After nearly hitting an all-time high in early 2024, the total market capitalization of cryptocurrencies partially retreated in the second quarter, falling 14.4% to close at $2.43 trillion at the end of June.

In this quarter, Bitcoin ushered in the much-anticipated fourth halving, which was successfully completed. Although each halving has opened a new era for cryptocurrencies, the market has reacted coldly this time. The US spot Bitcoin ETF market was very lively after it was approved in the first quarter, but in the second quarter, Bitcoin and the entire cryptocurrency market were quiet.

However, this does not mean that this season is without waves.

Our comprehensive Q2 2024 Cryptocurrency Industry Report covers everything from the market landscape to in-depth analysis of Bitcoin and Ethereum, an exhaustive look at the decentralized finance (DeFi) and non-fungible token (NFT) ecosystems, and a review of the performance of centralized and decentralized exchanges.

The report summarizes several key highlights, which can be found in the following 51 slides.

CoinGecko’s 2024 Q2 Cryptocurrency Industry Report:

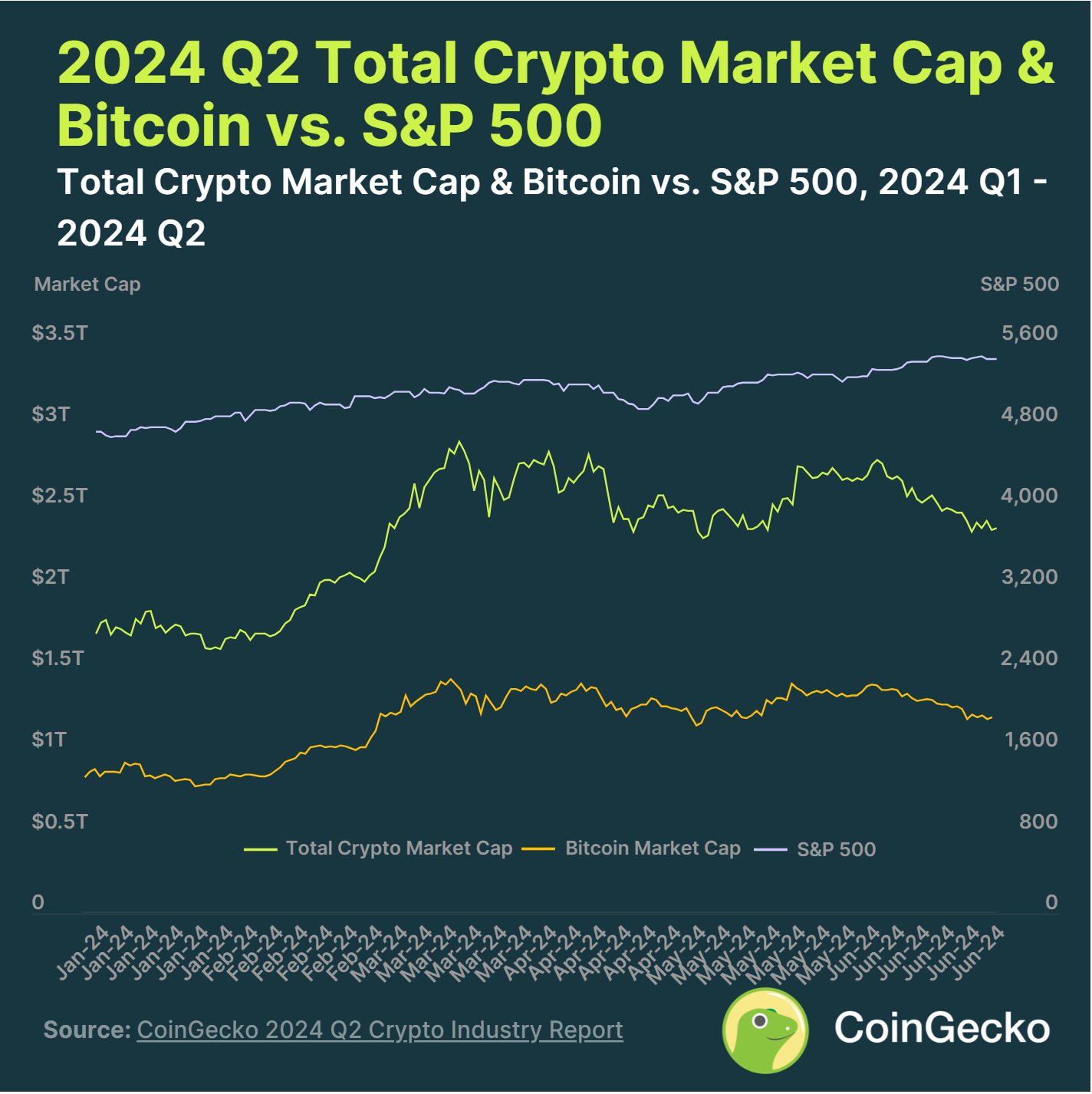

- The total market value of cryptocurrencies fell 14.4% in the second quarter of 2024, a weaker performance than the S&P 500 (which rose 3.9%).

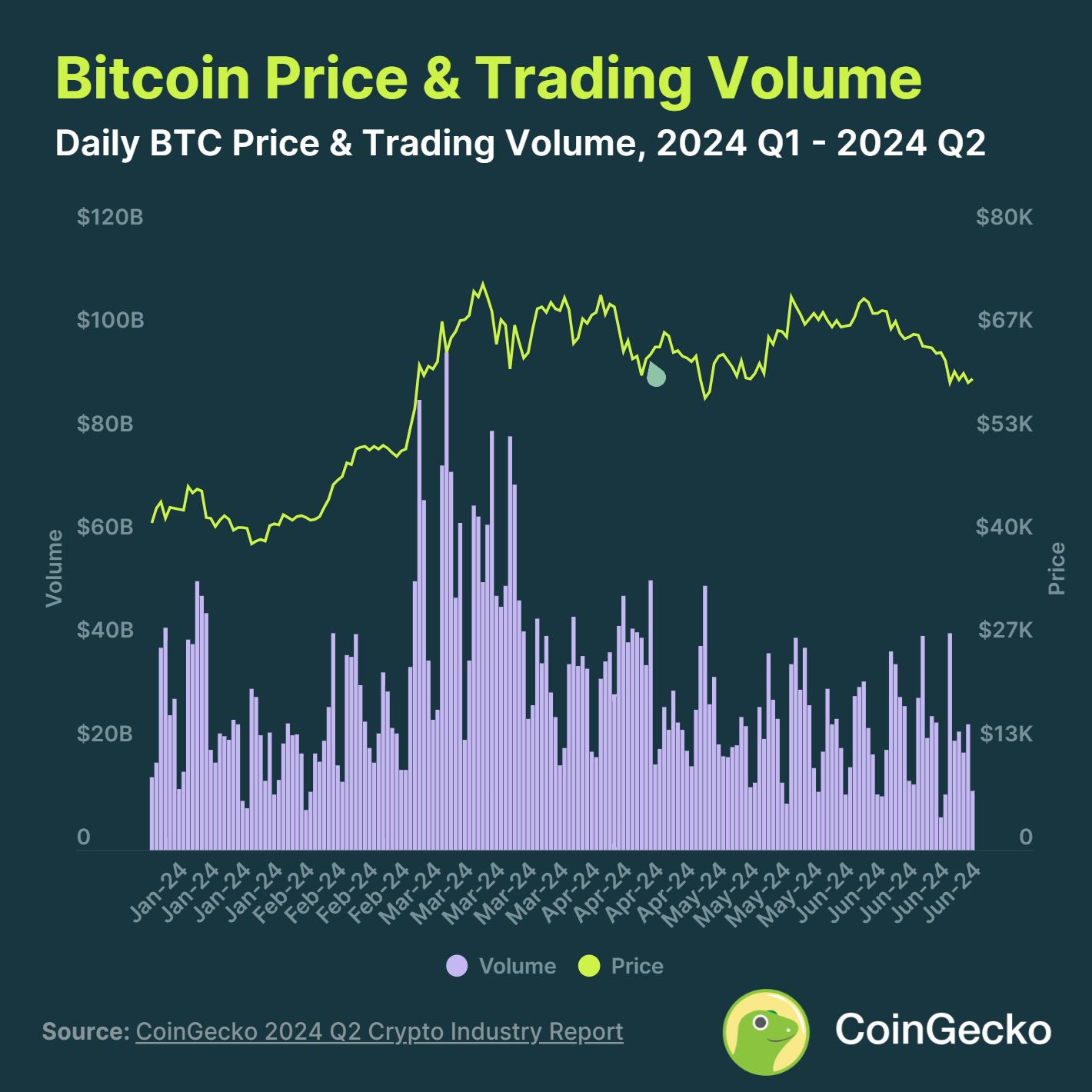

- Bitcoin is down 11.9% for the quarter, with prices ranging between $58,000 and $72,000, just shy of its all-time high of $73,000.

