Author: Parker Merritt Source: Coin Metrics Translation: Shan Oppa, Golden Finance

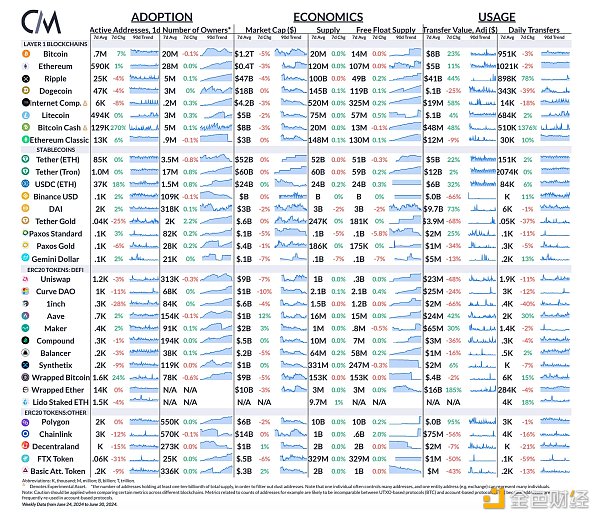

Key takeaways:

Post-halving, Bitcoin’s hash rate (30-day moving average) has fallen 7% from its all-time high of 626 EH/s to currently 580 EH/s

OKX’s large-scale UTXO integration brought a brief boost to transaction fee revenue, with miners earning $38 million in transaction fees in 3 days

Toronto-based mining company Bitfarms has made impressive progress in mining efficiency, reducing incremental energy consumption from 35 J/TH to 27 J/TH by 2024.

At the peak of the 2021 bull market, Antminer S19 was trading as high as $100/TH and is now trading on the secondary market for as low as $2.5/TH

Introduction

This week’s State of the Network report takes another look at the Bitcoin mining landscape, continuing our series of quarterly updates on the state of proof-of-work stakeholders. Since the Bitcoin halving in April, mining profits have been under pressure due to stagnant Bitcoin prices and depressed fee markets, although a short-term period of on-chain congestion has provided some revenue relief. Many mining companies are diversifying beyond pure mining and repositioning themselves as general infrastructure providers in an attempt to secure hosting contracts for energy-intensive AI applications. At the same time, the improvement of chip efficiency continues unabated, forcing miners to consider whether to continue to use old ASIC hardware or to conduct a comprehensive mining machine upgrade. In this report, we will take a deep dive into each of these factors to assess the health of the mining industry beyond Bitcoin’s price performance.

Mine consolidation

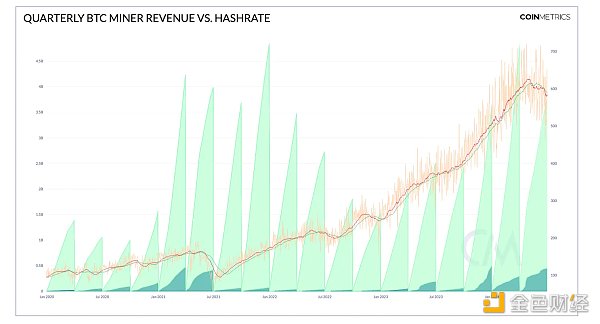

At first glance, Q2 2024 appears to be a relatively profitable period for Bitcoin miners. Of the 18 quarters since January 2020, which ranked fifth by total dollar revenue, miners earned a total of $3.77 billion through block subsidies and transaction fees. Of course, these gains are front-loaded due to the halving, with April alone accounting for nearly half of the quarter's revenue. May and June were tougher months for miners, as the Bitcoin block reward was reduced from 6.25 BTC to 3.125 BTC on April 20, and the popularity of the "Rune" token gradually subsided in the following weeks. As a result, Bitcoin’s hash rate is showing signs of miners quitting – the 30-day moving average of 580 EH/s is down 7% from the all-time high of 6.26 EH/s.

