Bitcoin (BTC) price reached nearly $65,000 during early trading hours on Tuesday. This notable surge reflects a significant shift in market sentiment.

For example, last week the Fear and Greed Index was 27 Fear, but now it has jumped to 65 Greed.

Why did Bitcoin price recover?

The recent rise is coupled with strategic market activity. For example, today the Japanese company Metaplanet announced that it had purchased 21.877 BTC, worth about $1.2 million.

With this acquisition, Metaplanet's total Bitcoin holdings increased to 225.611 BTC, or approximately $14.17 million. Additionally , Metaplanet recently issued $6.2 million worth of bonds to increase its Bitcoin holdings. The bond matures on June 25, 2025 with an interest rate of 0.5% per annum.

Read more: Who will own the most Bitcoin in 2024 ?

Analysts at 10X Market have pinpointed several reasons for Bitcoin price fluctuations. They noted that Bitcoin's value can change quickly depending on new information.

Since last Friday, Bitcoin has risen 10%, breaking away from an oversold rally and making a clear break from the downtrend. The sentiment shifted from bearish to bullish after the price broke the key price level of $61,133.

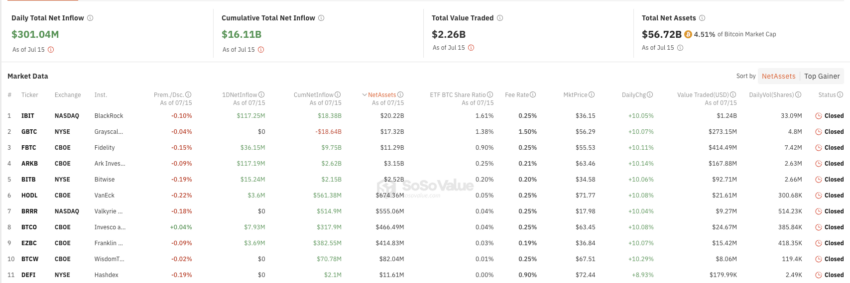

A major factor contributing to Bitcoin’s strength is significant market inflows. After four weeks of total net outflows of $8 billion, last week saw $3.3 billion in inflows, led by futures, stablecoins, and Bitcoin spot ETFs. In particular, Tether showed a positive trend by issuing $1 billion USDT.

Additionally, Bitcoin spot ETFs such as BlackRock's iShares Bitcoin Trust and Arc 21 Shares Bitcoin ETF experienced significant inflows, with each receiving more than $117 million on Monday. This suggests strong retail interest that appears to be more sustained than before.

External support and speculative activity also fueled the market. BlackRock CEO Larry Fink recently expressed an optimistic outlook on Bitcoin, greatly increasing investor confidence. Also adding to the positive mood is the news that the Ethereum ETF is likely to be launched on July 23 if approved.

Rumors that regulations on cryptocurrency will be eased in China and news that Korea's cryptocurrency taxation, which was postponed to 2028, will be postponed are also further stimulating the market. Both can further stimulate trading activity.

The political situation also affected market sentiment, with Donald Trump's chances of winning the presidential election increasing after the assassination attempt .

Avinash Shekhar, co-founder of cryptocurrency derivatives trading platform Pi42, agrees with 10X Market’s analysis.

“Bitcoin price surpassed $63,000 for the first time in two weeks thanks to recent market conditions. As altcoins followed Bitcoin's upward trend, the overall cryptocurrency market capitalization recovered to $2.4 trillion. The weekend saw further gains on the back of the failed assassination attempt on pro-cryptocurrency US presidential candidate Donald Trump,” Shekhar told BeInCrypto.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

In this situation, some believe that Bitcoin price has bottomed. However, Bitcoin, which hit $65,000 this morning, is moving around $63,000 as of this writing.

“Bitcoin has completed its correction. It was the deepest correction this cycle at -25.6% and the third longest correction at 42 days,” said Rect Capital.