1/N BTC will not rebound to the previous high

Please think about what the general environment was like when BTC reached its two previous ATHs?

1) Strong and sustained ETF buying, real money (Figure 1)

2) Liquidity of the peak version (February to the end of March) (Figure 2)

3) The market's excessive expectations for interest rate cuts reached around 180bp at the beginning of the year (Figure 3)

What is the current environment? You will find that even one of these conditions is not met right now. Let's dive in.

2/N

Regarding ETF buying, please refer to Figure 1. In fact, the "marginal purchasing power" is much lower than at the beginning of the year. How to understand? If buying is regarded as speed, then marginal purchasing power is acceleration.

Acceleration is actually an important concept in finance. For example, at the end of 2021, the US M2 and BTC peaked at the same time, but you will find that M2 still has a higher year-on-year growth afterwards, but the entire market has collapsed. One of the core logics is that M2 has already declined marginally.

3/N

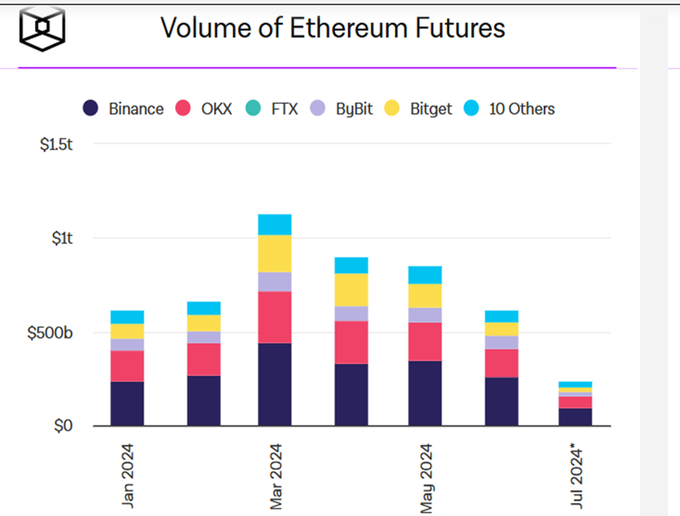

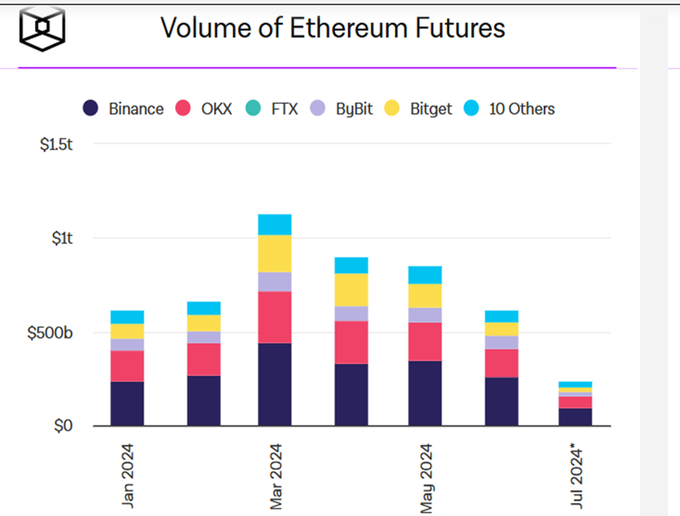

For liquidity, please refer to Figure 2 and some of the following figures, including the overall OI and trading volume of BTC contracts, the overall OI and trading volume of ETH contracts, etc.

If you want to explore more data about liquidity, you can even monitor the bid/ask spread of each token, as well as the thickness of the +2%... price, etc.

In fact, they all point in one direction: the peak liquidity has passed.

