Two Japanese giants, Sony and Metaplanet, have strengthened their dominance over cryptocurrencies in 2024. It comes as Japan battles a devaluation of its currency and government authorities have issued warnings.

Cryptocurrency adoption is on the rise in Japan, and companies are jumping into the space to provide alternative options to their customers.

Sony and Metaplanet advance into cryptocurrency

Sony entered the cryptocurrency market with the acquisition of digital asset trading service provider Amber Japan, valued at $103 billion. According to a press release, the company will change its name to S.BLOX.

Amber Japan operates the cryptocurrency trading service ‘Whale Fin’. Through this acquisition, we will provide easier-to-use services and bring more currencies and features to our apps. Whalefin confirmed the acquisition in an announcement on Monday.

“Going forward, as part of the Sony Group, we will work with the group’s various businesses to create new added value in cryptocurrency trading services,” the release said.

In retrospect, Amber Japan experienced financial difficulties following the FTX collapse in 2022. Parent company Amber Group had to work out a debt-to-equity deal with Pennbush Capital before Sony Group expressed interest. Sony leverages partnerships and acquisitions to strengthen its investment in Web3 This transaction marks Sony's entry into the cryptocurrency space.

As a Japanese multi-industrial conglomerate, Sony is not alone. Investment firm Metaplanet is also reportedly increasing its presence in the cryptocurrency industry.

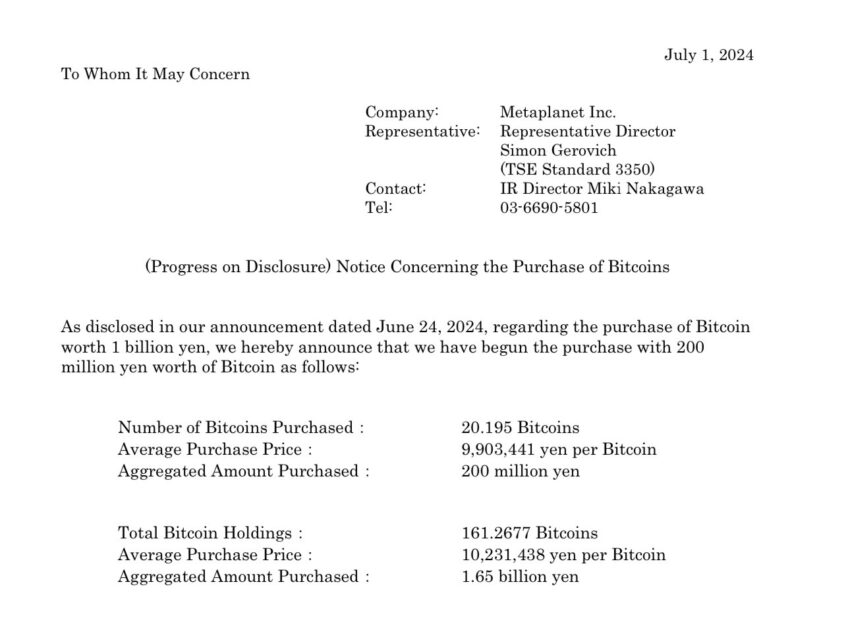

With the addition of 20.195 BTC worth $1.02 million on Monday, Metaplanet became Japan's largest corporate holder of Bitcoin . Like MicroStrategy, Metaplanet has been gradually increasing its Bitcoin holdings since April 2024. On June 11, it was disclosed that it had purchased $1.6 million in BTC, and on June 24, it decided to purchase an additional $6 million through bond issuance.

Read more: Who will own the most Bitcoin in 2024 ?

According to the report, the company's primary policy is to hold Bitcoin for the long term. The report cited a commitment to reduce exposure to Japan's local currency, the yen. We also aim to provide Japanese investors with access to cryptocurrencies through a preferential tax structure.

Japan switching to cryptocurrency as the value of the yen falls

The moves by Sony and Metaplanet suggest that cryptocurrency adoption is growing in Japan. This comes at a time when Japanese authorities are concerned about the depreciation of the yen. The massive devaluation of the Japanese yen and some of the monetary policies of the Bank of Japan (BOJ) have significantly changed the cryptocurrency landscape in Japan.

Reuters reported on June 27 that Japanese Finance Minister Shunichi Suzuki and Chief Cabinet Secretary Yoshimasa Hayashi expressed concern about the sharp decline in the yen.

BOJ Deputy Governor Shinichi Uchida said at the meeting: “The weakening yen is one of the factors causing inflation to rise, so we will closely watch the currency’s movements in guiding monetary policy.”

While stable currency movements are manageable, sudden unilateral movements tend to impact a country's economy. When a currency falls, investors may look for alternative assets to protect their wealth or seek higher returns. In this scenario, some investors may choose Bitcoin as a store of value.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

For example, Metaplanet said it took BTC as a reserve asset to reduce its exposure to Japan's debt burden and resulting yen volatility.

In the same scenario, as the US dollar fell ahead of this week's key jobs report, MicroStrategy founder Michael Saylor called for bullishness on BTC . He tells you to sell dollars and buy bitcoins. As of this writing , Bitcoin is trading at $62,813.