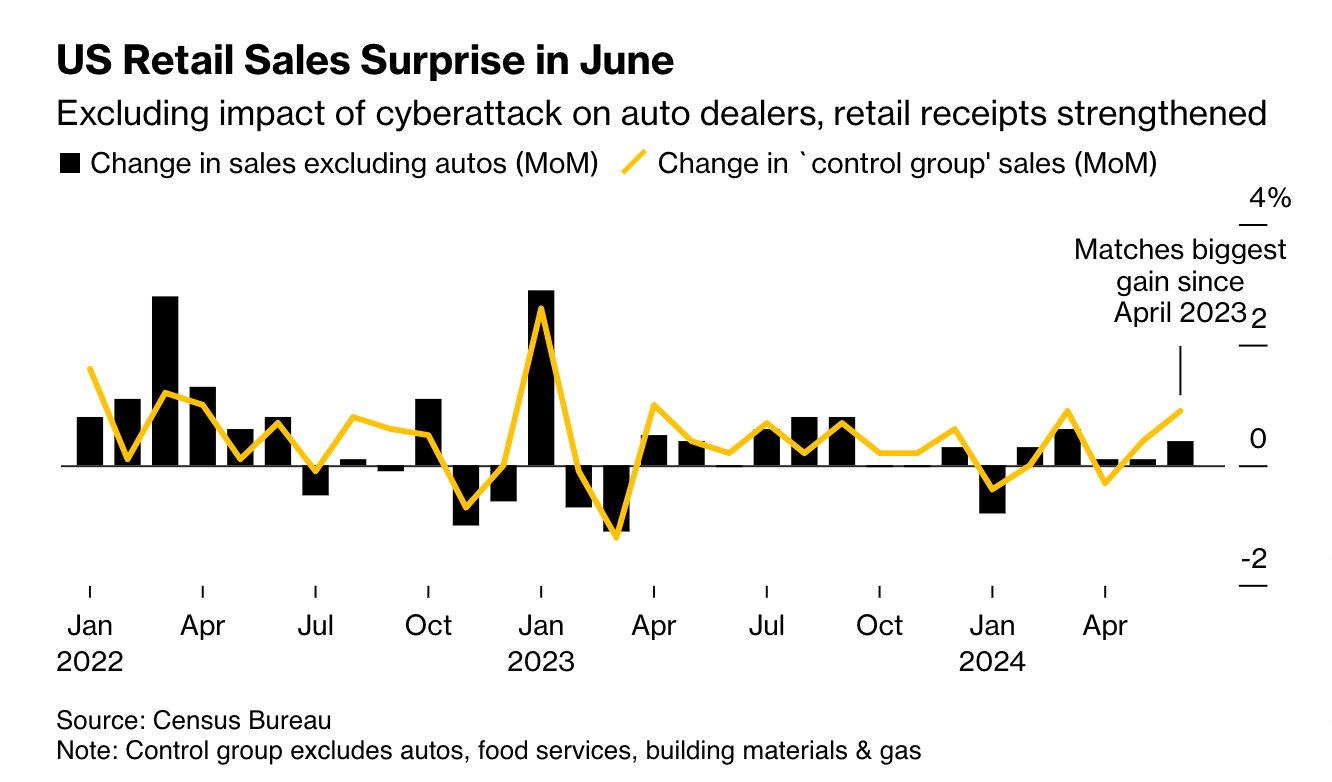

The U.S. Census Bureau released monthly retail sales data yesterday (16th), showing that retail sales in June were the same as in May (an annual increase of 2.3%). The sharp decline in auto dealers’ income due to the CDK hacking attack has been widely reported in other sectors. This was offset by stronger gains, reflecting the resilience of U.S. consumer spending.

Bloomberg pointed out that excluding the impact of cyber attacks on auto dealers, U.S. retail sales rose at the highest level in three months in June. Retail sales excluding automobiles increased by 0.4% from the previous month (not adjusted for inflation). The increase was revised up to 0.1%, indicating that consumer spending picked up at the end of the second quarter.

Note: CDK Global, the nation’s leading auto dealership software supplier, suffered a hacker attack in mid-June, which paralyzed the operations of more than 10,000 auto dealers and severely hit sales at the end of the second quarter. However, the industry expects sales in July There will be a rebound.

The market predicts that the Fed will cut interest rates 100% in September

The data bucks a trend that has seen consumption growth gradually slow in recent months as Americans have felt the pinch of higher interest rates and a cooling labor market in the first half of the year, suggesting the Fed is about to begin cutting interest rates as inflation data cools. The U.S. economy remains strong.

Rubeela Farooqi, chief U.S. economist at HighFrequency Economics, commented: "Consumption and economic activity have slowed sharply so far in 2024. But things are far from weakening enough to be considered a recession. We think spending and growth data, as well as general consensus, have slowed sharply. The improvement in inflation data supports an easing of the stance of monetary policy.”

Quincy Krosby, chief global strategist at LPL Financial, told Reuters: "This report does not negate expectations that the Federal Reserve will cut interest rates at its September 18 meeting unless inflation-related data is released indicating higher prices."

The release of the latest retail sales data has not weakened market expectations that the Federal Reserve will start to cut interest rates in September. The CME FedWatch tool shows that the possibility of the Federal Reserve cutting interest rates in September is as high as 100% (the probability of a 1-point cut is 93.3% , the probability of dropping 2 yards is 6.7%).

Extended reading: Ball’s major change: The U.S. labor market has fully cooled, and the Fed’s mouthpiece: The Fed’s interest rate cut signal is clear

U.S. stocks close in the red, with Dow Jones soaring over 740 points, hitting a record high

With financial markets predicting 100% interest rate cuts to begin in September and further cuts in November and December, all major U.S. stock indexes closed higher on Tuesday, with the Dow Jones soaring more than 740 points, its best single-day performance in 13 months, and The S&P hit all- time highs.

- The Dow Jones Industrial Average rose 742.76 points, or 1.85%, to close at 40,954.48 points.

- The Nasdaq rose 36.77 points, or 0.2%, to close at 18,509.34 points.

- The S&P 500 index rose 35.98 points, or 0.64%, to close at 5,667.2 points.

- The Philadelphia Semiconductor Index rose 26.32 points, or 0.46%, to close at 5,804.03 points.

Bitcoin breaks $66,000 mark

Earlier today, Bitcoin also hit $66,117, and was temporarily trading at $65,176 as of press time, up 1.76% in the past 24 hours.