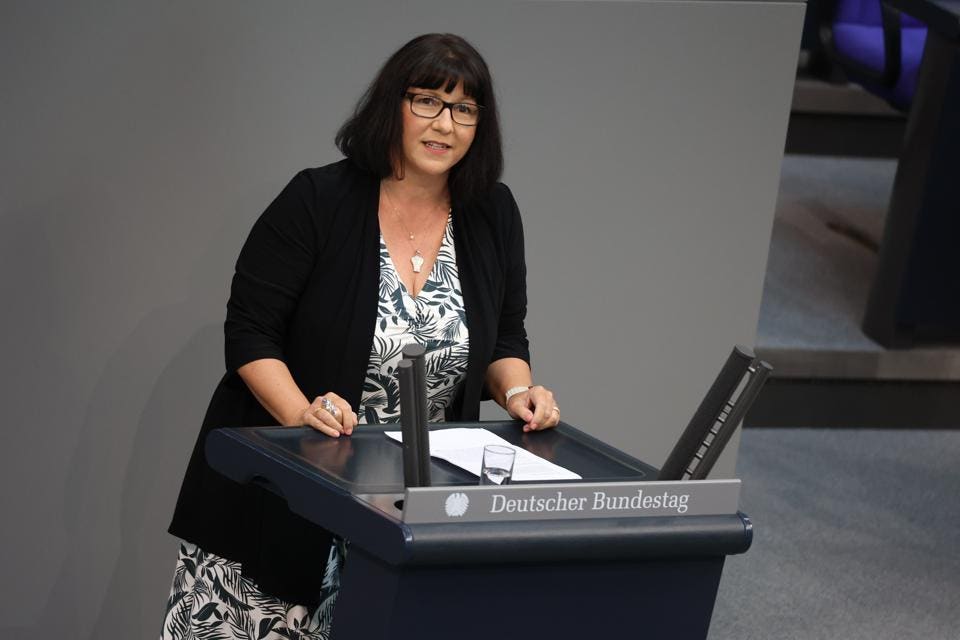

Berlin, April 27, 2023: Joanna Cotard (independent) speaks at the 100th German Congress.....

Image credit: dpa/photo alliance, GETTY IMAGES

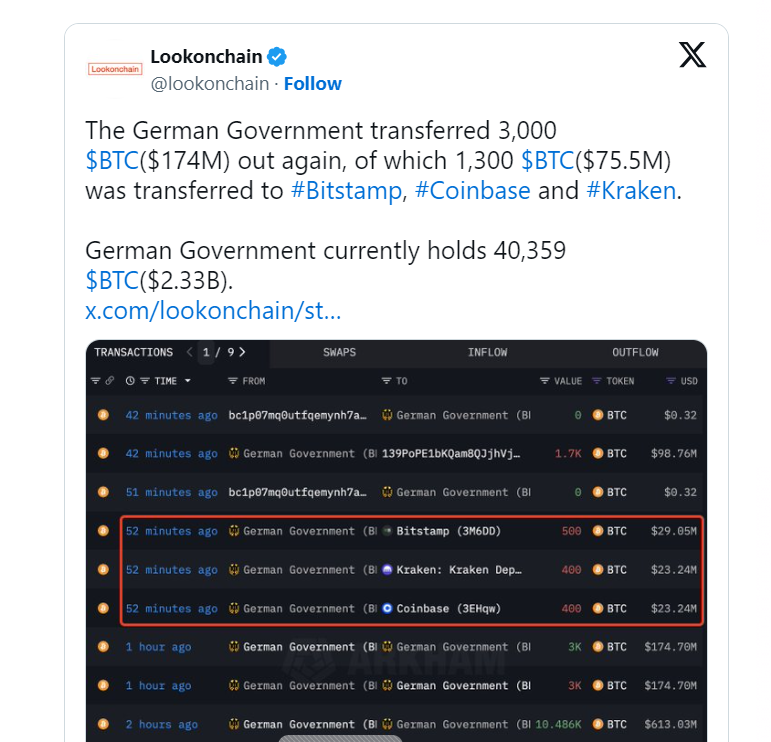

The German government recently stepped up its Bitcoin sales, moving around $75 million to exchanges like Coinbase, Kraken, and Bitstamp.

This is part of a larger strategy that has seen $315 million in Bitcoin sold since mid-June, with total sales exceeding $390 million in less than a month. The German Federal Criminal Police continues to sell Bitcoin, suggesting they may be planning to liquidate some of their reserves. Despite market concerns, the amount transferred represents only a small fraction of Germany's holdings, with 40,359 Bitcoins still in reserve.

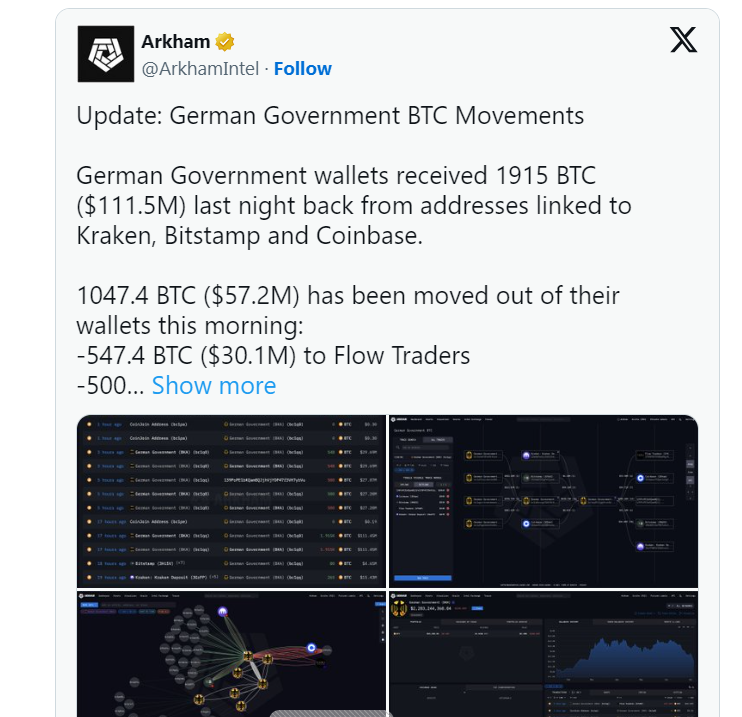

However, the German government recently unexpectedly withdrew 1,915 Bitcoins worth $111.5 million, a reversal from its massive Bitcoin sales that roiled the market in the weeks before. This has raised more questions and suspicions.