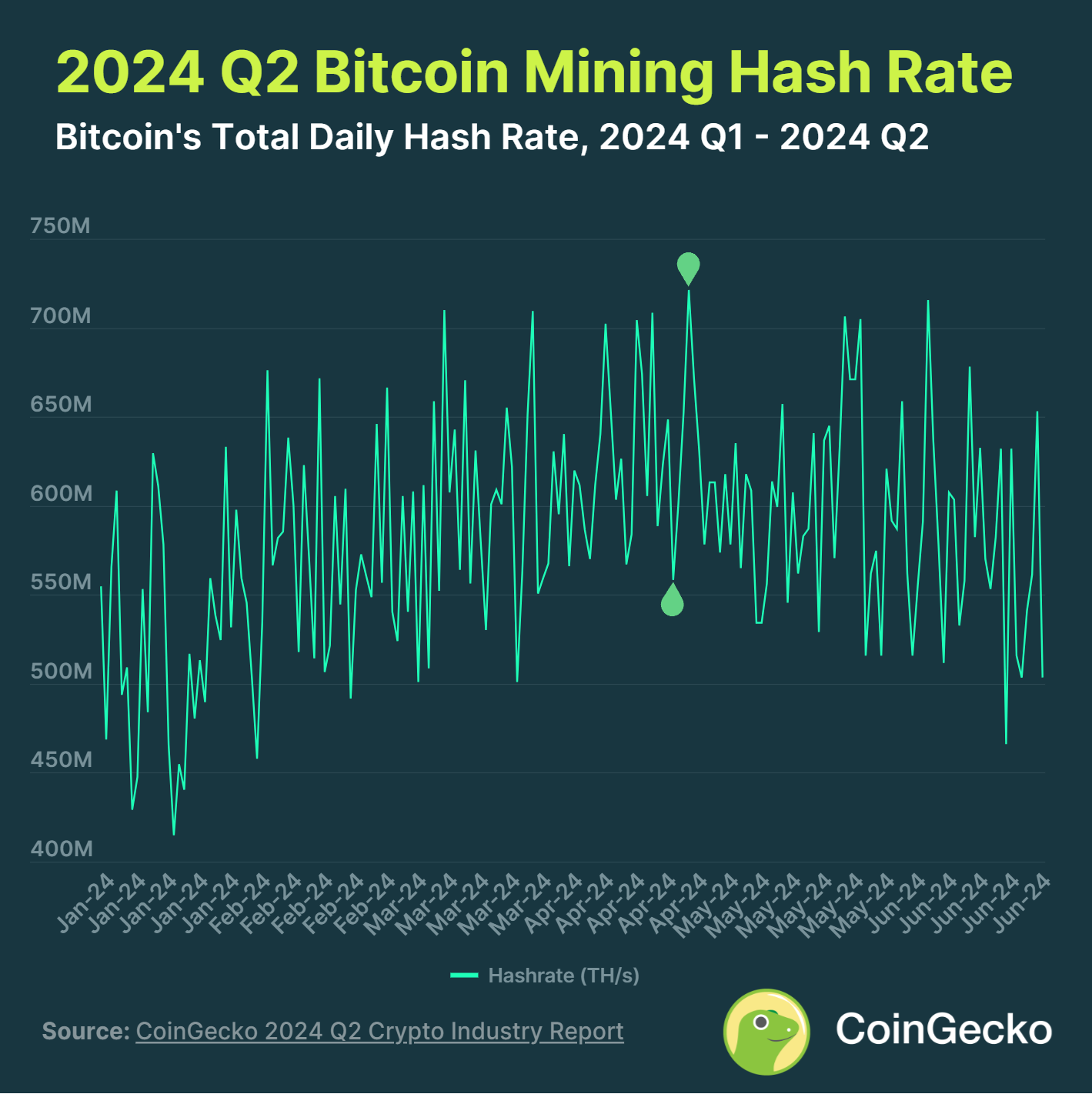

- Bitcoin’s mining hash rate fell 18.8% during the quarter, the first quarterly decline since the second quarter of 2022.