Source: Coin Metrics Network Data Pro

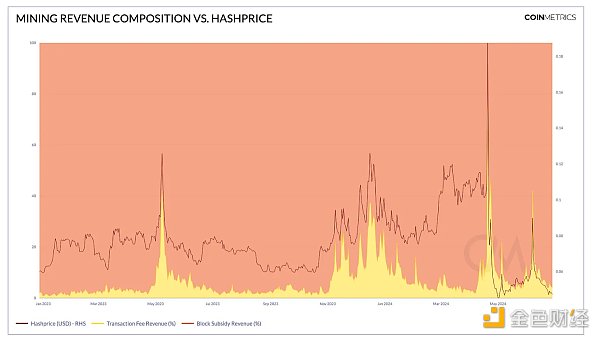

Although overall revenue momentum has weakened, the unexpected increase in on-chain traffic has provided some respite for miners. In early June, the Bitcoin memory pool was crowded with a large number of transactions that paid high fees. By noon on June 7, the average hourly transaction fee was as high as $945. This congestion period has significantly increased mining revenue. The price of computing power (USD revenue per TH/s per day) has soared to US$0.09, and handling fees contributed more than 42% of revenue.

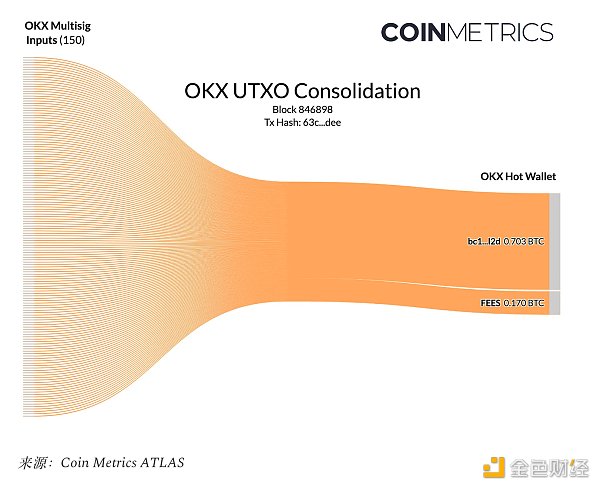

While spikes in fees are typically associated with token protocols like Ordinals and Runes, the recent boost in mining revenue was driven by the internal operations of a single centralized exchange. OKX (the fourth-largest exchange by Bitcoin spot trading volume) conducted a series of massive “UTXO merges” to clean up its books by consolidating fragmented Bitcoin shares into larger, more compact denominations. Since fees for Bitcoin transactions depend on the block space they consume, transactions involving many UTXOs are more expensive to transfer, while "merged" UTXOs can unlock payments with a lighter, more cost-effective on-chain footprint.

The UTXO merging process is similar to pouring a bunch of loose money into an automatic change machine and exchanging it for a $20 bill. However, like the change machine, this service comes with a price. While daily fee revenue is typically around $1-2 million, within 3 days of OKX’s UTXO merger, miners earned nearly $38 million. In hindsight, OKX could have executed their cleanup more efficiently, as they paid a huge premium for fast settlements - but miners certainly weren't complaining in the face of depressed transaction queues and record-low hashrate prices.

The importance of infrastructure

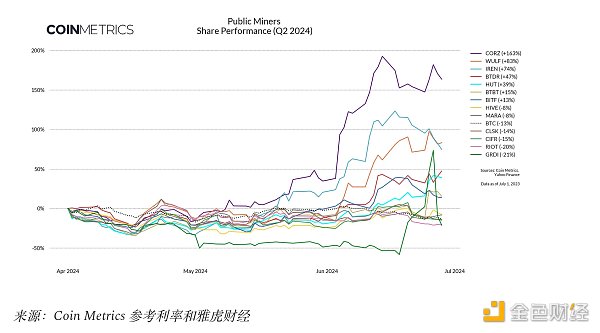

Since the Bitcoin halving, the share prices of most listed mining companies have been trading sideways alongside Bitcoin. Shares of the three major miners - Marathon Digital (MARA), Clean Spark (CLSK) and Riot Platforms (RIOT) - all failed to outperform Bitcoin in the second quarter, with only Marathon eking out tiny relative returns. The dark horse companies in the Bitcoin mining race have fared best so far, with Core Scientific (CORZ), Iris Energy (IREN), and TeraWulf (WULF) all outpacing their rivals by double-digit margins. Coincidentally, these companies are heavily riding on the artificial intelligence boom, positioning themselves as energy and infrastructure providers for a wider range of computing applications.

