Author: Peter Chung, Presto Research; Translated by: Tao Zhu, Jinse Finance

Summary

The Mt. Gox compensation plan will distribute billions of dollars worth of BTC and BCH to Mt. Gox creditors between July 1 and October 31, 2024. During this 4-month period, this may cause changes in the supply and demand dynamics of BTC and BCH, which may open up pair trading opportunities.

Our analysis suggests that BCH will see four times more selling pressure than BTC , assuming that: 1) for BTC, only a small portion will be sold, as creditors are mostly wealthy Bitcoin holders who “hold diamonds”; and 2) for BCH, 100% will be sold in the short term, given its much weaker investor base.

Long BTC perpetual contracts paired with short BCH perpetual contracts are the most effective market-neutral way to express this view, unless there is funding rate risk. Those who wish to lock in funding rates can explore other methods, such as short-term futures or borrowing BCH in the spot market.

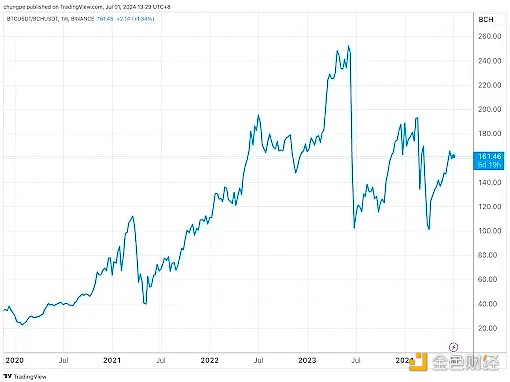

Figure 1: BTC/BCH ratio is on an upward trend

Source: TradingView, Presto Research

Preface

The “Notice Regarding the Commencement of Repayments in Bitcoin and Bitcoin Cash” issued by Mt.Gox on June 24th clearly stated that repayments for the so-called “Early Lump Sum Payment (described below)” selected by Mt.Gox will be made between July 1 and October 31, 2024. This will cause a change in the supply and demand dynamics of BTC and BCH during this 4-month period, potentially opening up pair trading opportunities. This report will explore this in detail.

Mt. Gox’s Repayment Plan

Mt. Gox was once the world's largest bitcoin exchange until it closed in early 2014 after losing nearly 1 million bitcoins held by customers. Some of those assets were later found. A trustee is working to repay creditors under the plan.

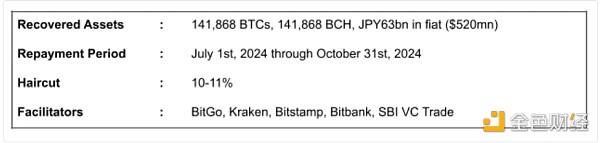

Under the plan, Mt. Gox creditors can choose to receive compensation “in advance” by taking a small cut based on the assets recovered to date, rather than waiting for “full recovery.” This option is often referred to as an “early lump sum payment (ELSP)” and will be preferred by creditors who want certainty of an upfront payment. The other option is to hold out and hope for further progress in asset recovery while taking on various risks that could affect the amount of repayment, such as the ongoing CoinLab lawsuit. Since the outcome of both issues is uncertain and there is no clear timeline, most creditors prefer to exit early. The highlights of the ELSP are as follows (Figure 2).

Figure 2: ELSP details

Source: CoinTelegraph, @intangiblecoins, Presto Research

The prevailing narrative is that billions of dollars in repayments will swamp supply and lead to a sell-off as recipients of repayments cash out in droves. While such a prospect is certainly unsettling for the market, assessing whether it will actually have a significant impact requires a more careful analysis. Generally speaking, so-called “overhang” risk in any market only emerges when 1) sellers are under time pressure, or 2) the opportunity cost of holding the asset is perceived to be high. Evaluating these two points for the two assets in question, namely BTC and BCH, we can observe different dynamics at play.

Analyzing Mt. Gox’s Creditors

Our analysis was inspired by the “X” theme from Alex Thorn, head of research at Galaxy Digital, which provides an excellent framework for thinking about this question. We have reproduced his table below and supplemented it with additional data for clarity.

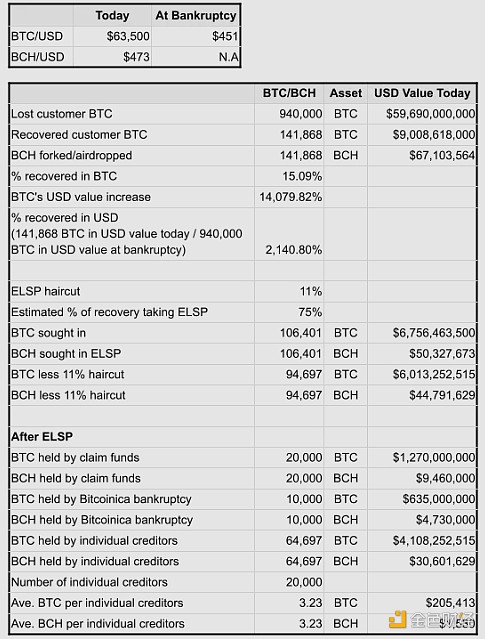

Figure 3: Analysis of ELSP repayments

Source: @intangiblecoins, Presto Research

Assessing how creditors might behave after receiving repayment requires a closer look at who they are. The table above shows that the two largest groups of creditors, outside of individual creditors, are “claims funds” and Bitcoinica. Claims funds are essentially institutional “vulture funds” whose purpose is to purchase bankruptcy claims at a significant discount. Fortress Investment Group and Off The Chain Capital were major players in the Mt. Gox trade. Over the past few years, claims funds have accumulated a large amount of BTC claims from distressed sellers, now 20,000 BTC according to Alex’s estimate. Bitcoinica, a defunct New Zealand Bitcoin exchange, had as much as 10,000 Bitcoins on deposit at Mt. Gox.