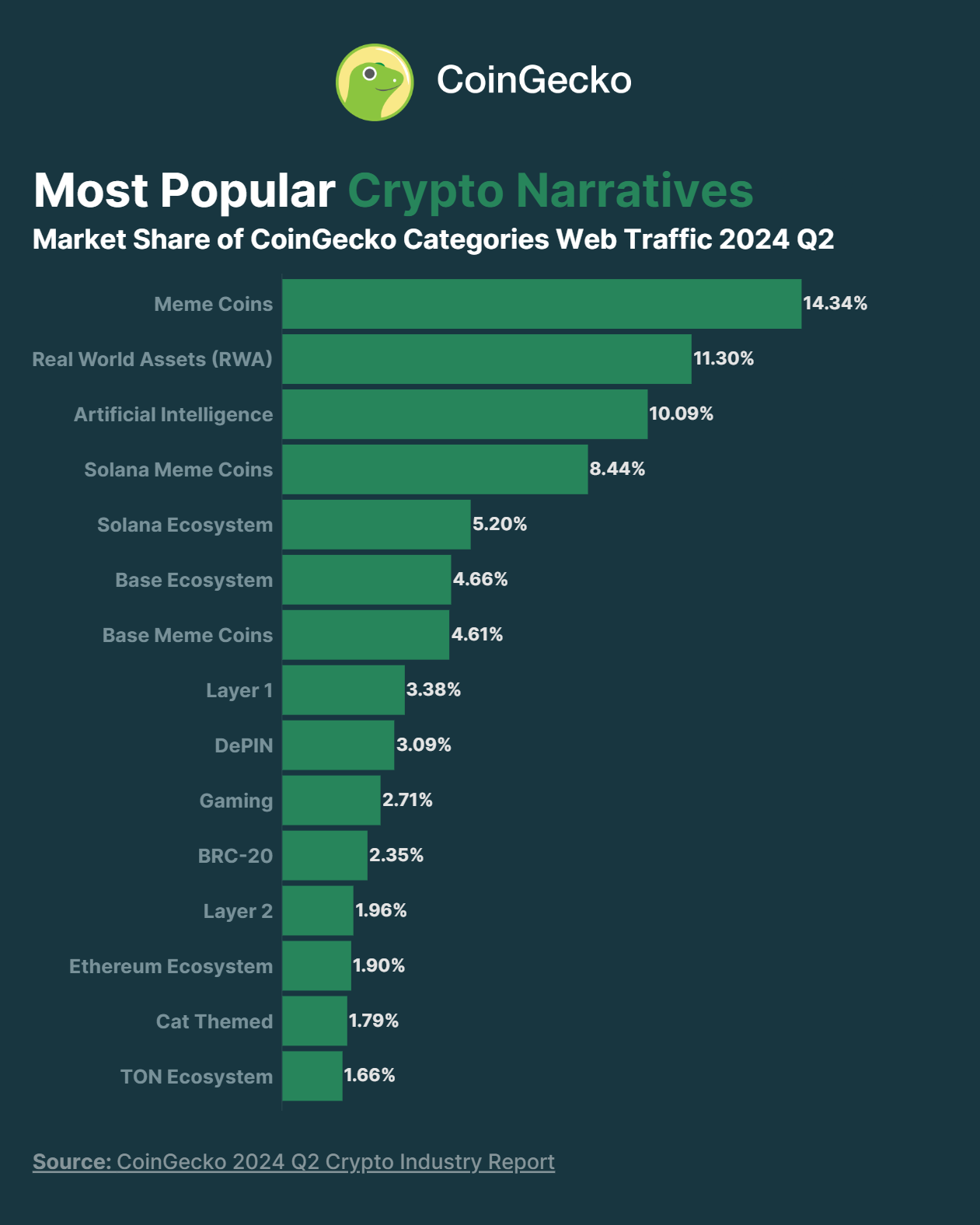

- In the second quarter of 2024, the top 15 categories on CoinGecko included “commemorative coins,” “artificial intelligence,” and “RWA,” accounting for 77.5% of web traffic.