3/N

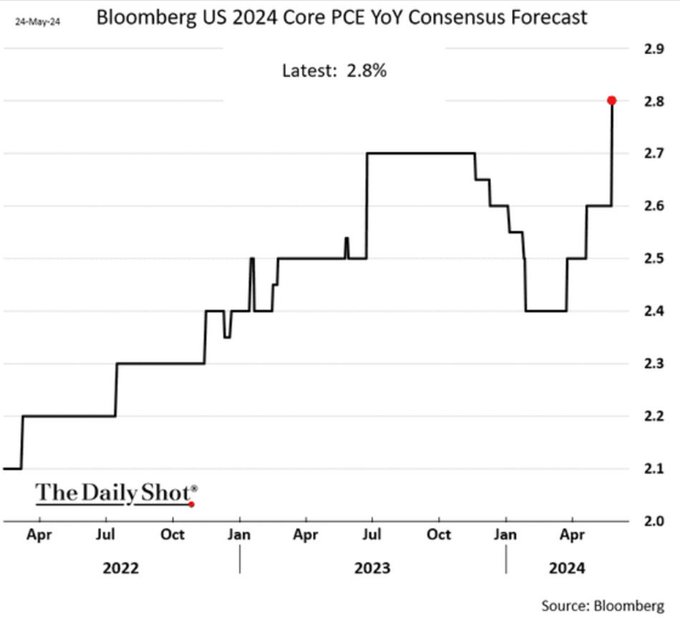

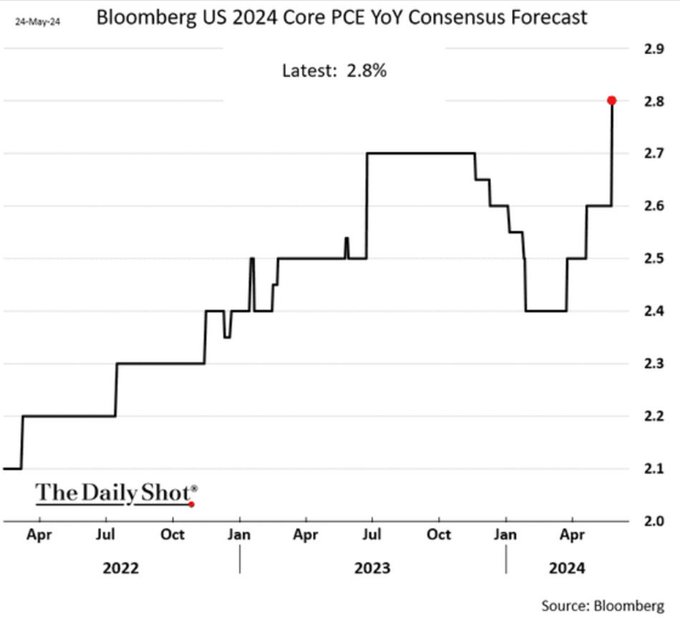

In response to the rate cut, after the CPI, the market priced in 60+bp (Figure 1 below). This is a far cry from the peak at the beginning of the year, when it was close to 180bp.

The market also continues to believe that the neutral interest rate is rising (Figure 2), currently around 3.7%: the Fed does not have much room to cut interest rates.

The neutral interest rate can be understood as PCE + GDP. Based on PCE and GDP expectations (Figures 3 and 4), it is almost impossible to reduce it to 3.7%. Even if it really drops to 3.7, it is far lower than 180 at the beginning of the year.

4/N

Based on this, we are currently facing a market with a ceiling.