In June, Core Scientific signed a series of multi-billion-dollar contracts with "AI supercomputing company" CoreWeave, agreeing to provide hundreds of megawatts of power capacity to host the company's high-performance computing (HPC) hardware. Soon after, CoreWeave submitted an "unsolicited proposal" to Core Scientific to acquire its entire business, but Core Scientific rejected the offer, citing its "growth prospects" and "value creation potential." proposal. IREN and WULF also highlighted their unique positioning in hosting HPC infrastructure, making them attractive partners (and possible acquisition targets) for AI companies increasingly facing energy constraints.

For other miners, share price movements are primarily driven by mergers and acquisitions within the industry. While small-cap miner GRIID Infrastructure (GRDI) has lagged behind peers since going public this year, CleanSpark announced its acquisition of the company in June, claiming the move would add 400 MB of power capacity to their portfolio over two years. watt. In May, Riot Platforms disclosed its 9.25% stake in Bitfarms (BITF), a slightly smaller miner that is suffering from corporate governance issues. Riot offered to acquire all shares of Bitfarms for approximately US$950 million, claiming that the acquisition would create "the world's largest listed Bitcoin mining company" by the end of the year. Bitfarms quickly rejected the offer, fending off Riot's hostile takeover by issuing a "poison pill" designed to dilute the stakes of entities seeking acquisitions on the open market.

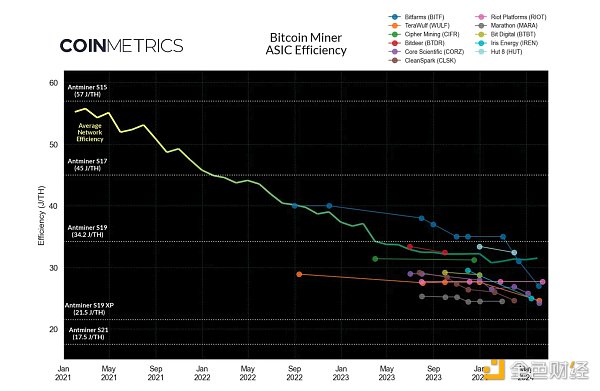

Riot's motivation for acquiring Bitfarms can be attributed to several factors, but one thing worth noting is the massive increase in their efficiency. Bitfarms has historically taken advantage of low-cost hydroelectric power and used older generation ASIC chips rather than upgrading to cutting-edge hardware. This has caused them to lag behind competitors in metrics such as mining efficiency, which is measured in “joules per terahash” (J/TH), which represents the incremental energy consumed to generate computing power. However, Bitfarms recently implemented a comprehensive mining machine update and purchased the 16 EH/s Antminer T21s (19 J/TH). In 2024, Bitfarms' average mining efficiency increased from 35 J/TH to 27 J/TH, surpassing Riot's stagnant efficiency of 27.7 J/TH.

Bitfarms has achieved impressive results in more than just improving average mining farm efficiency. Iris Energy has reduced average energy consumption by 15% over the past 6 months to 25 J/TH, and TeraWulf has achieved an 11% efficiency improvement during the same period, reaching 24.6 J/TH. Core Scientific, fresh out of Chapter 11 bankruptcy proceedings, currently leads the way with 24.23 J/TH, slightly ahead of current efficiency leader Marathon Digital's 24.5 J/TH. As the race to optimize operations shrinks to decimal point precision, miners are now setting their sights on next-generation ASIC chips to stand out from the competition.

