The homework that I have been urged to do for half a year has finally arrived.

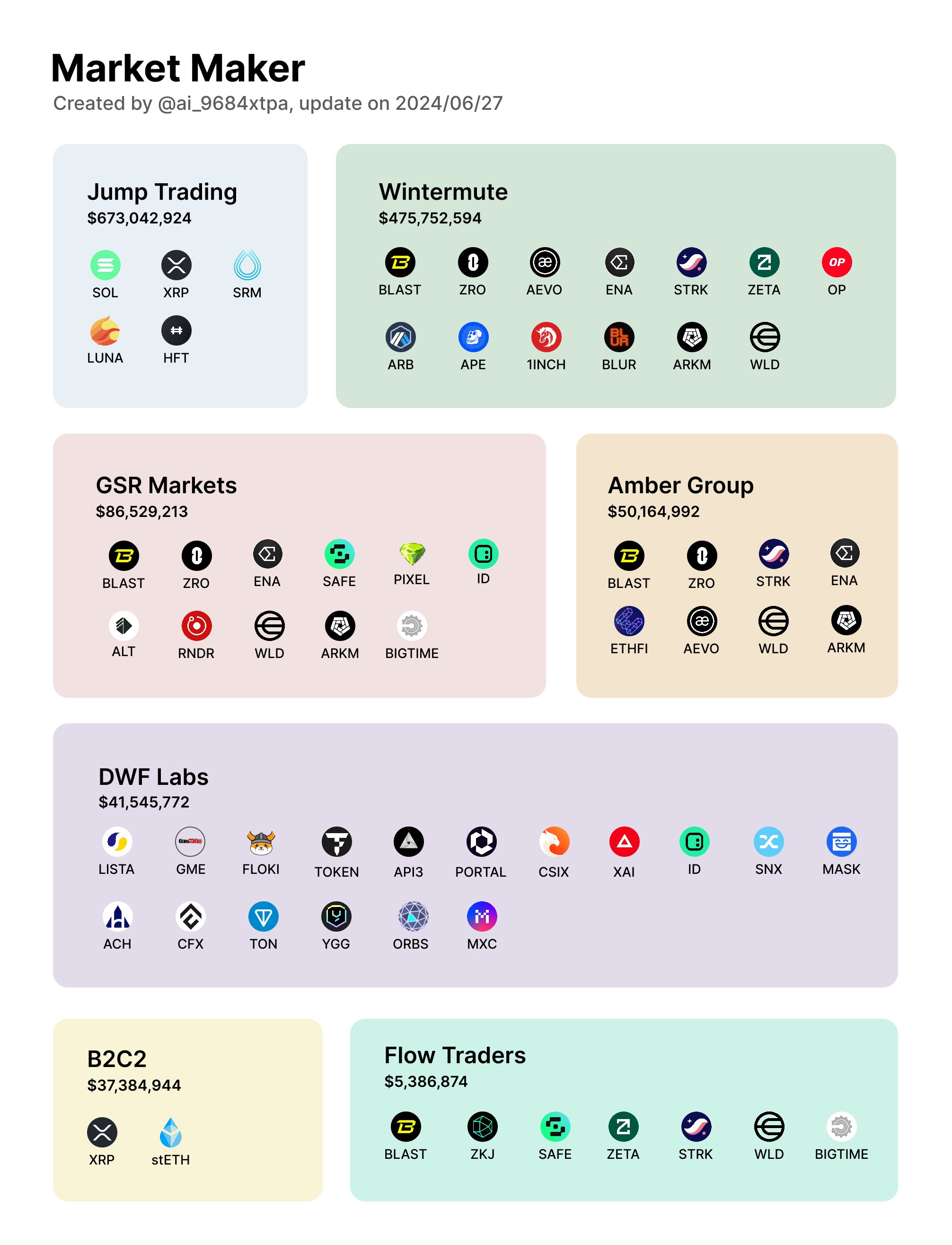

Summarize the market making situation of the seven major market makers Jump Trading / Wintermute / Amber Group / DWF Labs / B2C2 / GSR Markets / Flow Traders in this bull market.

