June ends! July begins!

The market continues my analysis last week. Last week I said that the $60,000 support level would hold and then rebound.

Now, BTC has rebounded as I said, and is currently trying to hit the EMA20 daily line of $63,700. If it can stabilize at $63,700 this week, the market will continue to rebound to the pressure level of $65,000.

In summary, the daily line is still in a rebound trend. Pay attention to the two pressure levels of EMA20 daily line 63,700 US dollars and 65,000 US dollars that have not yet been reached. As for the specific pressure level where the rebound will end, I still need to observe for a while.

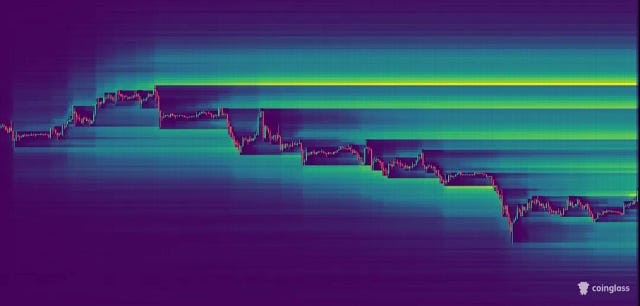

From the daily chart, BTC is currently tending to move towards a converging triangle pattern. As shown in the figure, the highs are indeed gradually decreasing, while the lows are gradually rising.

Generally speaking, the converging triangle pattern will often break out when it reaches one-third of the way through. This turning point is around October of this year.

In other words, if this converging triangle pattern is confirmed by the collective consensus of the market, then the large range of fluctuations we will experience next may continue for another 3 months. . . It really kills trend traders.

On the other hand, the longer the convergence shock lasts, the stronger and more persistent the new trend will be . When this shock lasting more than 200 days finally breaks through, it will inevitably lead to a trend that determines the weekly or even monthly level.

It is actually quite simple and crude to understand. If we finally choose to break upward, then we will at least see a round of crazy bull market.

The more important point is: if there is a strong rebound, the short liquidity above the current price is extremely sufficient, that is, there is new fuel all the way, as shown in the figure

There is no accumulation of long liquidity below, which means that the attraction for price decline is not as strong as the attraction for price rise.

The market is waiting for a signal to change trend

The current adjustment is mainly due to the selling of some long-term investors represented by miners.

It can be seen that the selling volume this time is obviously less than that at the end of 2017 and 2021, indicating that many long-term holders are "looking for swords on the boat" and believe that there may be a market in the future.

In addition to the sell-off, there is another important reason for the adjustment since April: the decline in global liquidity. With less money in the market, asset prices naturally fall.

The next question is, will there be a bull market like in 2017 and 2021?

It's nothing more than where does the money come from? Where does the ecological demand come from?

Where does the money come from? Basically, it depends on the Federal Reserve. If the US economy has a soft landing, the Federal Reserve will gradually cut interest rates, and a slow bull market will occur; if the US economy has a hard landing, all assets in the market may experience a bloodbath, and then the Federal Reserve will start printing money, followed by a rapid bull market.

Where does the ecological demand come from? Objectively speaking, there is no large ecological narrative in this cycle. It is only driven by ETF funds and meme coins . However, the technology iteration of the crypto market in this cycle is very fast, there are many innovations, and a lot of infrastructure has been built. A large ecological narrative may suddenly appear at some point.

So there is still room for imagination in the future market

Ethereum currently has great potential to become a platform for RWA (tokenization of world assets) in the future. In addition to Ethereum, the two public chains SOL and TON are also very eye-catching. They are not only hyping meme coins and small game coins. TON is based on Telegram, and SOL is based on Twitter X. They are both user traffic gathering places in the billions. Through the front end of web2, massive users are connected to the public chain system. Who knows how big a spark can be created in the future? The imagination space is indeed much larger than the defi ecology in 2021. After all, it can "foolproof" to allow hundreds of millions of new users to enter the world of blockchain ecology.

Follow me and go through the super bull market together!!!

Create a high-quality circle

Spot mainly

I will share some content: as shown below:

The overall position is ≥ 5,000u. If you want to join, scan the QR code below!

This is the end of the article. I will do a more detailed analysis in the communication group. If you want to join my circle, please contact me directly through the WeChat below!

Note: If the QR code is invalid, please leave a message in the background