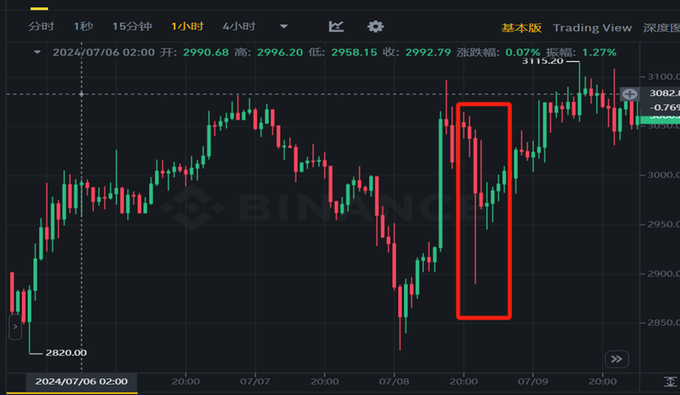

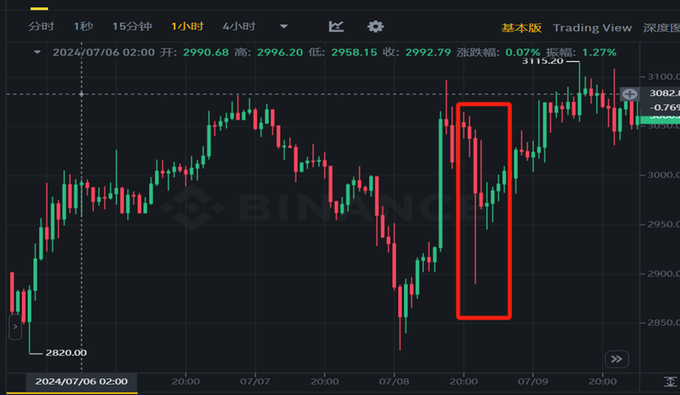

But at the same time, there may be a bottom, which mainly comes from: 1) During the German government's selling period, the market showed long-lost resilience: it was able to quickly recover lost ground after the spike. The last time it appeared was in March (Figure 1&2).