- Ethereum’s supply increased by 120,800 ETH during the quarter as issuance exceeded destruction.

- Spot trading volume on centralized exchanges (CEXs) reached $3.40 trillion, down 12.2% from the first quarter of 2024.

- Spot trading volume on decentralized exchanges increased 15.7% to $370.70 billion, driven by a surge in commemorative and airdropped coins.

1. The total market value of cryptocurrencies fell by 14.4% in the second quarter of 2024, which was weaker than the S&P 500 (which rose by 3.9%).

The total market value of cryptocurrencies fell 14.4% to $408.8 billion during the quarter, ending the quarter at $2.43 trillion. The market fluctuated between $2.30 trillion and $2.90 trillion, failing to reach new highs.

Meanwhile, the S&P 500 climbed to a gain of 3.9% at the end of the quarter. This caused the correlation between the total cryptocurrency market capitalization and the S&P 500 to drop significantly from 0.84 in the first quarter to 0.16 in the second quarter.

The volatility of cryptocurrencies remains high, with an annualized volatility of 48.2% for the total market capitalization and 46.7% for Bitcoin. In comparison, the volatility of the S&P 500 is only 12.7%, nearly four times lower.

2. Bitcoin closed at $62,734 in the second quarter of 2024, down 11.9%.

After hitting an all-time high of $73,098 in mid-March, Bitcoin has been fluctuating between $58,000 and $72,000. Despite the fourth halving, this has not had a significant impact on the price.

Bitcoin trading volume also declined throughout the quarter, with the average daily trading volume reaching US$26.6 billion, a decrease of 21.6% from the previous quarter.

At the end of the quarter, the market was shocked to learn that Mt Gox had begun moving its 140,000 bitcoin stash, while the German government also began selling its seized bitcoins.

3. Bitcoin mining hash rate hits record high and then falls back to -18.8%

On April 23, 2024, the total hash rate of Bitcoin mining reached an all-time high of 721 million TH/s, and then fell 18.8% in the second quarter. This is the first time that the Bitcoin hash rate has fallen since the second quarter of 2022.

Although the mining hash rate has fallen, the related industry is still developing rapidly. Companies such as BitDigital, Hive, Hut 8, Terawulf and Core Scientific have entered or are considering entering the field of artificial intelligence. At the same time, Tether announced that it will invest $500 million in mining business, and Block successfully developed a 3nm mining chip.

4. In the second quarter of 2024, "commemorative coins" became the most popular narrative, accounting for 14.3% of the market share

In the second quarter of 2024, commemorative coins, real world assets (RWA) and artificial intelligence (AI) became the most popular content in the market, accounting for 35.7% of the market share. This is similar to the trend in the first quarter.

In the ranking of cryptocurrency narratives, commemorative coins dominated with their significant influence, and the four related narratives ranked among the top 15 most popular. In addition, among the 49 blockchain ecosystems, Solana, Ethereum, Base, and TON all entered the top 15. Among them, Solana and Base became the most popular ecosystems with a market attention share of 22.9%.