Alex noted in his post:

His analysis assumes that 75% of creditors accept the ELSP.

Claim funds are unlikely to sell immediately because their limited partners are made up of early Bitcoin holders who are already wealthy and want to accumulate more money at a discounted price.

As a defunct exchange going through bankruptcy proceedings, it is unlikely that Bitcoinica will liquidate its holdings.

The current group of individual creditors may be "big spenders" because they have chosen to hold onto their claims for a decade, resisting aggressive bids from bond funds. Weaker creditors have had plenty of opportunities to exit, and they may well have done so.

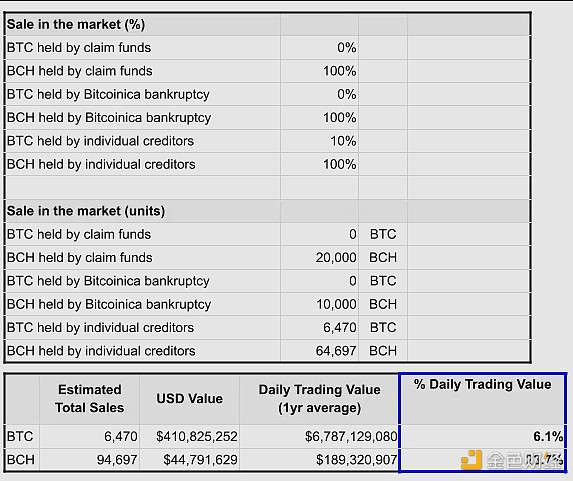

With the above in mind, we extend Alex’s original analysis by adding the assumption that creditors repay the portion that enters the market. Specifically, for BTC, we assume that only a small portion will be sold for the reasons mentioned above. For BCH, we assume that 100% will be sold in the short term (Figure 4). Consider that the Bitcoin Cash fork occurred three years after the Mt. Gox bankruptcy. The assumption here is that Mt. Gox creditors are unaware of the reasons for the Bitcoin Cash fork and are more likely to treat their BCH payments like any crypto enthusiast would treat an airdrop — i.e., immediately cash out or exchange for BTC. We apply these assumptions to the data in Figure 3 to derive the USD value of possible BTC and BCH liquidations. Much smaller trading volume compared to BCH. Since BCH has much smaller trading volume than BTC, the selling pressure on BCH is much greater than that on BTC — i.e., BTC accounts for 6% of daily trading value, while BCH accounts for 24% of daily trading value.

Figure 4: BCH’s selling pressure is 4 times that of BTC

Source: @intangiblecoins, Presto Research

The best way to exploit this asymmetric supply risk in a market-neutral way is to long BTC exposure while short BCH exposure. This can be expressed in a few different ways, but the most effective is the perpetual futures (perps) market. Perpetuals are exposed to the risk of fluctuations in funding rates, but this risk is easily dwarfed by the convenience of quickly establishing and unwinding bilateral bets.

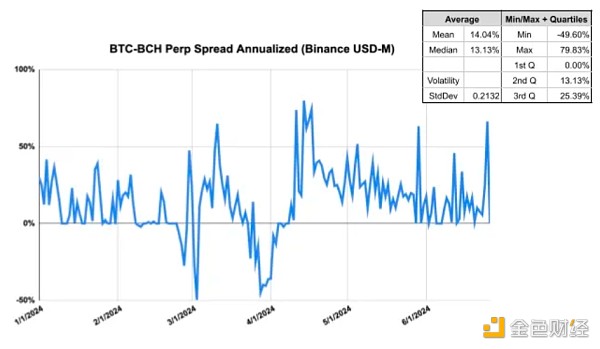

For example, let’s look at this trade expressed through Binance USD-M futures. The average annualized net funding rate for long BTCUSDT perpetuals and short BCHUSDT perpetuals is 13% in 2024 (Figure 5). If you were 3 months into the trade, the breakeven threshold would be 3.25%. Given that the BTC/BCH ratio is currently at 161, a move to the local high of 193 (+20% upside) would clear the barrier and generate a market neutral return of 17% after funding costs. The all-time high for the ratio is 252 in May 2023.

Figure 5: Financing costs for pairs trading

Source: Binance, Presto Research

Additionally, those who wish to lock in a funding rate can explore other methods, such as short-term futures or borrowing the underlying asset in the spot market. Some exchanges offer trading in the BCH/BTC pair, although liquidity is low (Figure 6).

Figure 6: The 24-hour trading volume of the BCH/BTC pair is $2.3 million

Source: Binance