- Wintermute Four Heavenly Kings participation rate 100%

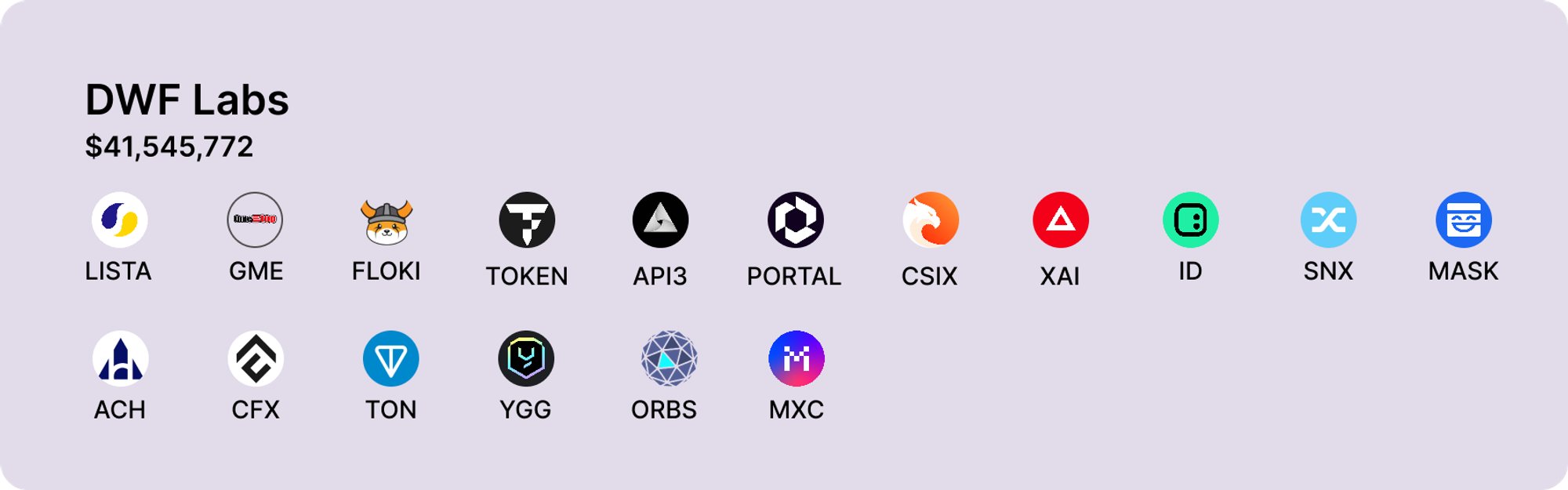

- DWF Labs enters the Meme track and TON ecosystem in a high-profile manner

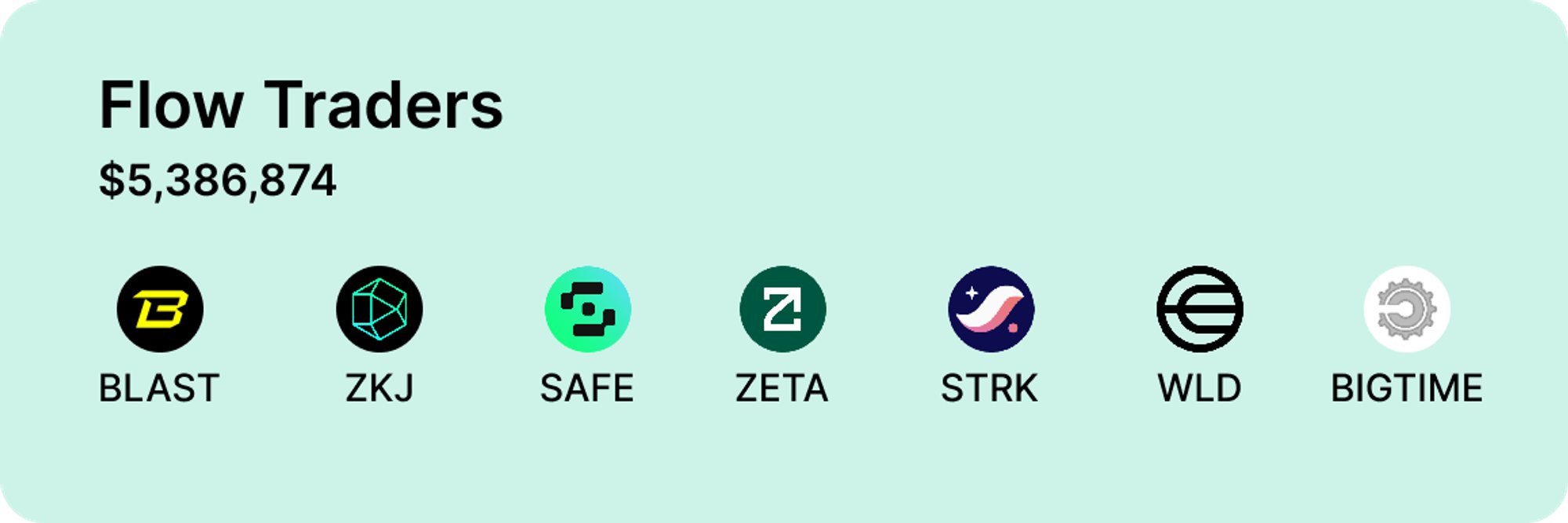

- Amber and Flow Traders activity increased significantly

1/ Write in front

As usual, in order to improve data accuracy, only the publicly verifiable market-making projects counted in the picture are selected. If there are omissions, please add them in the comment section.

2/ Market maker funds

As of June 27, 2024, the ranking from high to low according to the amount of funds on the chain is:

1. Jump Trading: $673 million

2. Wintermute: $475 million

3. GSR Markets: $86 million

4. Amber Group: $50 million

5. DWF Labs: $41 million

6. B2C2: $37 million

7. Flow Traders: $3.9 million

Here are some key points :

