The research team at cryptocurrency research firm Kaiko believes that Ethereum (ETH) price performance may outperform Bitcoin (BTC) following the launch of an Ethereum spot exchange-traded fund (ETF).

Kaiko said in a report released on Tuesday (15th) that since the U.S. Securities and Exchange Commission (SEC) approved the 19b-4 filing for the Ethereum Spot ETF in May this year, the sentiment of the cryptocurrency market has changed significantly, although ETH fell by about 20% in the next nearly two months, but this retracement does not tell the whole story. In essence, the market seems to be ready for the launch of spot ETFs.

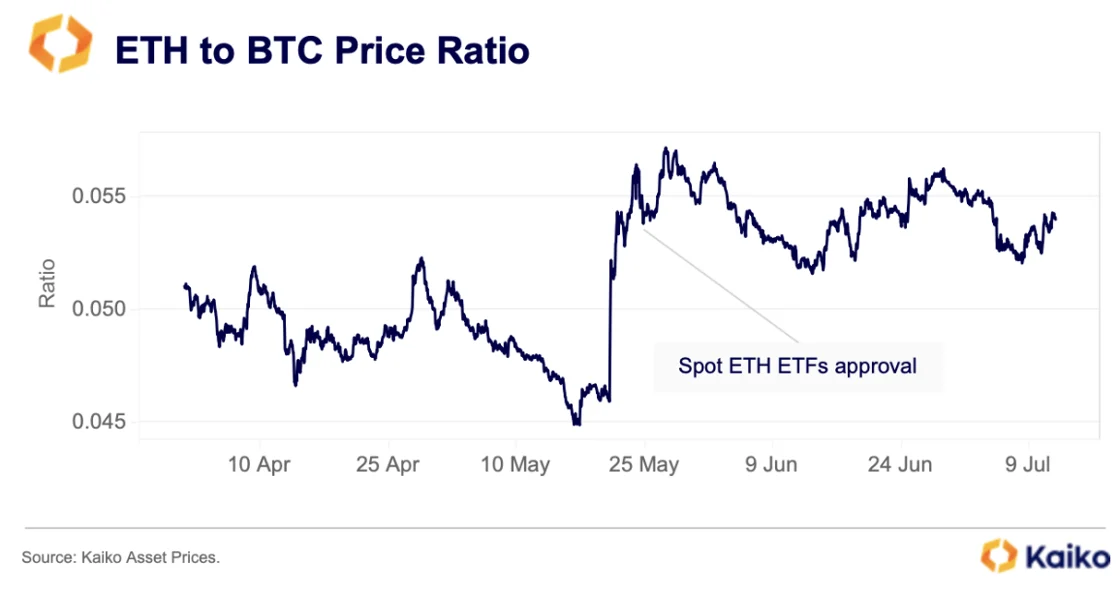

Kaiko explained that the ETH/BTC ratio, which measures the relative performance of Bitcoin and Ethereum, remains around 0.05, which is significantly higher than the level of nearly 0.045 before the ETF’s key application documents were approved. The higher ratio indicates that after the ETF’s launch, Ethereum’s The price performance of Bitcoin is likely to continue to outperform that of Bitcoin.

However, Andrew Kang, founder and partner of cryptocurrency venture capital firm Mechanism Capital, holds a different view . He said on the X platform that he believes the ETH/BTC ratio will continue to fall after the ETF is approved or launched.

According to "CoinDesk" citing people familiar with the matter, potential issuers of Ethereum spot ETFs were informed by the SEC on Monday that these funds can start trading next Tuesday (23rd).

