In the second quarter of 2024, the cryptocurrency market saw a subtle mix of new stories and significant price movements. The overall cryptocurrency market cap fell 14.4% to close at $2.43 trillion, but several sectors stood out, including meme coins, real assets (RWA), artificial intelligence (AI), and decentralized physical infrastructure networks (DePin).

Despite the Bitcoin halving, market performance was poor in the second quarter of 2024. Only a few sectors showed gains.

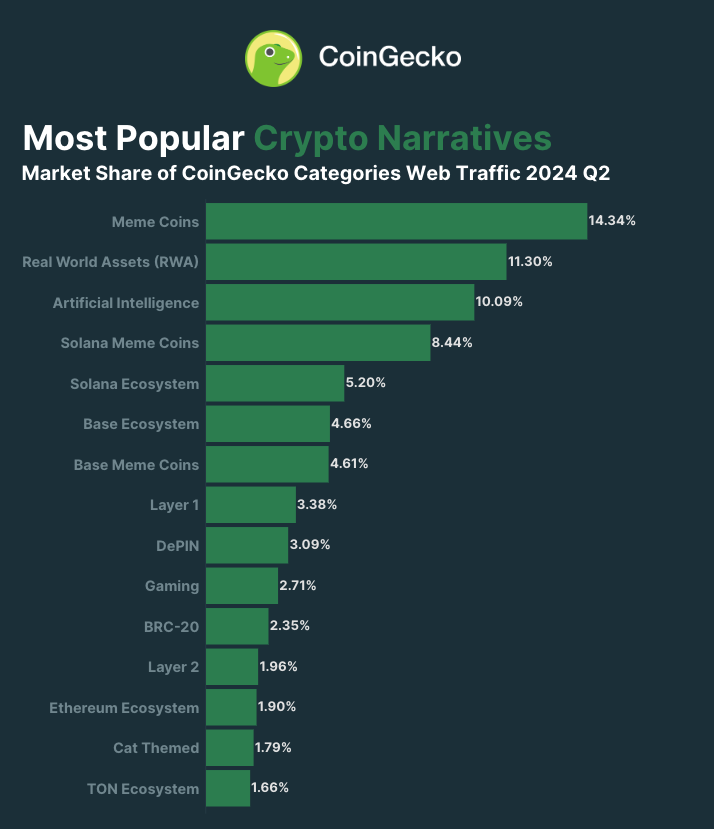

Major Cryptocurrency Narratives for Q2 2024

Meme coins continued to capture market attention , with narratives centered around the ‘cat-themed’ token making it into the top 15 cryptocurrency narratives. Four out of the 15 most discussed cryptocurrency narratives involved meme coins. In particular, blockchain ecosystems such as Solana (SOL) , Ethereum (ETH ), Base, and Tone also stood out, with Solana and Base jointly attracting 22.9% of market attention.

Read more: 7 Popular Meme Coins and Altcoins Trending in 2024

There was also great interest in integrating RWA and AI within the blockchain ecosystem. A relatively new story, DeFin has garnered attention for its ability to transform infrastructure and add innovation to blockchain applications by decentralizing physical assets.

Despite the overall market downturn, these narratives have shown resilience and growth. These changes signal a shift in investors' preferences for thematic and speculative investments. Additionally, the total annual volatility of the cryptocurrency market recorded a high figure of 48.2%, reflecting ongoing uncertainty and rapid changes in investment sentiment.

The CoinGecko report also discusses other noteworthy events in the fourth quarter of 2024. For example, the Mt. Gox custodian began moving 140,000 BTC and the German government began selling confiscated Bitcoin, which was met with a sharp reaction in the market.

Ethereum also saw inflationary changes in the second quarter, with a net increase of 120,818 ETH in circulating supply. This is a significant reversal from the previous deflationary trend, driven by a 66.7% decline in burn rates as network activity slowed.

Cryptocurrency exchanges showed different trends. Centralized exchanges (CEXs) such as Binance and Bybit have experienced varying fates.

Binance's market share reached 45% despite declining trading volume. Bybit's market share, on the other hand, increased to 12.6%. Decentralized exchanges (DEXs) such as Uniswap and emerging platforms Thruster and Aerodrome have seen significant increases in trading volume. They have benefited from strong meme coin trading and airdrop activity.

Read more: Best airdrops scheduled for 2024

CoinGecko co-founder Bobby Ong told BeInCrypto that the outlook for the second half of 2024 is cautiously optimistic.

“The cryptocurrency market is in a mixed situation in the second quarter and has entered a period of bottoming after the Bitcoin halving, with token airdrops in particular attracting attention. Although the outlook for the second half of 2024 is bleaker, we see positive signs, including improving macroeconomic conditions and teams continuing to build regardless of price fluctuations,” Ong told BeInCrypto.