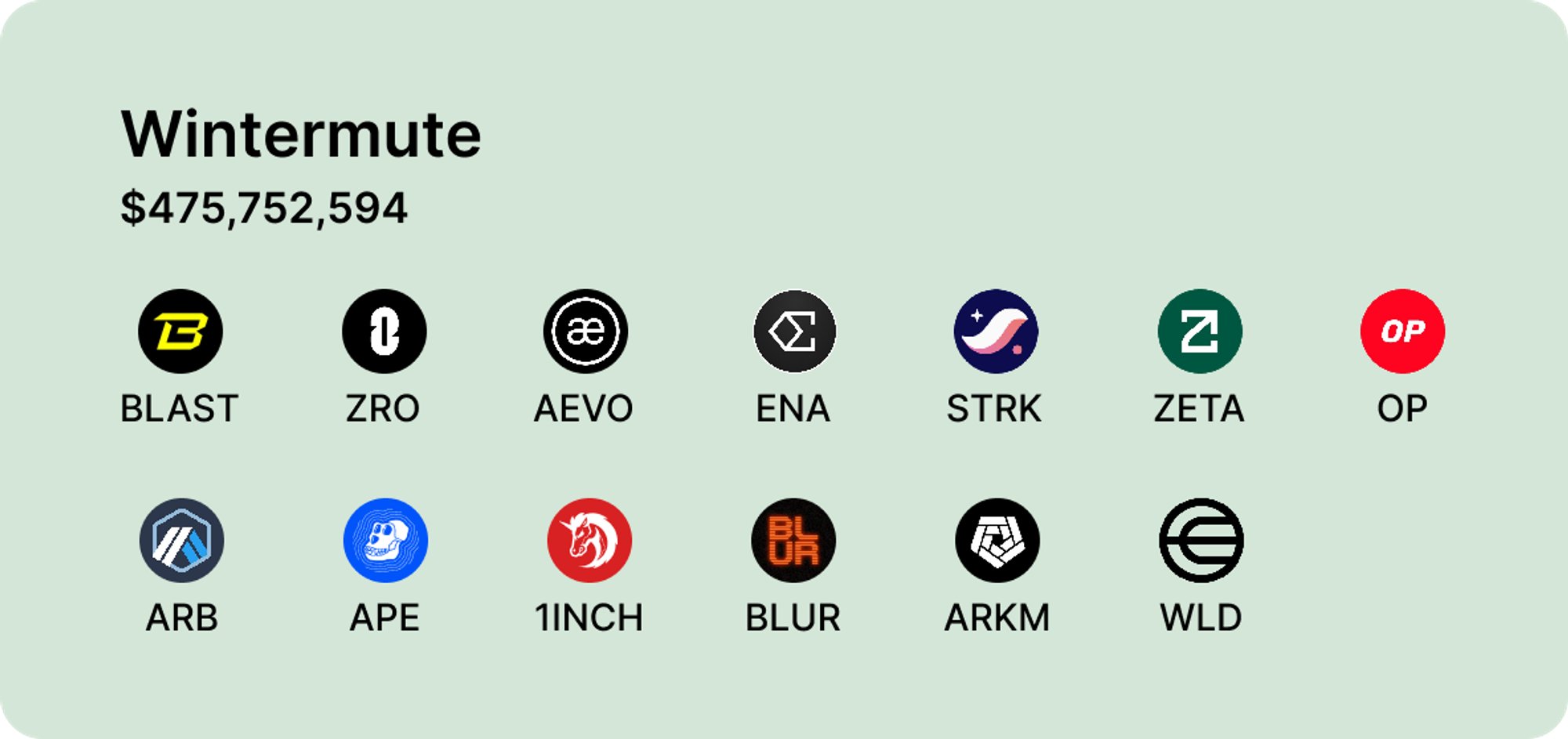

3/ Wintermute: 100% participation rate of the Four Heavenly Kings

Wintermute is present in almost all high-market-cap tokens in this bull market. Among the four kings (OP / ARB / STRK / ZK), except for ZK which lacks clear data support, Wintermute is involved in market making for the rest with a huge number of tokens. In addition, Wintermute has become the second largest market maker in Robinhood, with its trading revenue accounting for as much as 10%.

4/ Over the past six months, there have been two obvious changes in Wintermute’s large holdings

1. The holdings of the top 1 $ARB in 2023.11 have dropped sharply (39.73 million > 2.57 million). Correspondingly, we should often see information about ARB being deposited into the exchange.

2. As an ENA market maker, Wintermute holds $16.29 million worth of related tokens (10.01 million USDDE + 6.28 million USD ENA).

