According to Cointelegraph, Bloomberg senior ETF analyst Eric Balchunas told the media that the potential U.S. Ethereum spot ETF may only play a "supporting role" in the Bitcoin spot ETF.

Eric Balchunas said that compared with the record inflows of Bitcoin ETFs, the inflows generated by Ethereum spot ETFs may disappoint many people. Eric Balchunas said:

"Bitcoin is like the chili sauce of cryptocurrency. Investors will think this is enough, and these things will move in sync anyway. Ethereum is relatively difficult to explain. In my opinion, it is just a supporting role of Bitcoin."

Eric Balchunas explains that Bitcoin’s value proposition as “digital gold” is relatively easy to understand, but Ethereum and its broader decentralized finance (DeFi) ecosystem are more akin to tech stocks, making it harder for traditional retail investors Thoroughly understand.

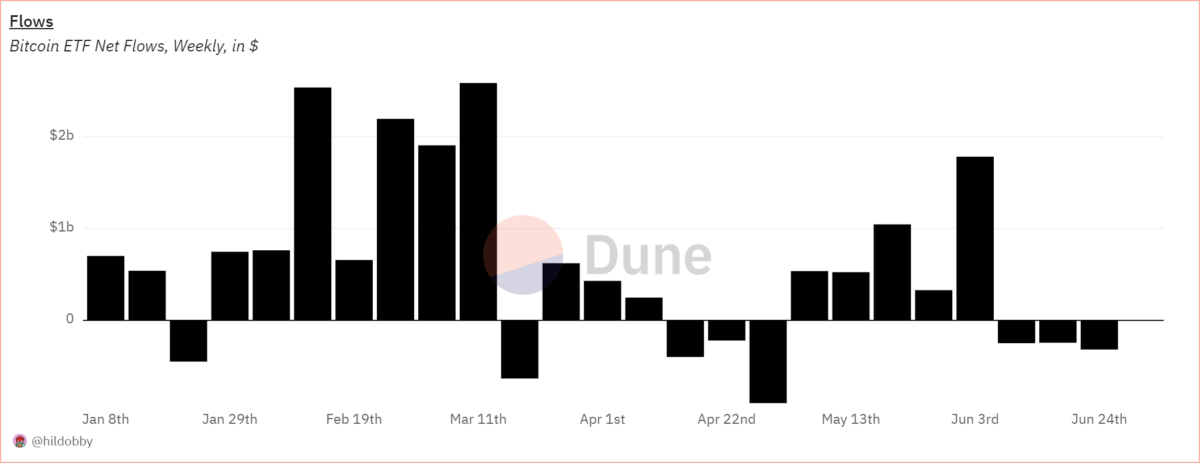

According to Dune data, the U.S. Spot Bitcoin ETF accumulated more than $701 million worth of Bitcoin in the first week of trading, which is a difficult achievement for the Ethereum Spot ETF.

However, 21Shares co-founder Ophelia Snyder still believes that the launch of the Ethereum ETF will perform well in terms of capital inflows. She told Cointelegraph:

“It’s unrealistic to think of a ‘Bitcoin ETF’ as the standard. The Ethereum ETF will be a successful ETF. It will perform much better than the average ETF. I think it will probably be in the top ten ETF listings of all time. 1/2.

However, considering that the inflow of funds when the Bitcoin ETF was launched far exceeded normal levels, Ophelia Snyder also reminded investors to adjust their expectations.