Table of contents

ToggleETF launch may improve Ethereum’s market liquidity

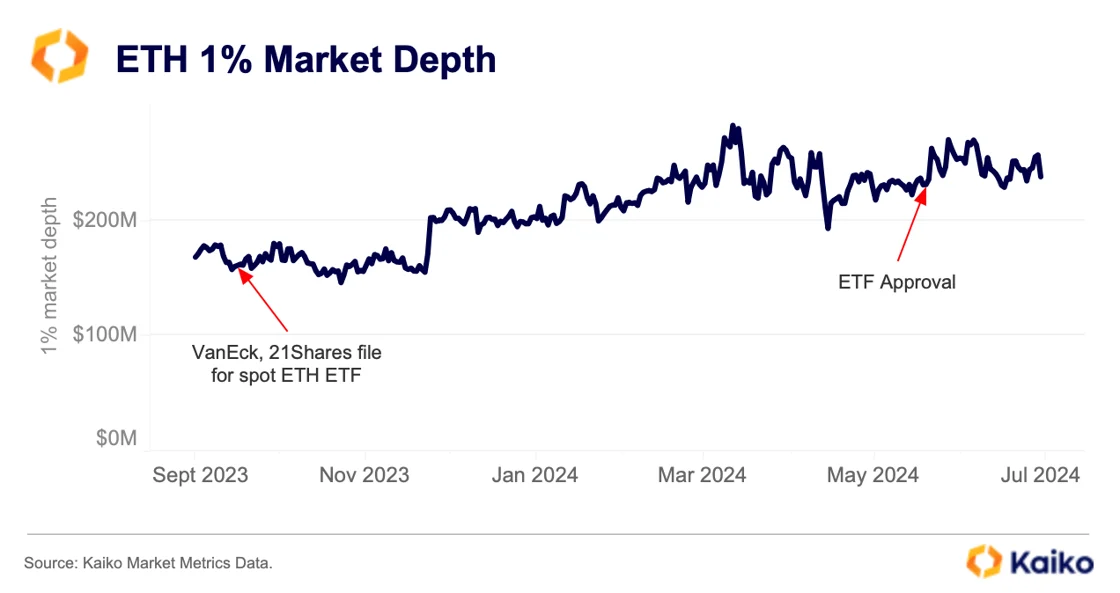

Kaiko’s research team noted that Ethereum’s liquidity conditions have generally remained stable, although trading volumes are typically sluggish during the summer. Since the approval of the ETF’s 19b-4 filing, Ethereum’s 1% market depth has continued to remain around $230 million. Although the value fell below $200 million in early May, the downward trend was reversed after the document was approved.

Kaiko believes that the Ethereum spot ETF may further improve the liquidity conditions of Ethereum, just like what happened with Bitcoin after the spot ETF was launched in January.

Ethereum hedging activity increases

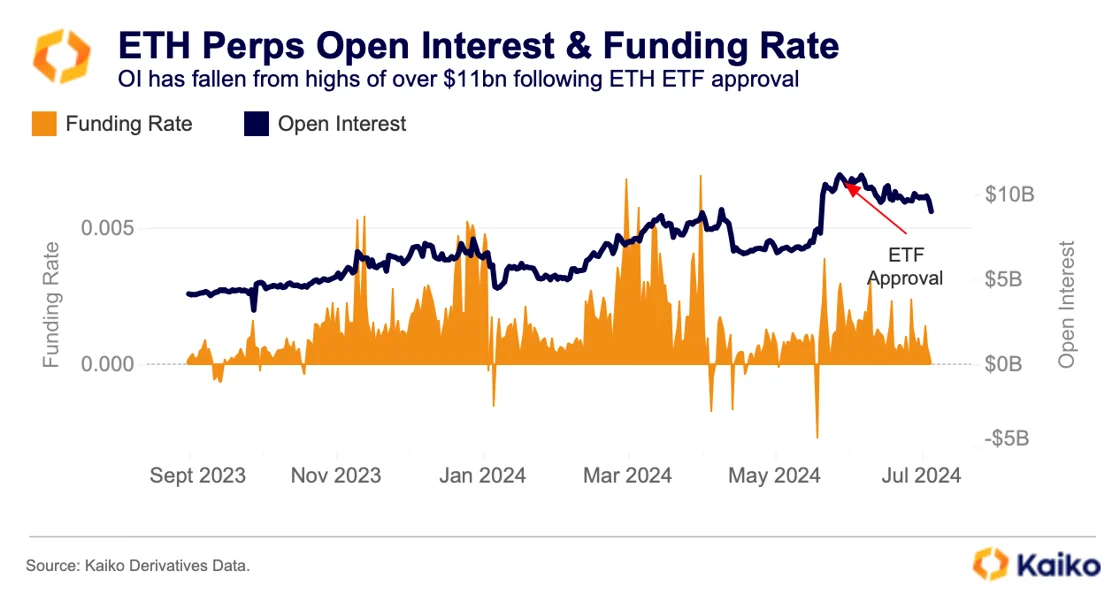

Kaiko’s report also noted that the Ethereum spot market has generally remained resilient during the 20% price drop, but the perpetual futures market has cooled faster and funding rates have halved since May, indicating weakening trader confidence. , because they are less willing to pay high funding rates to maintain long positions.

Additionally, Ethereum’s open interest (OI) also fell from its post-approval high of around $11 billion. The Kaiko research team said the decline in funding rates and open interest may be related to uncertainty about the timing of ETF launches.

However, Kaiko mentioned that the implied volatility (IV) of Ethereum options contracts has increased significantly in the past week, with the largest changes in ETH options expiring on July 19 and 26 on the cryptocurrency options exchange Deribit. Kaiko said the increase in implied volatility on the July 19 contract showed traders were willing to pay more to hedge existing positions and protect against large price swings in the short term. This short-term surge in contract IV shows some uncertainty among traders.