July is primarily focused on the possible launch of an Ethereum spot ETF. However, equally important events await several major assets, including Bitcoin.

BeInCrypto has compiled a list of key developments that could impact the cryptocurrency market in the coming month.

Bitcoin price could hit lowest in months

As of this writing, the price of Bitcoin remains above $60,000 at $61,150. Many were concerned that market uncertainty could lead to a drop below this level, but this is missing the bigger picture.

On the weekly chart, we can see that BTC is forming a double top pattern. This macro bearish pattern is a sign that an asset may be trending downward. Bitcoin price appears to have broken below the neckline of $61,483.

Support may be found at $58,874, but this pattern suggests a much larger decline. The price target is set at $50,982, 17% below the neckline, which would mark BTC's lowest level in four months.

The chances of this happening are rather high considering the “sell in May and go” mentality continues to influence BTC spot ETF inflows . If the volatility of the cryptocurrency market is added to this, it is very likely that it will fall.

Read more: Bitcoin Halving History : Everything you need to know

However, the Bitcoin price could rebound from $60,000 or $58,847, invalidating the bearish logic. This will be confirmed once $62,000 is restored as support.

Arbitrum could hit a new all-time low.

Arbitrum's price decline is expected, but the threat of a new all-time low is concerning. ARB, the second-largest layer 2 token after Polygon (MATIC ), has seen its price drop significantly in recent weeks due to a significant drop in demand. It has fallen to $0.799, down more than 60% since early March, forming a head and shoulders pattern.

The Head and Shoulders pattern is a bearish reversal chart pattern with three peaks, with the high peak in the middle (the head) flanked by two lower peaks (the shoulders). A break in the neckline indicates a possible trend reversal from bullish to bearish.

According to this pattern, Arbitrum's target price is expected to be $0, which is an absurd expectation because Arbitrum is a fundamentally strong asset. The most likely outcome is ARB, currently above its low of $0.739, hitting a new all-time low.

Changes in market sentiment could accelerate this decline, and ARB could see a new ATL before the end of July.

Read More: Arbitrum (ARB) Price Prediction 2024/2025/2035

On the other hand, if Arbitrum price can rebound from $0.739, it may attempt to break through $0.929. If the attempt is successful, ARB could rise above $1.00, invalidating the bearish logic.

Dying Non-Fungible Tokens

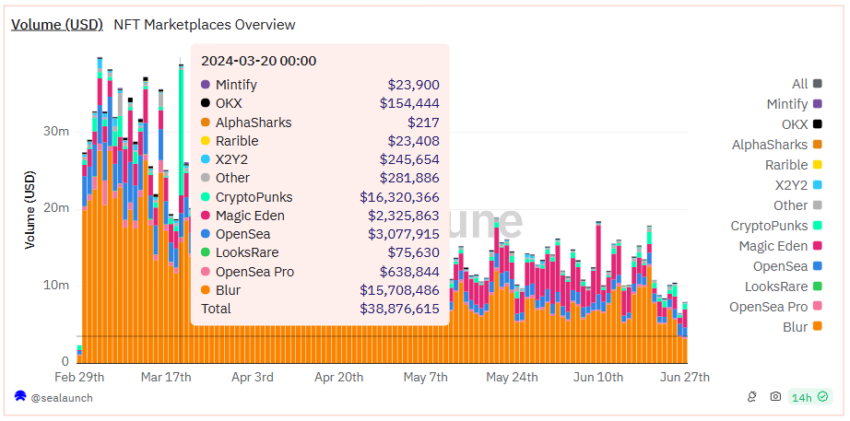

Non-fungible tokens (NFTs) came into the spotlight in 2022, but their performance since then has been disappointing. We saw some recovery in activity and demand in the first quarter of this year.

But this revival appears likely to be short-lived. Over the past three months, total volume has plummeted from $38.8 million to $7.9 million, a decline of 81%.

Read more: 7 Best NFT Marketplaces to Know About in 2024

There are two reasons for this decline. Firstly, the demand was minimal due to the lack of innovation available in this field. Second, there has been an increase in alternative investment options and assets such as real assets (RWA).

The rise of artificial intelligence (AI) tokens has also attracted the attention of investors. Given the growth potential of AI, cryptocurrency investors are leaning more towards choosing it.

As a result, NFT trading volumes may decline further if bearish market conditions and the aforementioned factors gain strength.