5. Ethereum turns to inflation mode, and the circulating supply increases by 120,000 ETH

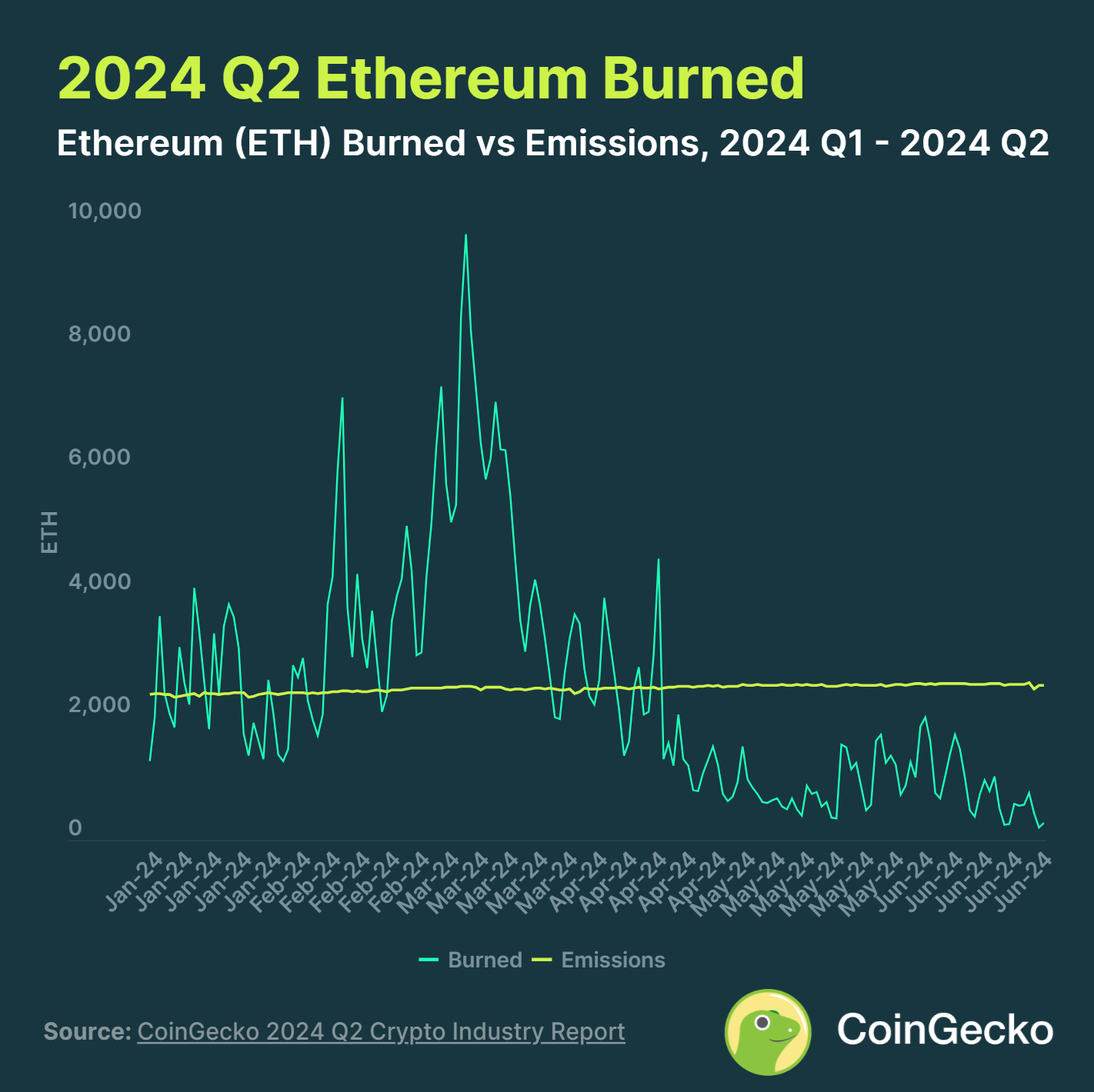

In the second quarter of 2024, although 107,725 ETH were destroyed, 228,543 ETH were newly released, resulting in Ethereum inflation, with the total supply increasing by 120,818 ETH. Due to the slowdown in network activity and the reduction in gas fees, the consumption rate of ETH decreased by 66.7% from the previous quarter.

Throughout the second quarter, there were only 7 days when ETH destruction exceeded its issuance, a significant decrease from 66 days in the first quarter. ETH transfer operations were the main contributor to the destruction, with a total of 6,838 ETH destroyed in the second quarter.

6. In the second quarter of 2024, the spot trading volume of centralized exchanges reached 3.40 trillion US dollars, a decrease of 12.2% from the previous quarter.

