Adopted virtually the same ETF design method as VanEck

Staking function excluded… Coin management company ‘Coinbase’

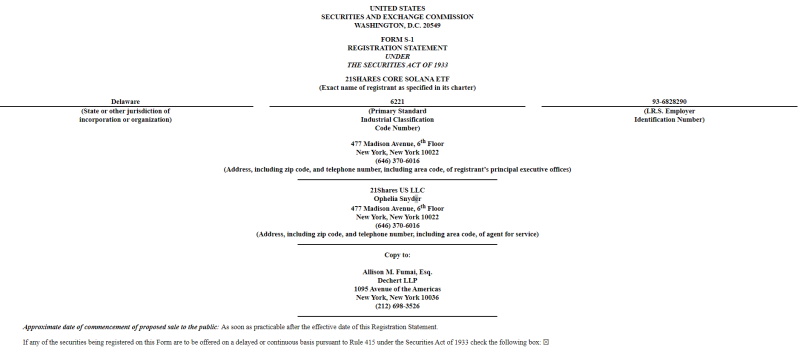

21 Shares submitted the Solana spot ETF securities report ‘S-1s’ to the U.S. Securities and Exchange Commission (SEC) on the 1st.

21 Shares' application adopted virtually the same design approach as Van Eck's application. Solana was classified as a product rather than a security, and an ETF was designed to track Solana's spot price while excluding Solana's staking function.

The application specified 21 Shares US and CSC Deliware Trust as the trust sponsor and 'Trustee', respectively, and Coinbase as the 'Coin Custodian' in charge of storing the coins.

Currently, while the Ethereum (ETH) spot ETF is expected to be launched on the market in July, Van Eck and 21 Shares have applied for the Solana spot ETF, and Solana has been named as a likely next runner.

However, experts predict that it will be difficult for the Solana spot ETF to be launched within the year.

Eric Balchunas, a Bloomberg ETF researcher, predicted, “Approval of the Solana spot ETF will be determined by the results of the November presidential election,” and added, “If former President Donald Trump is elected, the speed of approval could accelerate.” In addition, James Seifert, a researcher at Bloomberg ETF, said, “At the earliest, the approval results will not be available until March of next year.”

Reporter Seungwon Kwon ksw@