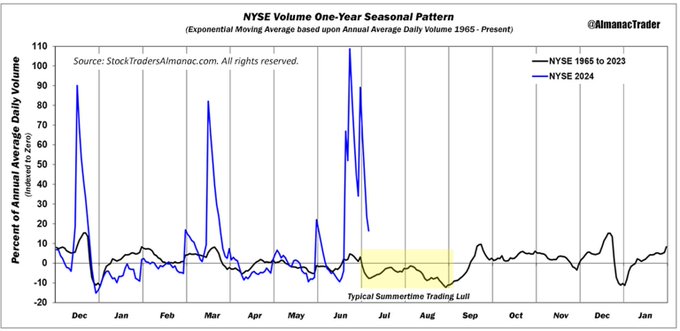

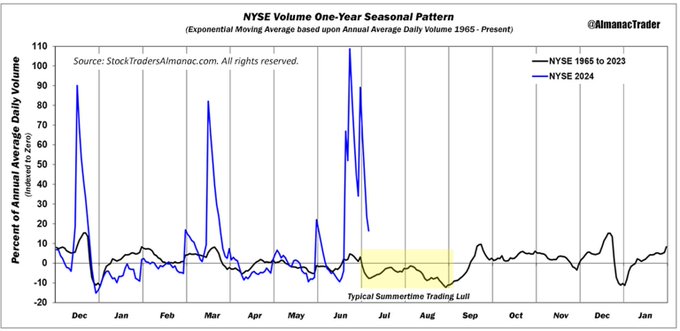

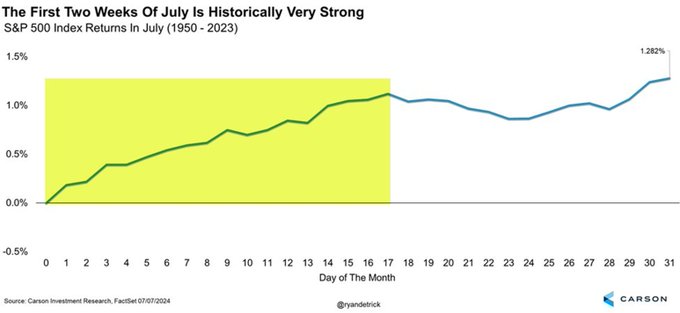

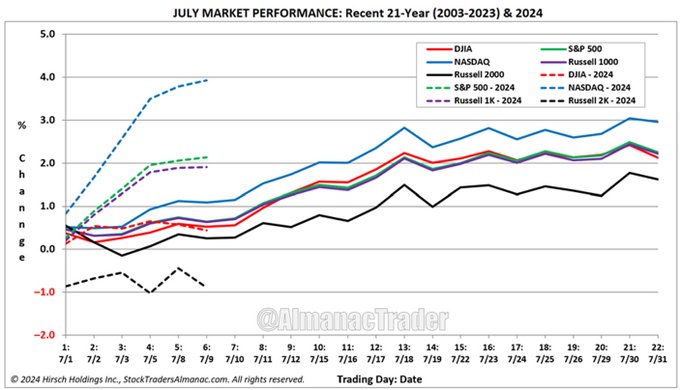

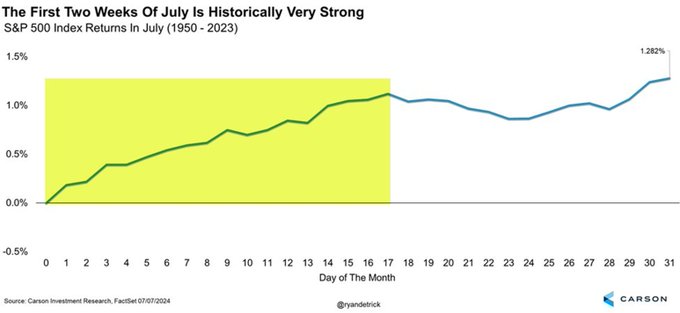

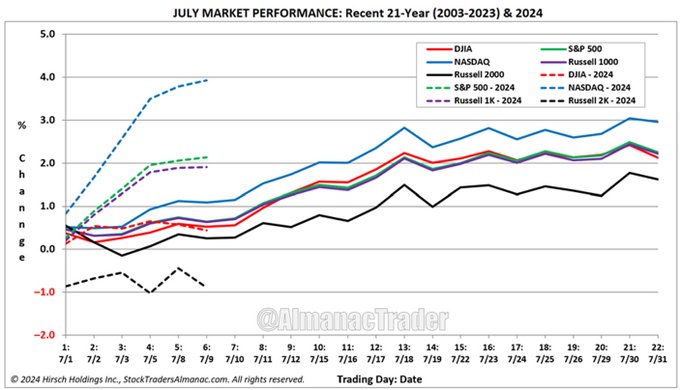

2) July has always been a strong season for the U.S. stock market (Figures 3 & 4), based on the current correlation between the crypto market and the U.S. stock market.

