proof nodes use specialized hardware to verify blocks.

High-end hardware: The sorter uses high-performance servers (such as 100 cores, 1TB memory, 10Gbps network) to process large amounts of transactions and generate blocks quickly.

2. Status access optimization:

In-memory storage: Sorter nodes are equipped with large amounts of RAM and are able to store the entire blockchain state in memory, eliminating SSD read latency and speeding up state access.

Parallel execution: Although the parallel EVM has limited acceleration effect in existing workloads, MegaETH optimizes the parallel execution engine and supports transaction priority management to ensure that critical transactions can be processed in a timely manner during peak periods.

3. Interpreter optimization:

AOT/JIT compilation: MegaETH accelerates the execution of computationally intensive contracts by introducing AOT/JIT compilation technology. Even though the performance improvement of most contracts in production environments is limited, these technologies can still significantly improve performance for specific high-computing demand scenarios.

4. State synchronization optimization:

Efficient data transmission: MegaETH has designed an efficient state difference encoding and transmission method that can synchronize a large number of state updates with limited bandwidth.

Compression Technology: By adopting advanced compression technology, MegaETH is able to synchronize state updates of complex transactions (such as Uniswap swaps) within bandwidth limitations.

5. State root update optimization:

Optimized MPT design: MegaETH uses an optimized Merkle Patricia Trie (such as NOMT) to reduce read and write operations and improve the efficiency of state root updates.

Batch processing technology: By batching state updates, MegaETH is able to reduce random disk IO operations and improve overall performance.

The above things are actually very technical, but if you jump out of these technical details, you can actually see that MegaETH is really good at technology, and you can also clearly feel a motivation:

By disclosing detailed technical data and test results, we attempt to enhance the transparency and credibility of the project, so that the technical community and potential users can have a deeper understanding and trust in the performance of its system.

Teams from prestigious universities are often favored?

In the process of interpreting the white paper, it can be clearly felt that although the name of MegaETH is a bit exaggerated, the documents and instructions often reveal the rigor and excessive details of a technical nerd.

Public information shows that MegaETH's team seems to have a Chinese background, and CEO Li Yilong is from Stanford and has a PhD in computer science; CTO Yang Lei is a PhD from MIT, and CBO (business officer) Kong Shuyao is an MBA from Harvard Business School and has work experience in multiple institutions in the industry (ConsenSys, etc.); the head of growth has some overlapping resumes with the CBO and also comes from the prestigious New York University.

A team of four people, all from top American universities, their influence in terms of connections and resources is self-evident.

Previously, we also introduced in the article "Graduate as CEO, where does Pantera lead the 25 million investment in Nexus come from" that although the CEO of Nexus is a recent graduate, he also graduated from a prestigious school, Stanford, and seems to have a solid technical background.

As expected, top VCs prefer technical giants from top schools. With Vitalik also participating in the investment and ETH included in his name, the technical narrative and marketing effects may be maximized.

At a time when the old "king" has become "dead", there is a lack of successors to the projects, and the market is neither going up nor down, MegaETH will obviously bring about a new round of FOMO effect.