ASIC era

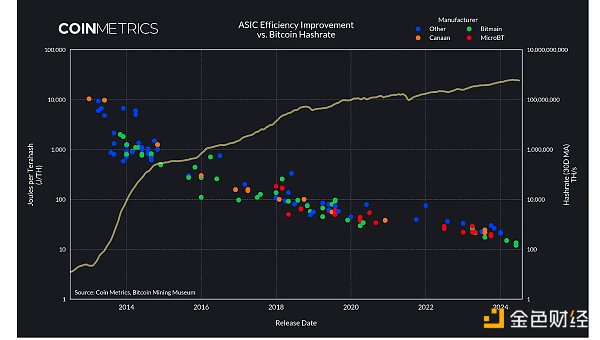

After more than a decade of chip manufacturing innovation, Bitcoin mining application-specific integrated circuits (ASICs) have achieved unprecedented improvements in efficiency. The first commercial ASIC chip - the Canaan Avalon 1 - was launched in January 2013, with a computing power of only 0.06 TH/s. Its power consumption is 620 watts, which is equivalent to an efficiency of 10,333 J/TH. At the time, this was a big leap in terms of raw computing power output, with the total network computing power at the time being only 22 TH/s. Shortly after the release of Avalon 1, rival manufacturers also aggressively entered the market, and continued technological advancements led to a 14,000-fold increase in computing power in two years.

The magnitude of efficiency improvements has tapered off from the early days of exponential growth, but manufacturers are still actively reducing the energy consumed per unit of computing power produced. In June, Bitmain announced their latest Antminer S21 XP series model. The water-cooled version has a computing power of 473 TH/s and an efficiency of 12 J/TH. While Bitmain remains the industry giant, emerging players like Bitdeer—led by former Bitmain CEO Jihan Wu—have announced plans to produce 5 J/TH ASICs in the second quarter of 2025 Ambitious plans for chips.

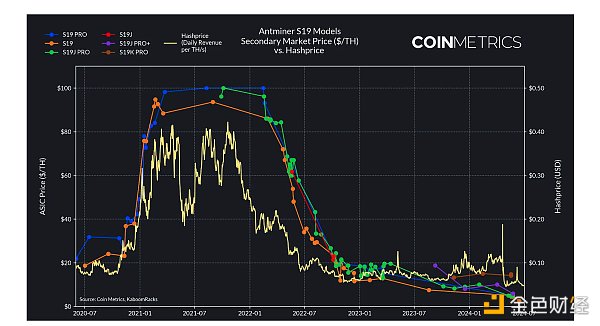

As Bitcoin miners began to retire their existing hardware fleets in favor of more efficient models, ASIC prices plummeted. While nominal prices vary based on hardware specifications, ASIC traders often quote prices in "dollars per terahash" ($/TH), providing an easily comparable metric for gauging the premium of various models.

The bull market in 2021 (coupled with China’s mining ban) has contributed to an extremely profitable period for BTC mining. This has resulted in a high premium for Antminer S19 models (90-110 TH/s), with prices remaining high at around $90-100/TH throughout the year. However, in 2022, plummeting revenue put tremendous pressure on ASIC premiums, with S19 prices falling by more than 80%. Post-halving, secondary markets such as Kaboomracks continue to capitulate, with the worse-performing S19 model in June trading as low as $2.5/TH.

Despite losing the luster of the new generation, ASIC fingerprinting shows that the S19 series still contributes more than 50% of the hash rate, suggesting that they are being redeployed to lower-cost sites rather than being retired entirely. Even 2016's Antminer S9 retains its place on the fringes of the grid, still reliably turning waste energy into electronic cash nearly a decade after its debut. While the most efficient operators will undoubtedly choose to replace their miners with the latest models, the rugged and highly industrial form factor of modern Bitcoin mining ASICs ensures that nearly every machine will eventually find its way into the proof-of-work ecosystem. a place.

in conclusion

Bitcoin’s fifth era may be characterized by consolidation, with deep-pocketed miners acquiring the assets of less efficient operators. The AI industry is also envious of the industry's unique energy infrastructure, and many listed miners have successfully adopted a more general data center strategy. Others remain focused on Bitcoin and view HPC juggling as a temporary diversion. Regardless, all miners must look to the future if they want to survive the onslaught of efficiency improvements and competitive pressures, and the long-term trend of BTC prices remains an unpredictable input to a highly capital-intensive business model.

Network data insights

Summary metrics