The strategy mirrors the U.S. government’s recent sale of confiscated bitcoin, raising concerns about the impact on the market, especially as repayments to Mt. Gox creditors loom.

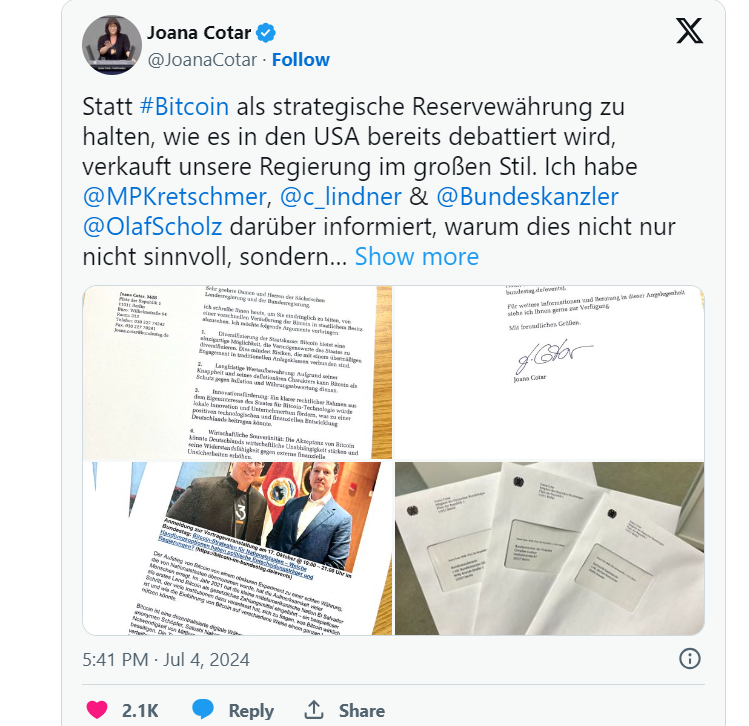

Independent MP Joanna Cotard expressed frustration and concern about the lack of a coherent strategy. "I can only speculate on the reasons why the government is selling shares now," she told Forbes. "Germany is currently facing a severe budget shortfall, which could be one reason. The upcoming elections may also play a role," Cotard noted. She stressed that the government was apparently clueless about the potential impact of its actions, adding: "I am not at all sure that the government is aware of the consequences of its sale of shares. The government also seems to be unaware that this sale will not necessarily be conducted through the stock exchange, but rather through over-the-counter transactions ."

Cotard urged a strategic approach, highlighting the missed opportunities. “I am concerned that the government has no strategy at all on how to deal with Bitcoin. That is why I called for such a strategy in my letter to the government. We need to diversify our fiscal position and eventually consider Bitcoin as a strategic reserve currency and hold it,” she said.

While Germany is selling Bitcoin, Wall Street is taking the opportunity to buy the dip. “It’s frustrating to see such a great opportunity wasted by politicians who have no clue about this,” Cotard reflected.

The German government’s ongoing Bitcoin sales are being closely watched, with analysts predicting volatility in the market in the short term. The strategic impact of these actions on Germany’s financial future and the wider cryptocurrency market remains a key area of debate.

As the situation develops, the Bitcoin market will watch how these large-scale government sales affect it and whether other countries will adopt similar strategies. Germany's Bitcoin sales highlight the need for a clear strategy to manage digital assets, balancing current financial needs and long-term opportunities.

Several other countries also hold large amounts of Bitcoin. As of 2024, the United States tops the list, followed by China and the United Kingdom.

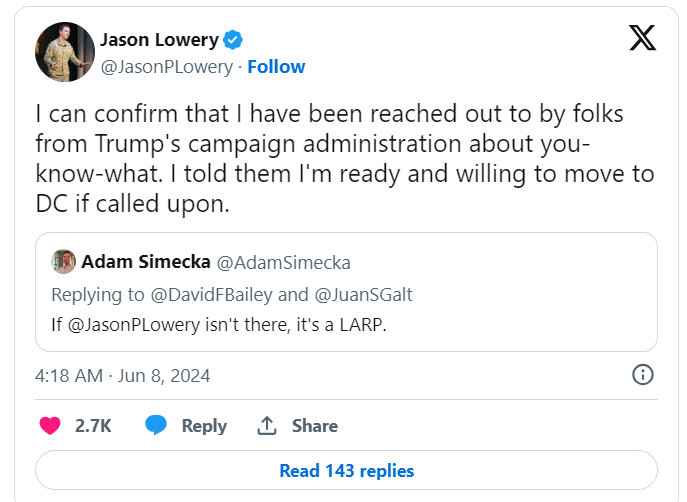

There are signs that countries such as the United States are taking advice on how to strategically integrate Bitcoin into national security and economic policy.

While the world watches Germany’s evolving Bitcoin strategy, actions taken by other countries will continue to shape Bitcoin’s future as a strategic reserve asset. The need for a cohesive and forward-looking approach has never been more evident – and we are watching game theory in action.