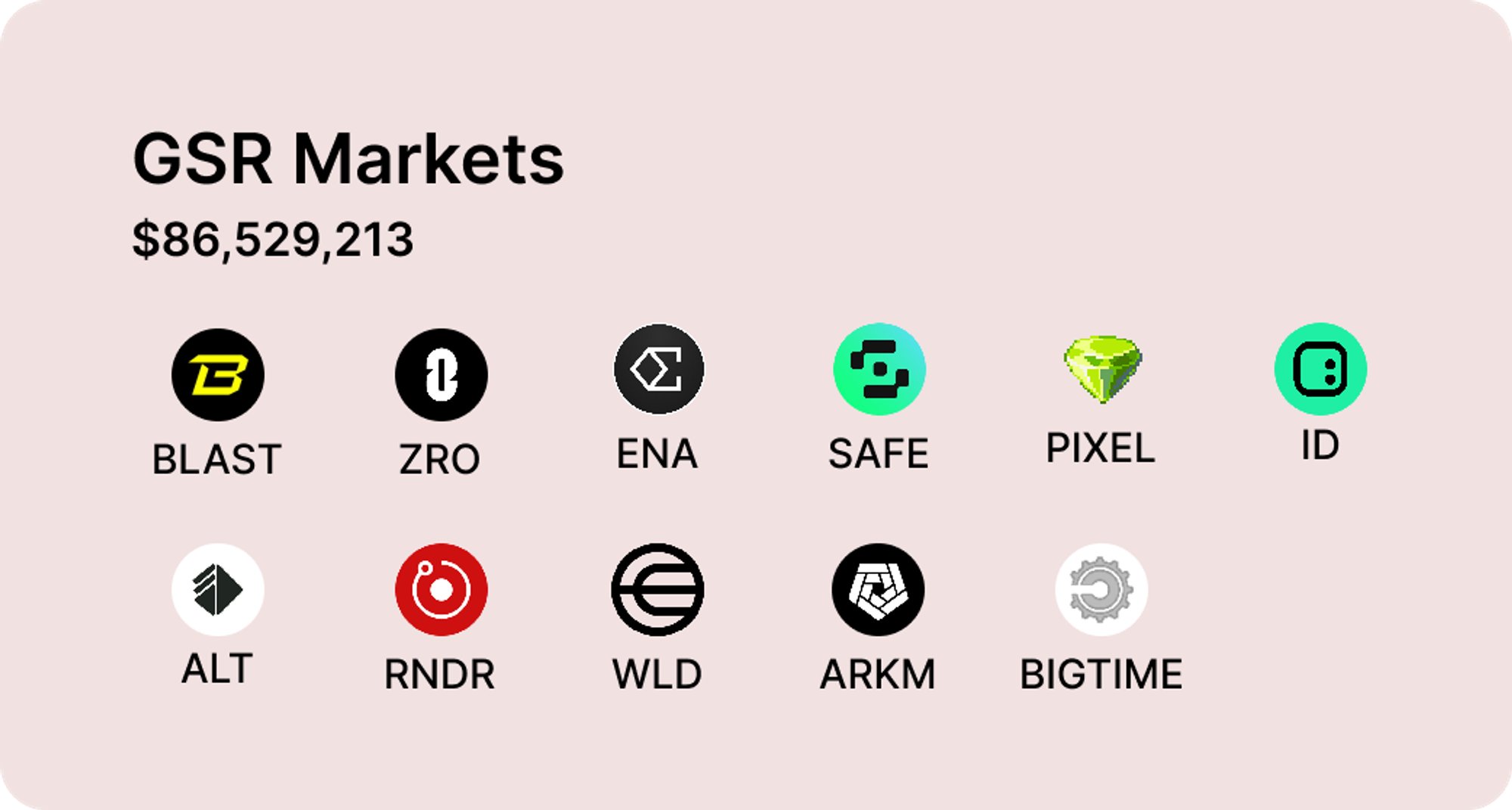

5/ GSR Markets

Rumor has it that he is “Binance’s official market maker”, and his recent market-making participation in the Launchpool project is indeed quite high.

It should be noted that the asset that previously ranked TOP1 in GSR’s holdings $WLD has decreased by nearly 87% (13.06 million > 1.66 million), and was replaced by $GALA, which currently still holds 9.88 million US dollars in tokens, with almost no change in more than half a year.

6/ DWF Labs: High-profile entry into the Meme track and TON ecosystem

DWF is undoubtedly the most active market maker in this bull market - it pushed a number of Altcoin such as FET/JASMINE to rise rapidly in early February, and when the Meme exploded in May, it officially announced investments in projects such as FLOKI/TOKEN/GME, and was deeply involved in the Ton ecosystem.

They really don’t miss any hot spots and make the “VC + MM” model very successful.