5/N

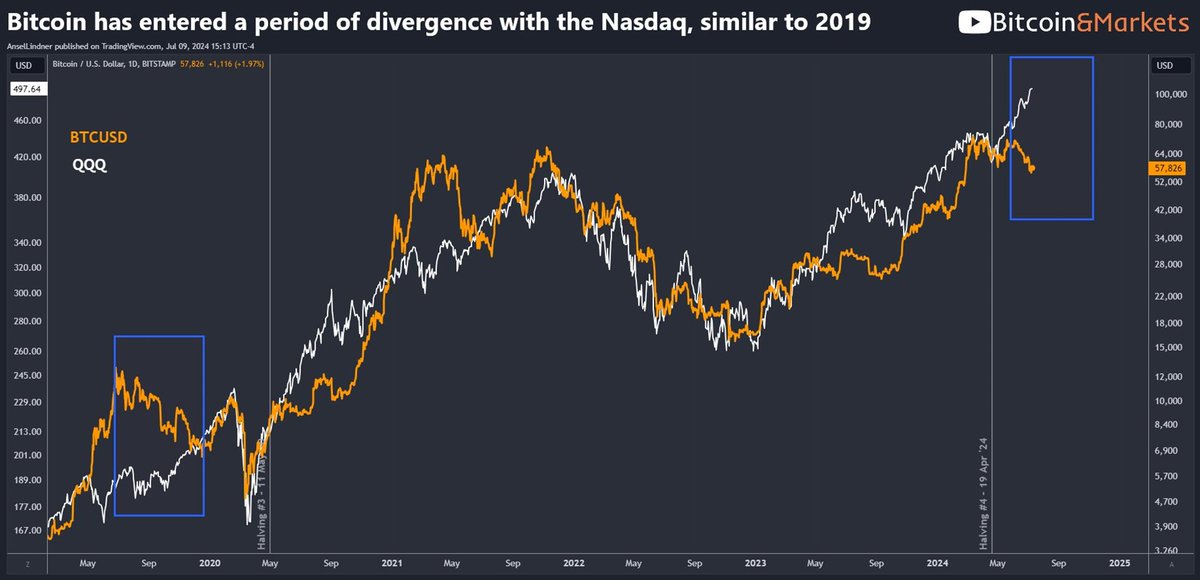

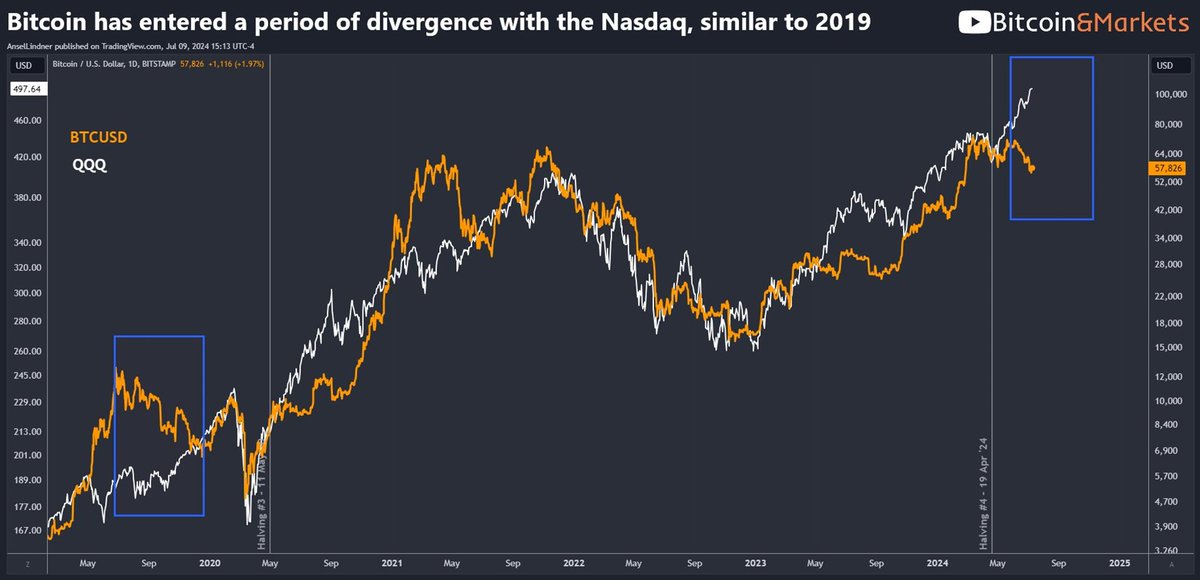

That is, after May 2023, once the crypto enters the garbage period, it will follow the decline of the U.S. stock market instead of the rise (Figure 1). The current strength of the U.S. stock market may not drive the crypto, but at least it can drag down the "bottom".