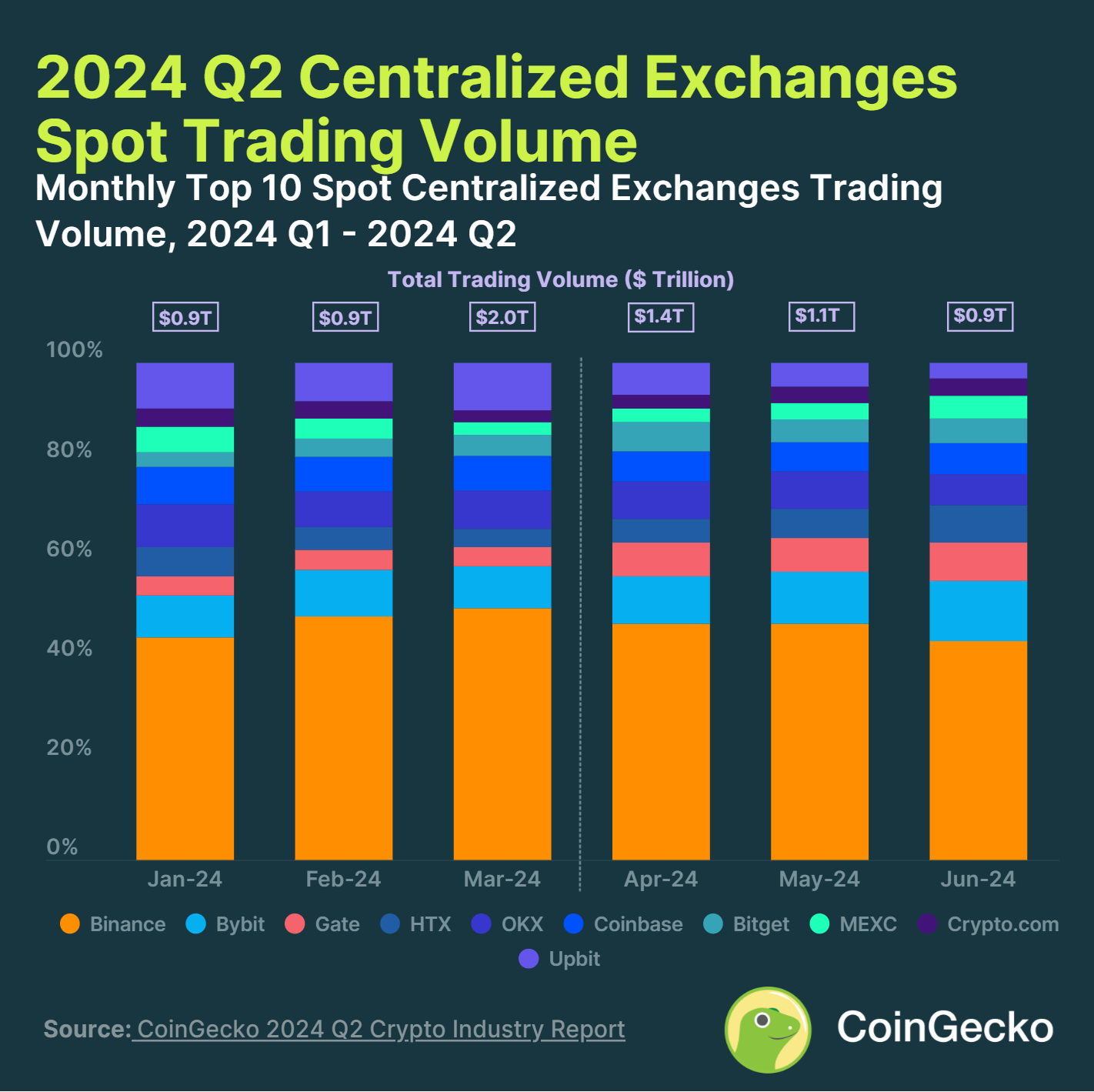

In Q2 2024, the spot trading volume of the top ten centralized exchanges (CEXs) reached $3.40 trillion, showing a 12.2% quarter-on-quarter decline, in line with the trend of the overall cryptocurrency market.

Despite the decrease in trading volume, Binance remains the CEX with the largest market share, reaching 45% as of June 2024. Meanwhile, Bybit surpassed Upbit in the second quarter to become the second largest spot CEX, with its market share increasing to 12.6%.

Among the top 10 spot CEXs, only 4 saw an increase in trading volume, with Gate seeing the most significant growth, reaching 51.1% ($85.2 billion), Bitget and HTX increasing by 15.4% ($24.7 billion) and 13.7% ($25.5 billion), respectively. During this period, these exchanges also saw a significant increase in the number of new listings and project launches.