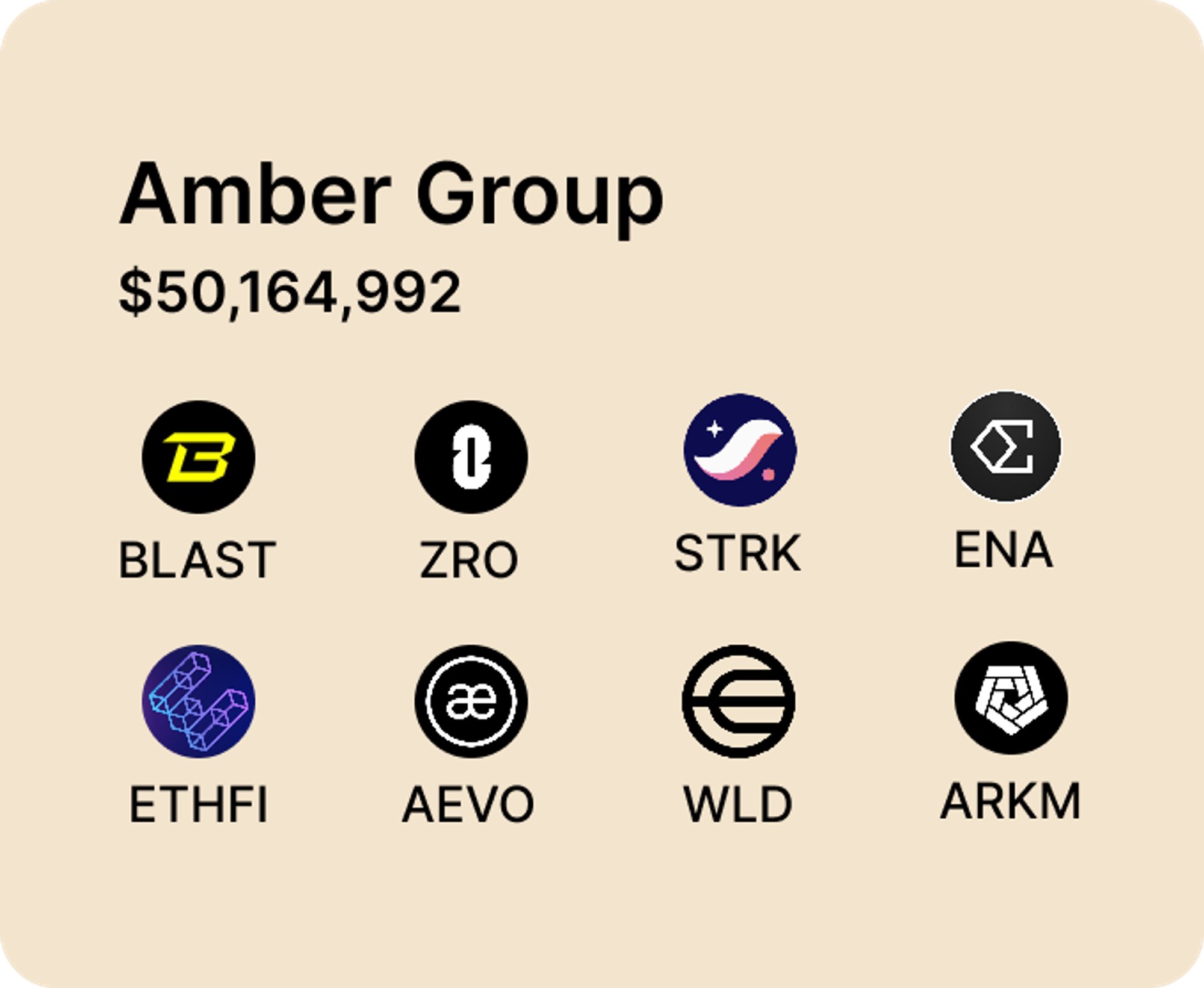

7/ Amber Group & Flow Traders

These two market makers may not be as famous as the above three, but their presence has been very strong in recent months, especially Amber, which has participated in popular narratives such as liquidity staking/L2/interoperability protocols.

Amber currently holds $12.74 million of ZRO, while the top holdings of Flow Traders are BTC/ETH and UNI/MKR, the main narrative DeFi tokens of the last bull market.

8/ Specific positions of other market makers

8/ Specific positions of other market makers

The amount of funds of most market makers has increased significantly. In addition to the factor of "exchange funds flowing to the chain", the hot market in the first half of the year also made MM make money. For example, GSR publicly stated that "revenue in the first half of the year increased by more than two times year-on-year."

For those who are interested in holdings, please see the Arkham dashboard for details. I won’t expand on it here👉 https://platform.arkhamintelligence.com/dashboards/view?dashboardID=77ad9d95-8d52-4958-a6ab-1c807db155f2