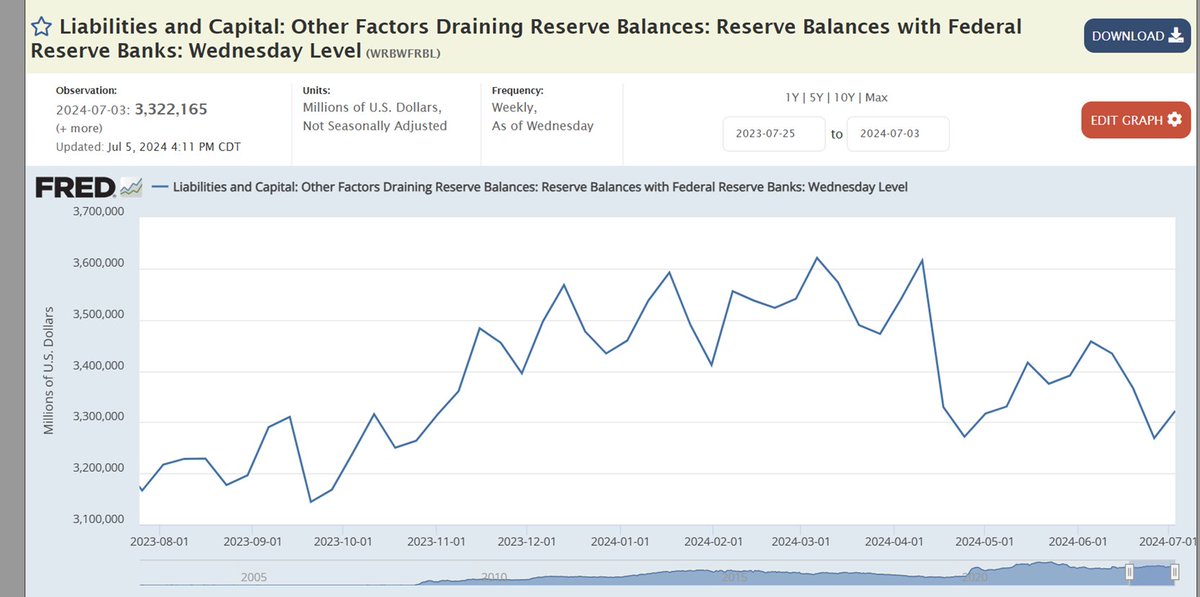

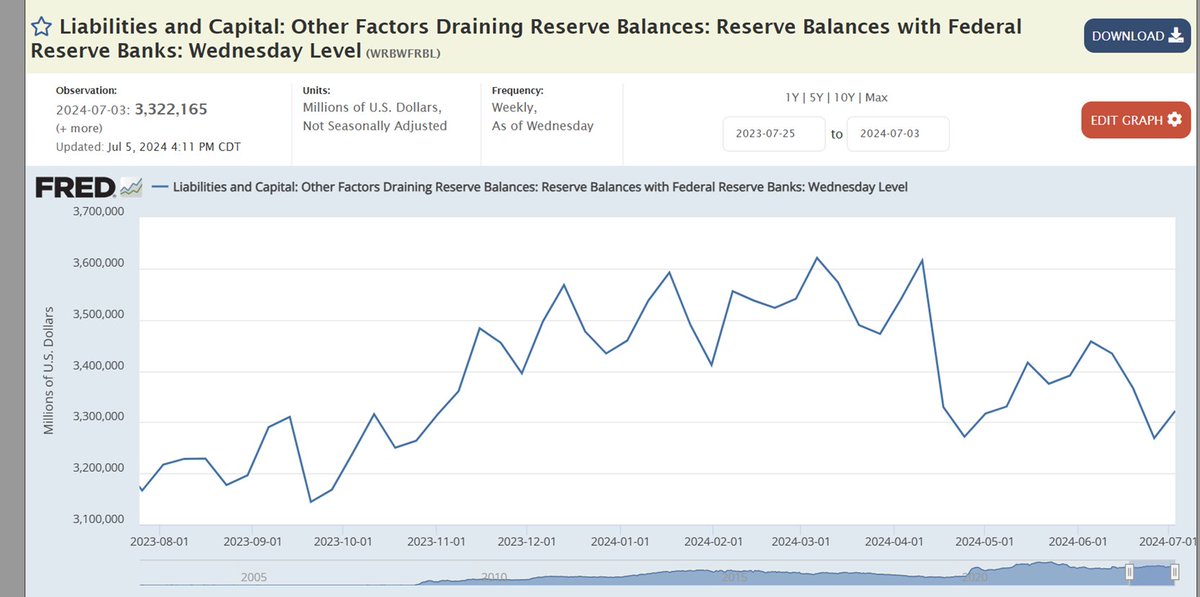

3) Macro liquidity has escaped the worst at the end of June: At the end of June, macro liquidity deteriorated significantly due to the dual impact of TGA and RRP. However, after entering July, it began to gradually improve and will hardly repeat the same mistakes in the short term. Figure 234

6/N

It is also important to note that August is the summer vacation, and liquidity will further decline. At the same time, according to seasonal factors, volatility will gradually increase. Low liquidity + high volatility will definitely increase market difficulty.

Combined with factors such as Mentougou, my current strategy is mainly based on BTC/ETH/SOL bands, and I basically do not participate in copycat and meme markets (mainly because my personal ability is too poor).

The above is the latest work of Abstract Studio