7. The transaction volume of decentralized exchanges reached US$370.7 billion, a month-on-month increase of 15.7%

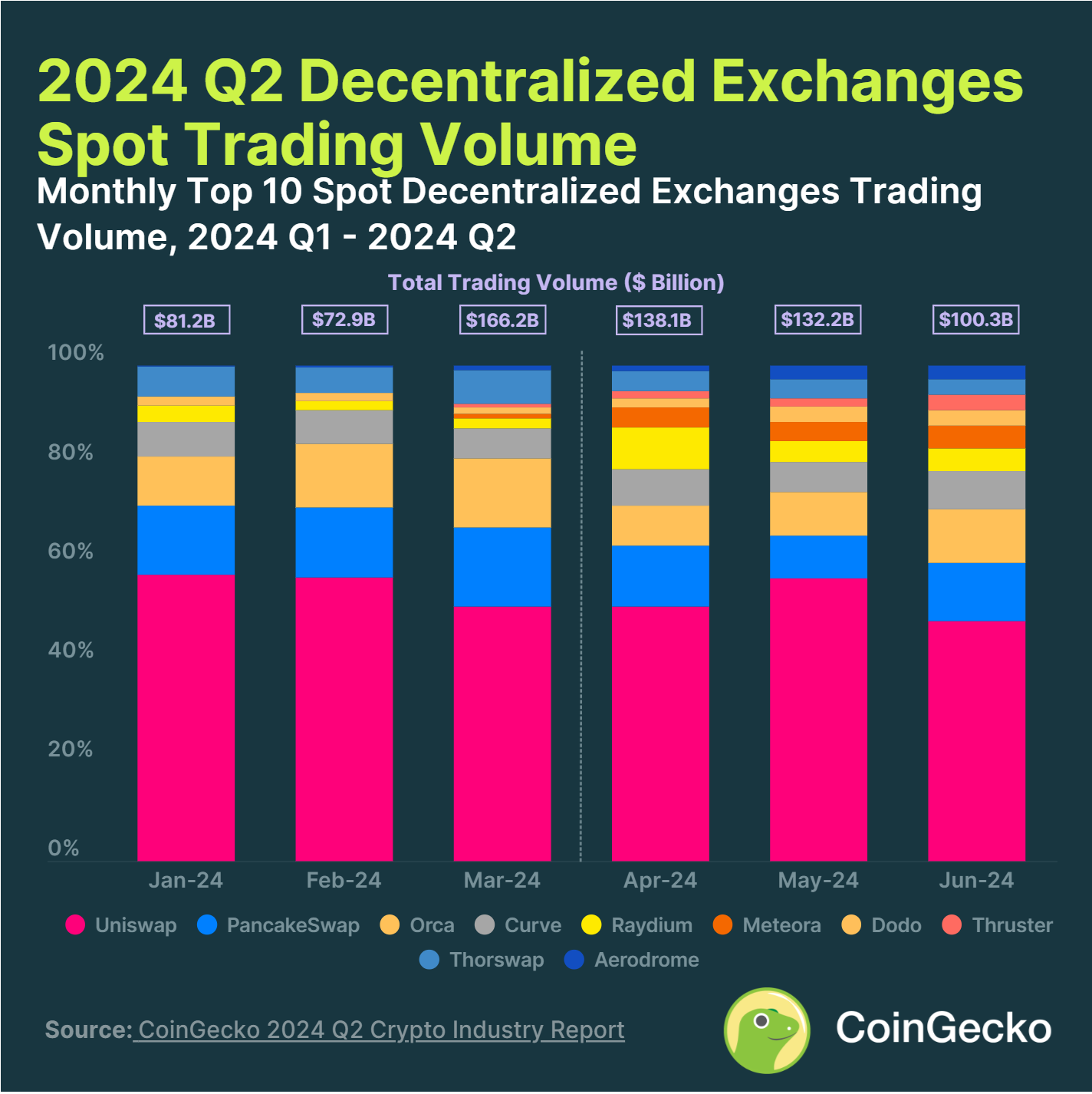

In the second quarter of 2024, the spot trading volume of the top ten decentralized exchanges (DEX) reached US$370.7 billion, a quarter-on-quarter increase of 15.7%, thanks to a surge in popular currencies and multiple airdrop activities throughout the quarter.

Uniswap continues to maintain its dominance, with a market share of 48% as of June 2024. However, among the top ten DEXs, companies such as Thruster and Aerodrome present a challenging situation. Thruster, a native product of Blasts, saw its trading volume increase by 464.4% month-on-month (to $6 billion), and its market share reached 3% at the end of June. Thruster benefited from Blasts point farming, while Aerodrome benefited from the surge in Meme coin trading volume on Base, which increased by 297.4% (to $5.9 billion) and also had a market share of 3%.