CoinShares reported that Bitcoin ETPs saw a net inflow of $10 million last week and outflows from short Bitcoin increased to $4.2 million, indicating an improvement in market sentiment. In addition, the Coinbase Premium Index fell to -0.19 last week, the lowest level since November 2022, which may indicate an imminent rebound in Bitcoin prices.

As the cryptocurrency market entered July, market sentiment seemed to have improved. On the 25th, the Bitcoin spot ETF ended its seven-day net outflow, and on the 28th, net inflows reached $73 million, the highest single-day inflow in two weeks.

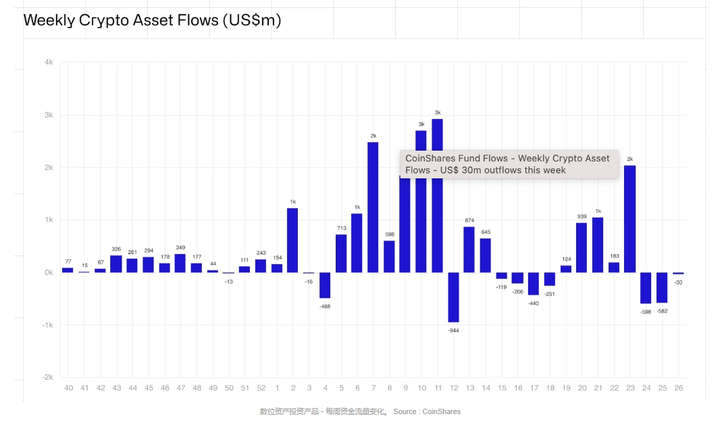

In addition, according to the flow data of digital asset investment products compiled by CoinShares, although the most recent week was the third consecutive week of net outflow, the total outflow amount has been significantly reduced from US$598 million and US$582 million in the previous two weeks, and has dropped to a net outflow of US$30 million in the most recent week.

CoinShares: Signs of positive Bitcoin sentiment emerging

CoinShares said in the report that most digital asset issuers saw small inflows compared to previous weeks, although this was offset by Grayscale's $153 million outflow.

In terms of products, multi-asset and Bitcoin ETPs led other products with net inflows of $18 million and $10 million, respectively, and the total outflow of funds short Bitcoin increased to $4.2 million last week, indicating that market sentiment may be shifting.

A range of other Altcoin also saw inflows, most notably Solana ($1.6 million) and Litecoin ($1.4 million); however, Ethereum saw its largest outflows since August 2022, totaling $61 million, bringing outflows over the past two weeks to $119 million and making it the worst performing asset in terms of net flows so far this year.

From a regional perspective, the United States saw inflows of $43 million, while Brazil and Australia saw inflows of $7.6 million and $3 million, respectively. Negative sentiment permeated Germany, Hong Kong, Canada, and Switzerland, with outflows of $29 million, $23 million, $14 million, and $13 million, respectively. The Coinbase Premium Index reached its lowest level since November 2022

In addition to the money flow data suggesting a reversal in Bitcoin sentiment, the Coinbase Premium Index fell to nearly -0.19 on Friday, its lowest level since the FTX crash in November 2022.

The Coinbase Premium Index is the difference between the BTC price on Coinbase and the BTC price on other exchanges. This negative data shows weak demand and selling pressure from US investors. One of the reasons behind this may be that investors are worried that the US government will sell confiscated assets through Coinbase, resulting in a discount on Coinbase's BTC price.

In the past, when the Coinbase Premium Index showed a serious negative value, it was often close to the bottom of the current price, and BTC subsequently rebounded sharply in the next few months. For example:

In early November 2022, the Coinbase Premium Index fell to a rare low of -0.33, coinciding with the BTC bear market low below $16,000, before prices soared to nearly $25,000 by February. That’s an increase of more than 50%.

The index low in August 2023 came a few weeks before Bitcoin bottomed out at around $25,000.

Bitcoin then rose from October to January, nearly doubling in price, and hit a new all-time high in March.

Most recently, the indicator plunged to as low as -0.17 on May 1, when Bitcoin was trading around $58,000, before BTC rallied by about 27% in June to nearly $72,000.

The next six months to a year will be very good for BTC. At least in the near term, the Coinbase Premium Index has become a reliable, deterministic, and sometimes even leading indicator of overall market trends.